With the weather warming up, I’m starting to get the itch to get back out on the golf course. I know people who don’t play the game struggle to see what is so interesting about golf, but I can tell you there is a lot more to it than just chasing a little white ball around the countryside. Golf may be a competitive sport professionally, and many amateurs like to put a bit of money on the line against their mates. However, anyone who has played the game knows that it’s never you against the other player. It’s all about the battle between you and the golf course. Or, more accurately, the battle between you and that space between your ears. If you focus on what the other guy is doing, you are always going to lose. Knowing who the real opponent is is the key to improvement.

The same can be said for investing. If you’re a trader, you are playing a zero-sum game. Every time you win, someone on the other side of the trade loses. However, it’s not like this for investors. It’s not a competition between you and other people. What everyone else is doing is irrelevant. You need to master yourself, and more importantly, you have to know what it is you are competing against.

People tend to think they are trying to beat the market but that is really not the case. The market just is. It doesn’t even know you exist. It’s the sum of all the information available driven by the impulse of human emotion. You cannot conquer this beast. The market just tells you the price of things, no matter how crazy it may seem.

Know your enemy

If you are going to be successful at investing, you better know what you are up against. What exactly is it you are trying to beat? Think about that for a minute. Why is it that you have to expend all this time and energy trying to run your own personal hedge fund? Why do you have to pay some ‘expert’ to guide you through this lifelong struggle? Why can’t you just put your money in the bank and get on with more important things?

The standard answer to these questions can be summed up in one word: inflation. But what does that mean? Well, here’s the definition: inflation is the rise in the cost of goods and services over time. It sounds almost innocent, doesn’t it? The price of things just goes up a little over time, so you should invest to keep pace with it. No big deal right? Any half-decent financial planner can help you put a plan in place to handle that.

The truth is a little more sinister. That 2-3% inflation number that governments and central banks report to you every month is heavily manipulated to begin with. But it doesn’t even come close to measuring the size of the monster that is actually eating up your spending power. The final boss, the thing you are really playing against is much more significant than a natural rise in the price of stuff over time.

You are competing against currency debasement.

What the hell is that you ask? Well, in the old days, when coins were made out of gold and silver, debasement was the act of mixing base metals with the precious metals, therefore reducing the amount of the ‘good stuff’ in money. By using less gold and silver in the coins, the issuer lowered the value of the currency.

These days, debasement takes place when a government prints money, increasing the money supply without a corresponding increase in output. Debasement gifts more money to governments for spending and bailing out their banker friends, and the result for citizens is inflation.

Can you think of a country where that may be happening?

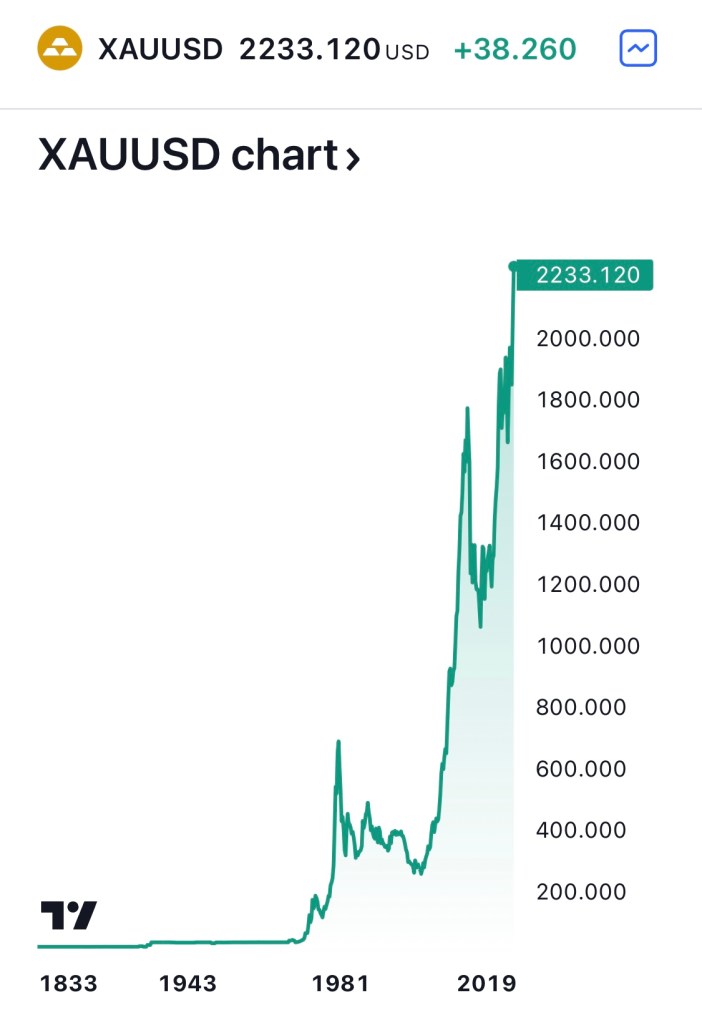

Gold was long considered money, and still is by many people. A good way to judge if your currency is being debased is to take a look at how it is performing against gold.

Hmmmm, maybe printing all that money in order to escape deflation has more than achieved the expected result…

And before we rag too hard on the Bank of Japan, here’s the US dollar. And yes, the chart goes back to 1832 – can you spot where the currency came off the gold standard?

