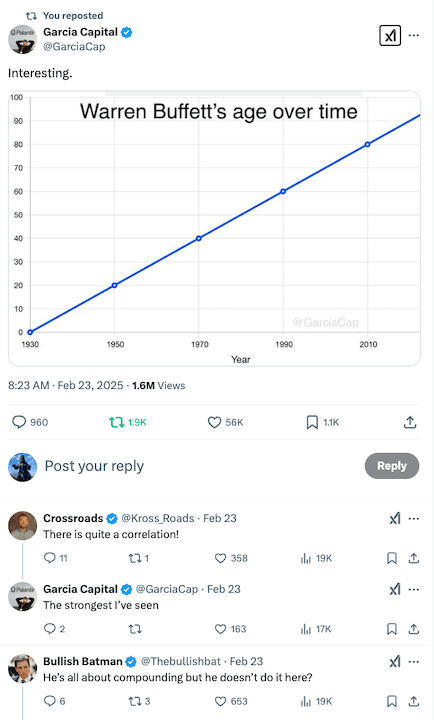

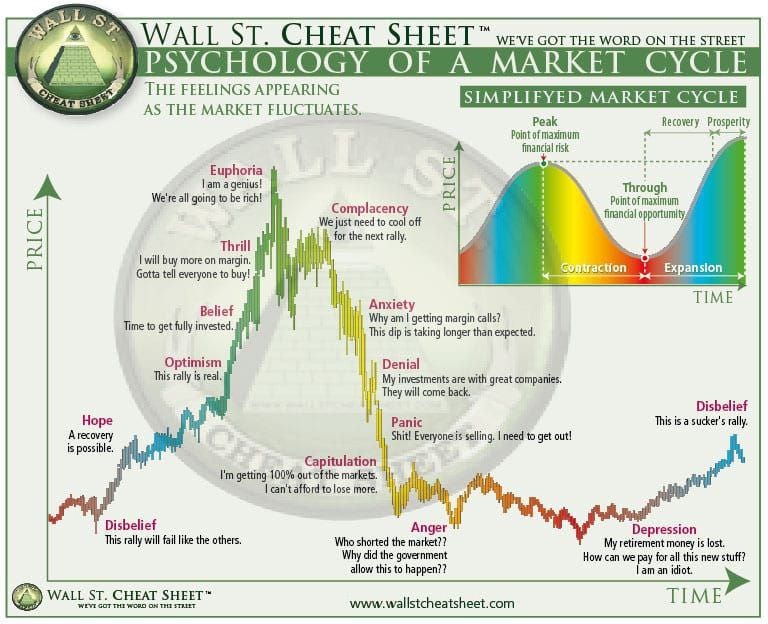

With markets looking a little shaky of late, it’s worth remembering the old saying that time in the market beats timing the market. With Warren Buffett once more making news in Japan this week, this post and Bullish Batman’s comment tickled me:

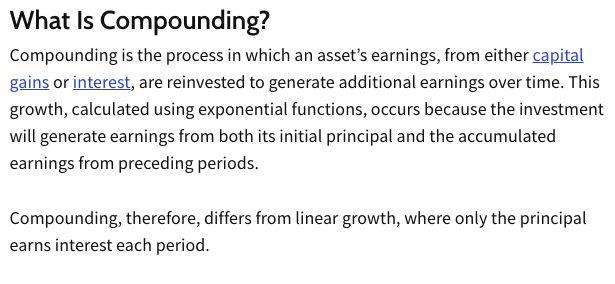

I think readers of this site will have at least a basic understanding of the benefits of compounding on investments. That said, it can take some time to actually experience its power. I have noticed that one of my accounts, which started small and took a while to grow, has picked up momentum in the last 12 months. I haven’t added new money to it for a while but have been diligently reinvesting capital gains and dividends, resulting in a significant acceleration in growth.

Here’s the Investopedia definition of compounding:

I shared a simple example of the Power of Compounding back in 2017.

It’s a great reminder that, although short-term price moves make headlines, we should focus on investing for the long term. Accumulate good assets and hold onto them!

Is Uncle Warren coming back?

Warren Buffett has mastered the art of buying quality stocks and allowing them to compound over the long term. In his recent letter to shareholders, the Berkshire Hathaway CEO commented that he is keen to increase his investment in Japan’s big five trading companies. You may remember that Buffett has been playing a very smart game in Japan, issuing debt at around 1% in yen to buy solid companies that pay around 4% income. Shares in those trading companies surged this week in anticipation that Buffett may be coming back for more.

