I started this site in 2017 and ran out of things to say about the basics of financial planning some time ago. If you are just getting started, I put together a thread of simple financial planning tips from my early posts, which you can view on X here.

The basics don’t change, but the environment can change drastically. If you plan to live in Japan for the long term, you are probably now figuring out how to adjust from living in a country where deflation was the norm to one where prices are rising. Looking into the future, one of the big questions is whether this inflationary environment will stick, or will Japan be back at zero interest rates and falling prices in a few years? How can we plan when we don’t know the variables we will likely deal with?

Prediction is very difficult, especially if it’s about the future. – Niels Bohr

I have a client who was an economist at a financial institution for many years. He told me he always felt it was his job to have a view. For some reason that has stuck with me and I think it is important in my job too. It’s also important not to be wrong, though! I wish I could tell you I have always held the correct view and never been wrong, but I doubt you would believe me. I have, however, gained some experience over the years, which has helped me develop some skills in dealing with the uncertain future we face.

Strong views, loosely held.

Having a view is helpful but you don’t have to marry it. If something changes or evidence comes to light that proves you wrong, you can simply change your view. Don’t get caught up in the social media battle to be right about everything. In just the last few years, people have pivoted from being epidemiologists to vaccine experts to geopolitical analysts to macroeconomists to AI gurus and now, tariff experts.

It’s exhausting.

So, I thought today I would take a look at some basic data about the Japanese economy and share my view on what a person living here should focus on in terms of financial planning and investment.

Debt is a problem

Japan still has a strong, productive economy but it is not expected to grow fast. The predicted real GDP change for 2025 is 1.1%. (IMF) Government debt to GDP is currently 255%. (Trading Economics)

December 2024 CPI (inflation) was 3.6% and, in response, the Bank of Japan recently increased the overnight interest rate to 0.5%. The 10-year yield on government bonds currently stands at around 1.2%.

Japan is clearly not going to grow out of its debt problem. Demographics do not support the level of growth required to meaningfully reduce the size of the mountain. When governments can’t outgrow their debt, they usually end up inflating their way out. I struggle to see how the BOJ leadership can raise rates high enough to head off this outcome but they will of course delay it as long as possible.

It doesn’t look good for the yen

In January 2023, I wrote a post charmingly titled How screwed is the yen? It actually holds up pretty well for a two-year-old post. The problems facing the currency have not changed very much and we are still hanging around at 155 yen to the dollar.

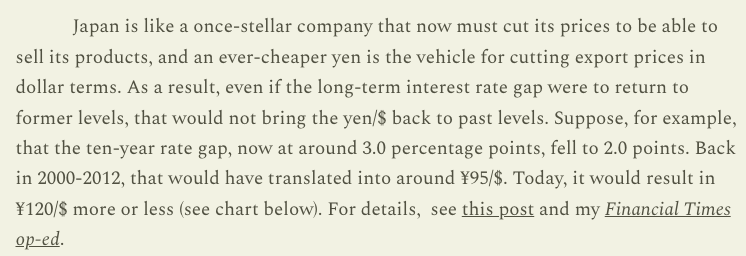

I have re-read this excellent post by Richard Katz several times: The BOJ, the Fed and The Future Of The Yen. He notes that although the gap between US and Japan overnight rates may close, the gap between the two countries’ long-term yields is unlikely to follow suit, meaning the yen probably won’t recover as strongly as some think it will. Here’s an excerpt from that piece:

Some of the issues people in Japan are facing when planning for their financial future are as follows:

- Continuing yen weakness

- Concern that the pension system will not meet their retirement needs

- Rising interest rates, but not rising too far

- Negative real rates (interest rates lower than the rate of inflation)

- Rising wages but negative real wages relative to inflation

People are already feeling the pinch. If you bought rice recently, you know what I mean. Furthermore, prices of 1,656 food items are set to rise this month according to this Japan Times article.

So, what can we do?

If you are a regular reader, I am probably repeating myself, but here are some action items to consider:

Check your base currency – are you really going to spend all of your future money in Japan? Are there big expenses overseas that you are likely to be on the hook for in future? If so, you need to save and invest some or all of your money in that currency. More on that here: What is your base currency?

JPY cash is trash – even if your base currency is yen, you are going to lose against inflation over time if you keep all of your money in the bank. Sure, you need to keep a liquid emergency cash reserve, but everything else needs to go somewhere more productive. CPI was 3.6% in December. The BOJ’s target inflation rate is 2%. How much is your bank paying you in interest?

Fill up tax-free vehicles first – another no-brainer. If you are eligible for NISA and/or iDeCo, they are the first stop for investment money. NISA especially is an incredible deal as you can access the money freely if you really have to. Bad luck if you are a US citizen – you should explore options for investing back home. And remember, if your spouse is eligible, they should be maxing out tax-advantaged options, too.

Yen-cost average – if you are young, regular investment in a global stock index fund/ETF is a perfectly good strategy. You can worry about diversification later.

Learn to diversify – lump sum investments require more care. And the closer you get to spending your capital, the more you need to protect it. Diversification across asset classes (not geographical areas) is how you do this. Own some bonds, stocks (growth, value, dividend), property (physical or REIT), commodities and alternatives. Use a core/satellite allocation to dial up/down risk.

Explore dividend stocks – Japanese dividend stocks offer a great way to keep pace with inflation in yen terms. More here: How to beat inflation with Japanese dividend stocks

Lever up – if you are here for the long run, owning property is still better than renting. Even if you are risk averse, I am still seeing 35-year fixed-rate mortgages at under 2%. Floating rates are still well below 1% and, in some cases lower than 0.5%. It is still very cheap to borrow money for a home in Japan.

Stack gold and bitcoin – the two kings of hard assets and possibly the only satellite holdings you need. Average in over time and hold. More here: Facing inflation – the four assets you should own

A fistful of dollars – if you are the entrepreneurial type, I recommend brainstorming ways to earn money in USD. As the global reserve currency, it will be the last one standing in the Fiat race to the bottom. Read up on the dollar milkshake theory. If you can get paid in bitcoin, even better!

To summarise: have a view, make a plan and adjust it as you go. If you need help, don’t be shy about getting some. You will get better at this with practice.

Top image by tawatchai07 on Freepik

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.

Can one get a mortgage without income from japan?

LikeLike

Probably difficult, but I guess it depends. If you have permanent residence and your overseas income is from a contract with a well-known company, then maybe. Still a bit of a stretch, though…

LikeLike