The crypto Twitter community has not been much of a fun place to hang out this past year or so. Down bad, pissed off, fighting about Jpegs and shitcoins. FTX gone. Binance in trouble? Tether in trouble? The SEC suing Coinbase and declaring everything bar Pokemon cards a security.

It’s called the bear market and everybody hates it.

Then suddenly a shining knight comes riding over the horizon on a giant black stallion, leading an army of gleaming warriors.

Holy shit, it’s Blackrock and the institutions…

I remember the rallying cry during the 2018/2019 bear market was ‘The institutions are coming!’ And now, a whole market cycle later, they are here.

And everybody hates it.

Wait a minute…isn’t this supposed to be what everyone was hoping for? Blackrock filed for a spot bitcoin ETF, and so did Fidelity and Wisdomtree. Invesco is reviving its application. Everyone wants to launch a US spot Bitcoin ETF, and when I say everyone…

Jokes aside, this is a big deal. Blackrock is the world’s largest asset manager with about $8.6 TRILLION under management. The iShares range has over 400 ETFs. They have only ever had one ETF proposal rejected by the SEC. These guys mean business.

And they are not the only Tradfi (traditional finance) institution getting into crypto. Schwab offers BTC and ETH. Deutsche Bank is applying for a digital asset license in Germany. The institutions are actually coming this time.

So why all the hate? Well, Bitcoiners have a romantic rebellious streak, and it seems like many of them really thought they were going to be the alternative to Tradfi. But unfortunately, that’s not how the world works. Did people really think that Wall Street was going to let them keep all of this? They were either going to kill it or take it, and they haven’t been able to kill it…

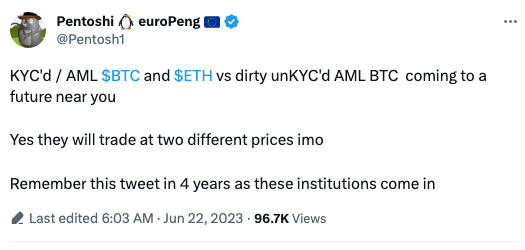

Here’s an interesting thought:

Not much to say about that, except that it seems like a high-probability outcome, and you would want to own both ‘clean’ and ‘dirty’ types if possible…

Being bearish though, that’s another matter. It’s crazy to me that we have gone through the standard -80% crash, Luna, 3AC, FTX debacle, SEC crackdown etc. etc. etc. and Bitcoin is still at $30,000! That’s ¥4.2 million! It’s even more crazy how bad the mood has been, despite the insane resilience on display. If it’s not dead by now, it must be pretty damn hard to kill!

Admittedly the mood, and the price, have been lifted somewhat by the Blackrock news, but I would still say that the overall sentiment in crypto is pretty bearish. (people who aren’t involved in crypto assume it’s long since dead I imagine)

This tweet from Hugh Hendry in response to a gold investor caught my eye:

Making price predictions on BTC will almost always make you look silly, especially in the short term. However, a 3x or 5x move in the next couple of years is something that Bicoin could manage on retail fever alone. What would it look like with a raft of shiny new US ETFs approved?

Don’t stay bearish too long anon.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.