Today, we have a guest post from the team at PlanetDAO. I discovered their Facebook ad last week and was intrigued by their focus on protecting cultural heritage whilst embracing the principles of decentralisation. After exploring their website, I made a modest investment in the Hayama Bamboo Forest House project – not primarily for financial gain, but because I believe in the project and want to be part of it. I’m excited about engaging with the local community and other co-owners.

This is not a paid post, and there are no affiliate links. I’m sharing simply because I admire PlanetDAO’s work and the DAO model.

And now, I will turn it over to PlanetDAO to explain more.

Contributed by the PlanetDAO Team

PlanetDAO was launched to address a growing challenge in Japan: the preservation of cultural and historical properties. As local economies evolve and traditional inheritance patterns shift, many significant buildings risk being lost to time. This innovative model addresses this challenge by connecting global investors with Japanese cultural properties.

The Challenge of Cultural Preservation

Historic properties in Japan, particularly temples and traditional houses called kominka, struggle with maintenance and preservation when local resources can no longer sustain them. PlanetDAO’s mission is to unlock these properties’ potential through the collective participation of a diverse global community.

A Collaborative Model

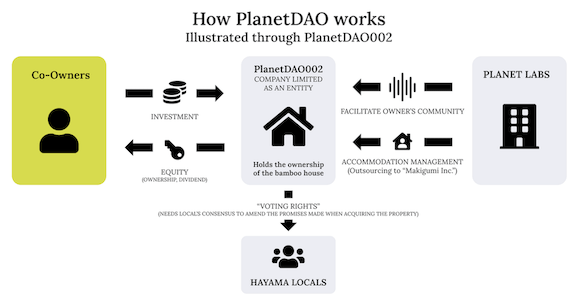

The model operates in four distinct phases. The process begins with identifying properties and building relationships with local communities during the sourcing phase. In the fundraising phase, opportunities open for interested parties to participate in property ownership. Throughout renovation, the focus shifts to property transformation while maintaining cultural integrity. The operational phase then combines vacation rental management with community engagement.

Participant Engagement

Participants who join the PlanetDAO community become co-owners, part of something larger than traditional property investment. The term “co-owners” rather than “investors” reflects the collaborative nature of these projects. Co-owners participate in voting on key decisions, engage with fellow community members through both digital platforms and in-person events, and play an active role in shaping the future of these cultural properties.

First Success: Ryogonji Temple (PlanetDAO001)

PlanetDAO’s first project, Ryogonji Temple, demonstrates the potential of this innovative approach. Located in the historic Irokawa district, this 170-year-old temple gained recognition as a registered Tangible Cultural Property in 2021. Adding to its historical significance, the stone stairs leading up to the temple have also been recognized as cultural heritage, symbolizing the enduring craftsmanship and cultural richness of the region. Despite its relevance, only four local supporters remained, leaving the temple’s future uncertain.

Through community investment, the project raised ¥34,540,000 for preservation and development. Today, the project has 134 co-owners from 15 countries actively participating in its development. Co-owners engage through regular online meetings and voting, and several have already visited the property in person, demonstrating the genuine community involvement that the model fosters.

The project is now entering an exciting phase, with architects submitting proposals for the renovation. Co-owners will be involved in key decisions throughout this process, maintaining their active role in the property’s evolution. The property is scheduled to open for bookings in early spring 2026.

Current Project: Bamboo Forest House (PlanetDAO002)

The second project focuses on an 80-year-old residence in Hayama’s Kamiyamaguchi district, recognized as one of Japan’s top 100 Satoyama landscapes. The Bamboo Forest House holds historical significance as a former farmer’s residence and a cherished gathering place for local artisans.

The property features an impressive 7,199 square meters of bamboo forest, offering a tranquil retreat from urban life. The surrounding bamboo grove, carefully maintained for decades by the local community, creates a natural sanctuary that embodies traditional Japanese landscape aesthetics.

The project is currently open for investment, with detailed information about participation opportunities available on the PlanetDAO website.

Building Trust in a New Model

While the first project demonstrated the potential of this innovative approach, each new project brings its own challenges. The global nature of the DAO model, which invites participation from people worldwide who share a commitment to cultural preservation, requires building trust across borders and cultures.

Connecting with potential participants who may be unfamiliar with this investment approach takes time and patience. While in-person conversations often help address initial skepticism, establishing credibility in the digital age remains an ongoing journey. This challenge reinforces the importance of transparency and community building in PlanetDAO’s commitment to cultural property preservation.

Looking Forward

PlanetDAO continues to evolve its approach to cultural preservation. The team is exploring opportunities to expand to additional properties across Japan while developing new ways to engage global participants in local cultural preservation.

Those interested in joining this community of cultural preservation enthusiasts, or learning more about current and future projects, can visit the PlanetDAO website. The team welcomes scheduling online calls to share more about their vision and answer any questions.

Disclaimer: This post is for information only. It should not be considered personal financial advice and does not constitute an offer or solicitation to invest in any of PlanetDAO’s projects. Investments like these carry specific risks and readers should conduct their own research before proceeding.