If that doesn’t make you mad, I don’t know what will. It certainly answers the question of why we have to spend so much time learning to invest.

You are probably understanding that investing is not a choice here. If you don’t learn how to do it, your spending power is toast. Do you think these governments are going to stop?

If anything, debasement is picking up the pace. The world’s economies took on too much debt and are not producing nearly enough to pay it back. The only way out of this hole is to inflate the currency which means that you and me get screwed.

Oh, and if you want to see what monetary debasement looks like when combined with climate change, take a look at cocoa these days:

Better stock up on Easter eggs folks!

Yes, all Fiat currency

I know I said let’s not rag on Japan, but let’s rag on Japan, shall we? Finance Minister Suzuki has been out every day this week expressing his ‘concern’ over ‘excessive’ moves in the currency. After printing to infinity, he even had the nerve to blame the weakness in the yen on, wait for it, ‘speculators’!

It’s straight-up gaslighting and I’m ‘speculating’ that with debt to GDP at 263%, they are going to continue to incinerate the yen. Don’t get me wrong, this isn’t Turkey – the liras of this world are on their death bed and there isn’t long left to say your goodbyes. Japan has a highly developed and productive economy so the currency isn’t going to implode tomorrow, but have no doubt, it is going to die a slow and painful death and that pain will be felt by you if you don’t protect yourself.

The US dollar is the global reserve currency. This doesn’t free the US from the endgame of its own excessive money printing. It just means it will be the last man standing. All currencies will go down against the dollar. The dollar will go down after the demise of everything else.

No double bogeys!

Back to the golf analogy – I don’t know who said it but there’s a quote that goes something like: ‘A bogey is one bad shot. A double bogey is one bad shot followed by a stupid shot.’

If getting yourself into a position where you have money in yen that you one day want to spend in another currency was your mistake, it’s time to make sure your next shot isn’t a stupid one.

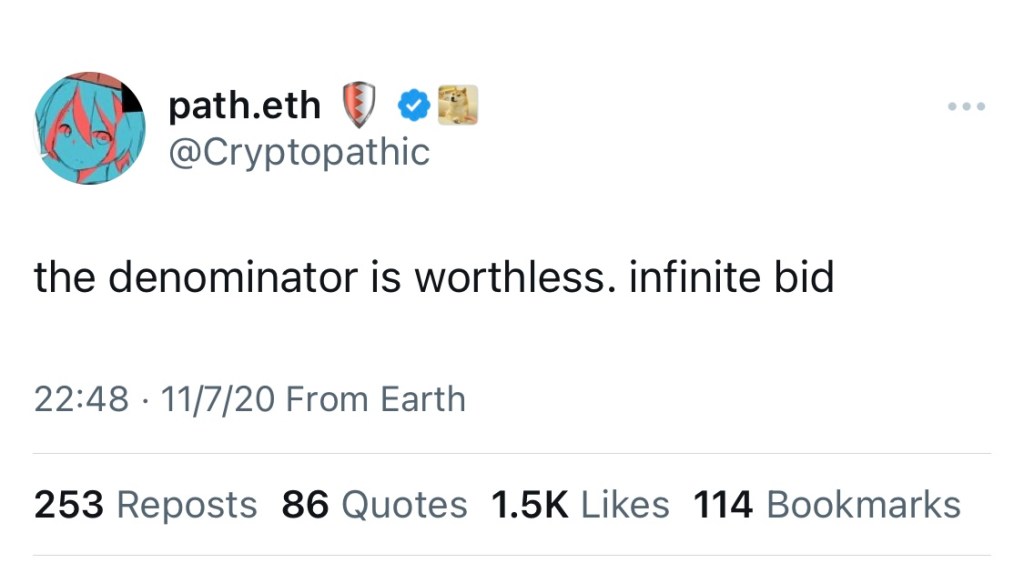

Even if you are planning to stay in Japan and spend your yen here, sitting in cash will devour your spending power. So how do you fight currency debasement? You have to own assets. Assets, like food and other goods, are ‘stuff’. A currency that is being debased goes down against stuff. The Nikkei 225 is not at ¥40,000 by accident. The denominator is going down against shares in companies. Japan’s average land prices rose by 2.3% last year. The denominator is going down against land. I look at my stocks app and a Japanese gold ETF is up over 3% today. It seems like people are getting the message. (great thread about that from Weston Nakamura here)

Harden up your assets

If you’ve been reading my blog for a while, you will be familiar with how I like to structure investments: a ‘core’ diversified portfolio that holds a broad range of assets combined with ‘satellite’ holdings of tactical assets that fit current market conditions. The satellite holdings you want to beef up in order to stave off currency debasement are ‘hard assets’. By this, we mean tangible assets or assets that have a fundamental value. Real estate is a good example. Commodities, especially gold, are another.

You don’t have to buy houses, office buildings and bars of gold to achieve this. You can own Real Estate Investment Trusts (REITs) for a small amount of money. You can own a gold ETF. Is the real thing better? Sure, but we don’t have to be purists about it. The currency is going down against gold ETFs – problem solved.

You’re going to talk about Bitcoin again, aren’t you?

Nah, I’ll just post a chart.

Happy Easter everyone!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.