So, here we are. Overnight, the Federal Reserve announced a rate cut of 50bps, the first cut in four years. Projections imply a further 50bps later this year and another 100 bps in 2025. Welcome to the rate cut cycle.

US markets reacted cautiously, with stocks rising ahead of the announcement only to give back those gains and close down slightly. 50bps is considered a big initial cut, so it will be interesting to see how markets behave over the next few days as they digest the news.

Surprisingly, the yen fell against the dollar to the upper ¥143 range and Japanese stocks were up strongly this morning. Again, time will tell if the initial reaction is the correct one.

The macro gurus will no doubt be fighting it out as to whether the US economy is coming in for the much-vaunted soft landing or heading for recession. Jerome Powell sounded upbeat on America’s economic prospects and made clear that he views the larger cut as a move to prevent the Fed from falling behind.

We will find out in due course.

Sometimes the most obvious take is the correct one: rate cuts are generally bullish for risk assets over time, although we may need to ride out some volatility in the short term. The doomers will keep dooming but optimists make more money in the long run:

“Bulls make more than bears, so if anything being an optimist about life and about things in general is a great attribute as an investor. You just can’t be starry-eyed and naive.” — Stanley Druckenmiller

Deja vu

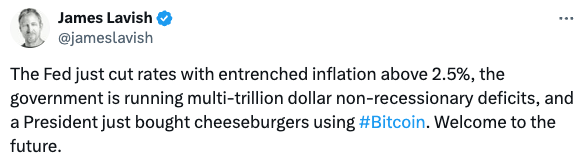

Three assets that are a hot topic in this new environment are gold, silver and bitcoin. It’s funny because I remember these three getting a lot of attention four years ago. Granted, the post-Covid crash environment in 2020 was very different from today – for a start, the Fed funds rate was already at zero in September 2020. However, it’s interesting how things move in cycles. Gold is around all-time highs now and silver enthusiasts are clamouring for a breakout. It has a strong 2020 feel to me, so I thought I would take a look back and see what happened four years ago.

Observe the five-year charts:

As you can see, both gold and silver reacted quickly to the stimulus injection that followed the March 2020 Covid shock. Liquidity is generally good for hard assets. Bitcoin took longer to catch alight but when it did, the fireworks were spectacular as it took out the previous all-time high of $20k and then marched right on to $60k and then $69k in 2021. That move started at $6k at the end of March 2020 and BTC was still only $11k on 19 September 2020.

I like all three of these assets in the current environment, but I like one much more than the others.

Game time soon, anon.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.