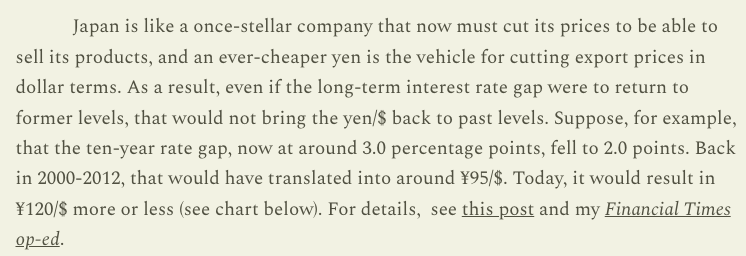

Despite The Oracle of Omaha’s endorsement, the trading houses still face significant headwinds related to yen movements and Donald Trump’s tariff policies. The US President’s aggressive stance on that issue is unsettling for companies that rely on smooth international trade. It doesn’t seem to worry Buffett too much, though.

Speaking of the yen, on 25 February it hit a four-and-a-half-month high of ¥148 to the dollar. With inflation on the rise, the Bank of Japan will come under pressure to continue to raise rates while the US Federal Reserve has rate cuts on pause for now.

The Corolla index reaches 50%

This is new to me, but this Nikkei Article refers to a Toyota Corolla index. It measures the affordability of a typical mass-produced Japanese car by dividing the price by the average annual income. During the good times, it has been as low as 20% but currently stands at a whopping 50%. For comparison, in the US it is 30%.

This clearly illustrates that, although wages are rising, they are failing to keep pace with inflation in Japan.

Nvidia beats on earnings again

In the US this morning, Nvidia might well have saved markets from severe pain, at least in the short term. The chip powerhouse once more beat analyst’s expectations and issued solid Q1 guidance. The company reported Q4 revenue of $39.3 billion and expects $43 billion plus or minus 2% in Q1. Shares were up +3.7% in anticipation of the report but are down in after-hours trading.

It seems to take a lot to get investors excited these days. Trump is talking about a 25% tariff on chip imports and the AI behemoth is still weathering the DeepSeek storm. You may remember that Nvidia’s previous earnings also beat expectations but the stock fell afterwards.

Is the US economy slowing?

Despite the S&P 500 trading near all-time highs, sentiment in the US is increasingly muted. The downbeat mood is generally attributed to Trump’s tariff talk, however, in this Yahoo Finance article, Neil Dutta argues that it is more likely because the US economy is slowing down. He points to weaker economic data coupled with the Fed’s pause on rate cuts acting as a “passive tightening of monetary policy”.

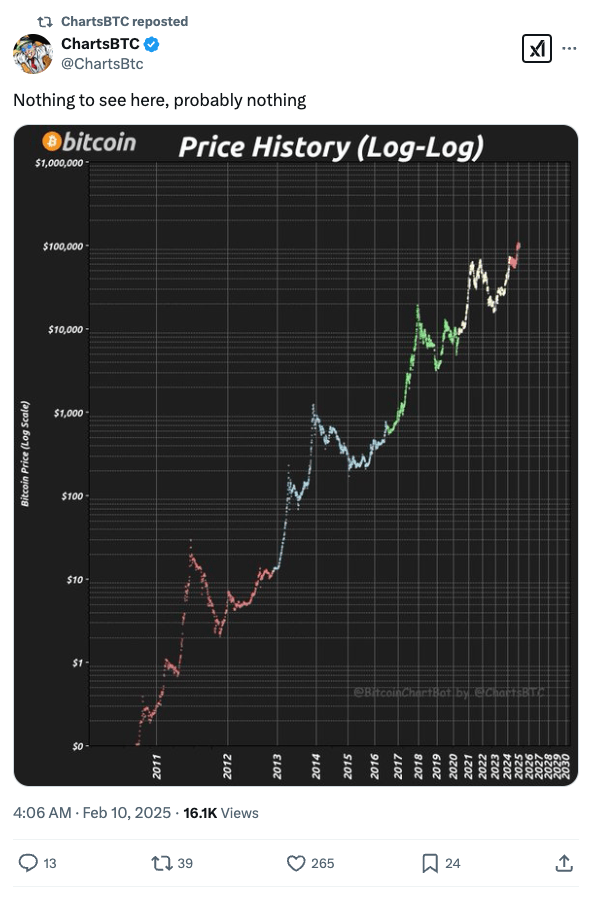

That argument makes a lot of sense and could also explain why, despite a slew of good news, Bitcoin failed to break back above $100k and has now broken down instead. People who have been ‘waiting for a dip’ are not so keen now they have one. We may have to endure some economic pain to push the Fed to start cutting again before the bull market resumes. (no, I don’t think it’s over)

Also, it’s notable that hedge-fund manager Steve Cohen recently struck a bearish tone for the first time in a few years. You can see a snippet of his interview here. (in case the embedded link below doesn’t work)

Cohen states that he isn’t expecting a disaster, but things could be difficult over the next year or so, and it wouldn’t surprise him to see a significant correction.

All the more reason to keep a long-term view and focus on compounding those assets over time!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.