After all the doom and gloom of 2022, 2023 has been a pleasant surprise for some brave investors. It looks like stocks actually did bottom in October last year and if you own US big tech and Japanese stocks you’re enjoying a bumper year!

And now comes the big question? When do I sell?

In case you forgot, the idea of investing is to buy low, sell high and beat inflation in your base currency. Sounds simple doesn’t it? Personally, I’m pretty good at the first part. Fear is easy to spot. Granted, it takes some guts to run towards the carnage when everyone else is running away, but I have successfully conditioned myself to embrace the pain in markets and buy stuff when it’s on sale.

In my experience, the selling part is harder than you think it will be. Because it’s generally time to sell when people are euphoric and euphoria is kind of addictive. It’s even harder to sell when things are simply good – they could always get better right? And you don’t want to leave money on the table.

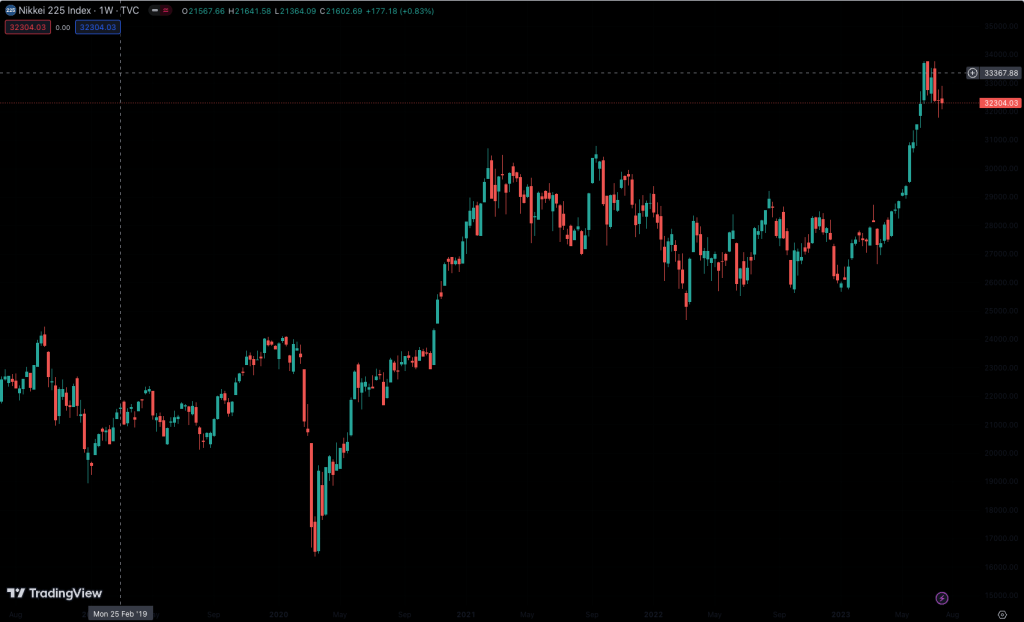

I was watching the Nikkei News Plus 9 program on BS TV last night and a very serious-looking guy from Monex Securities was talking about Japanese stocks. I think he is the chief strategist at Monex and he identified what looks a lot like a double top in the Nikkei 225 chart. Ok, I had noticed that too. He explained that he thinks that means the index will likely trade in a range of approximately ¥31,000 to ¥33,000 for a while. I wish I had a video of it – he described the range as a box, and at one point he handed the presenter an actual cardboard box with Nikkei 225 written on it and asked him to look inside. The presenter rummaged around and came out holding four crisp ¥10,000 notes. Yes, the Monex guy explained, once the Nikkei breaks out of the box, it’s going to ¥40,000! Wahey!

Forgive my cynicism, but I immediately began wondering if it might not be time to get the hell out of Japanese stocks! There wasn’t a lot of explanation going on about how the index goes from the box to ¥40,000. I’m no technical analyst, but it sounded a lot like hopium to me. Still, the guy is the chief strategist at Monex so I assume some research went into this.

The US market is looking interesting too. The S&P 500 is up +18% so far this year. Fantastic! However, dig around a little and you find that it’s actually only seven stocks that have driven those returns. Those stocks are, of course, big tech and the narrative that’s driving them, in case you’ve been living under a rock, is AI. Feeling euphoric yet?

So it’s possible that things are a little overdone. All bets are on the Fed hiking rates again at month-end and leaving them there for at least the rest of the year. History does not bode well for a soft landing from an extended period of irresponsibly loose monetary policy followed by a burst of inflation and a breathtakingly fast tightening cycle. This generally does not end well. There is a lot of talk of the stock rally broadening out but it’s early days and if the tech companies sell off, the last one out the door can probably turn the lights off for a while.

So is it time to sell? If so, how much and how do you do it?

First of all, let’s take a breath and remember that we need to consider core and satellite holdings separately. The core being the 70-80% of a portfolio that is broadly diversified, and satellite being the 20-30% we may have in something a little sexier. We’re not talking about simply dumping all of our investments because the market might go down.

I have already written about how to buy low and sell high in your core allocation here. In short, you establish a strategic asset allocation that meets your risk profile and then rebalance it once per year. The rebalance, in effect, sells part of holdings that have gone up in value and reallocates to the holdings that have gone down. That’s it, no further action required!

Satellite holdings are generally invested in assets that add a little more spice to your overall portfolio. They sometimes have a higher risk/return profile and may change over time depending on market conditions and what is hot.

So let’s say, for example, you’re living in Japan and you have a core portfolio invested in an internationally diversified range of assets that is matched to your risk profile and base currency. However, over the last year or so the weak yen has prevented you from investing more outside Japan. Meanwhile, the rise in inflation meant that sitting in JPY cash was a dumb idea and so you’ve been allocating to a range of dividend-paying Japanese stocks to make sure you preserve your spending power. And low and behold, somebody lit a fire beneath the Japanese equity market and your boring Japanese boomer stocks are mostly up between 20% and 50%!

The man at Monex says the Nikkei is going to ¥40,000 and, much as you are intrigued by that idea, you are not sure you share his confidence!

What do you do?

Quite the dilemma, albeit a nice one to have. So what do the options look like?

- Sell the lot – the gains are way more than the dividends you are going to earn over the next 12 months, so take a break and come back when things are cheaper again.

- Sell part of your holdings – you’ll be happy you took some profit, but if the Monex guy is right, ka-ching!

- Roll the dice and keep it all – there’s ¥40,000 in that box!

Of course, there is no correct answer and it depends on your personal situation, risk profile blah blah blah. For the record, I’m in the option 2 camp. I’ve been selling incrementally and I try to sell on green days. If nothing crazy happens I’m looking to gradually cut my holdings in about half. That said, in the process of accumulating Japanese stocks I have found some that I think are keep-forever-type companies.

I still think the Bank of Japan is going nowhere fast on adjusting rates and if inflation comes down, there will be less pressure on them to take action. But if that pressure builds and it looks like they might blink, I go option 1 in a hurry.

US big tech I’m not so concerned about. Everyone should own some of that for the long term, and if you are buying index funds you probably own more than you realise!

So prepare for a hard landing while hoping for a soft one. And learn from the experience as you go.

Today marks 26 years since I landed in Japan. There’s a lot to be thankful for!

And if the Nikkei hits ¥40k I will get a box and take a photo with it.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.

One thought on “Nikkei ¥40,000? Thinking outside the box”

Comments are closed.