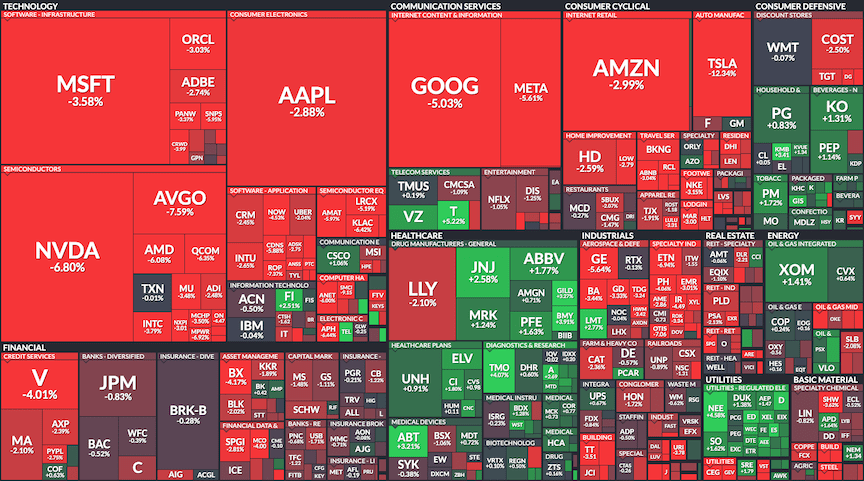

After showing signs of wobbling the last few weeks, US markets slumped on 24 July with big tech shares leading the move down. Tesla Inc (TSLA) fell -12.3% after a Q2 earnings miss while Alphabet Inc (GOOGL) dropped -5% despite beating earnings expectations. That was enough to trigger an avalanche and the NASDAQ ended -3.6% lower and the S&P 500 endured its worst day since 15 December 2022, falling -2.2%.

Correction territory

Japanese shares followed the US market down, with the Nikkei 225 index falling -3.3% today as exporters laboured under a strengthening yen. The benchmark index peaked on 11 July at ¥42,426 and has trended downwards since then. It turns out that I wasn’t imagining things when I asked Are we shaking? at the end of June.

Investors will now be wondering if this is simply a healthy correction after a big run-up or the start of a larger move downwards. It is too early to begin talking about a bear market but we are certainly in correction territory. A correction is defined as a fall of -10% from a recent high and the Nikkei closed today down -10.7% from the 11 July peak.

At 3pm today, USD/JPY was trading at ¥152.7. The current rebound in the yen is being driven by expectations that the Bank of Japan will raise rates at its policy meeting next week. In addition, the US Federal Reserve appears to be moving in the direction of rate cuts starting in September. A sustained sell-off in stocks may well need confirmation of rate cuts in order to stabilise.

Semiconductor stocks fall hard, Lawson delisted

Semiconductor-related stocks are bearing the brunt of the current selloff with Disco Corporation (6146) falling for seven straight days. Disco fell a further -4% today to close at ¥46,850, well off its peak of ¥68,850 set on 11 July.

In other news, convenience store operator Lawson Inc. was delisted from the TSE on 24 July following a successful tender offer from KDDI Corp. KDDI will partner with Lawson’s parent company, Mitsubishi Corp to take the company private.

A stock to watch

Crypto followed the trend in traditional markets with Bitcoin falling to around the $64,200 mark. Ethereum is down around -8% despite the successful launch of the Ethereum ETFs in the US on 23 July.

Meanwhile, Japanese Bitcoin proxy Metaplanet Inc. (3350) has been on a wild ride. The stock has risen more than +1,100% since the company announced its Bitcoin treasury strategy in early April. However, the FOMO really kicked in this week with shares accelerating to ¥300 on 24 July. Metaplanet is back trading around ¥220 today but is still a stock to watch as investors try to front-run the potential decisive break of Bitcoin’s all-time high in the coming months.

It seems likely that traders view Metaplanet as a tax-efficient way to gain exposure to Bitcoin price moves. Crypto in Japan is taxed as miscellaneous income, whereas stocks are taxed as capital gains.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.