“The line between gambling and investing is artificial and thin. The soundest investment has the defining trait of a bet (you losing all of your money in hopes of making a bit more), and the wildest speculation has the salient characteristic of an investment (you might get your money back with interest). Maybe the best definition of “investing” is “gambling with the odds in your favor.” ― Michael Lewis, The Big Short: Inside the Doomsday Machine

I recently came across this post lamenting how young people are being tricked into treating investing as gambling.

“Most investing apps aren’t for investing. They are dopamine-fueled casinos — flashing charts, fake “free” trades, and endless FOMO to keep you chasing.”

There is probably some truth to this. Certainly, investment products look quite different these days from when I started in the advisory business. However, here’s a funny thing: I’m currently reading an old classic, Jack D. Schwager’s ‘Market Wizards’, and it’s shocking to find how many of the ‘wizards’ have a background in gambling. What’s more, almost all of them use gambling analogies in relation to trading.

In case you don’t know the book, which was published in 1989, it is a series of interviews with top traders, exploring how they made their money. Despite being a little dated, it’s a fascinating read if you like that sort of thing. I haven’t finished it yet and am making some notes as I go. Here is a note I made from the interview with Gary Bielfeldt, who was known for his sizable trades in treasury bonds in the 1980s:

On poker and the concept of playing the percentage hands:

You don’t just play every hand and stay through every card, because if you do, you will have a much higher probability of losing. You should play the good hands and drop out of the poor hands, forfeiting the ante. When more of the cards are on the table and you have a very strong hand – in other words, when the percentages are skewed in your favor – you raise and play that hand to the hilt.

Apply the same principles to trading. Wait for the right trade. If a trade doesn’t look right, you get out and take a small loss; it’s precisely equivalent to forfeiting the ante by dropping out of a poor hand in poker.

When the percentages seem to be strongly in your favor, be aggressive and really try to leverage the trade, similar to the way you raise on the good hands in poker.

Of course, not all gamblers are made the same. Those who understand probability fare much better than those just out to have some fun.

“If you do not manage the risk, eventually it will carry you out” – Larry Hite

One of the recurring themes from the book is risk management. This is a broad subject, but almost all of the traders talk about how they scale back their activity when they are trading poorly. In golf parlance, a bogey is one bad shot; a double bogey is a bad shot followed by a stupid shot.

Cutting losers quickly while letting winners run is another common theme. Ed Seykota’s three golden rules are: Cut losses, cut losses, cut losses! Paul Tudor Jones’ mantra is “never average losers”.

Jones says: “Never trade in situations where you don’t have control. For example, I don’t risk significant amounts of money in front of key reports, since that is gambling and not trading.” That’s an interesting comment considering the number of people I see trying to trade the latest inflation report or Fed meeting.

Bruce Kovner’s first rule of trading is “Don’t get caught in a situation in which you can lose a great deal of money for reasons you don’t understand”.

All of these great traders stress that making mistakes is not only normal, but an important part of the process. PTJ is known for catching major turning points in markets however, he is not the sniper that many people imagine. He may try repeated trades over a period of weeks, getting out as the market moves against him before probing again until he finally finds that turning point.

Larry Hite notes: “You can lose money even on a good bet. If the odds of the bet are 50/50 and the payoff is $2 versus a $1 risk, that is a good bet, even if you lose. The important point is that if you do enough of those trades or bets, eventually you have to come out ahead.”

Trading vs investing

Schwager makes two key distinctions between trading and investing: First, a trader will go short as readily as long. In contrast, the investor – for example, the portfolio manager of a mutual fund – will always be long. If he is uncertain about the market, he may only be 70% invested, but he is always long.

Second, a trader is primarily concerned about the direction of the market. Is it going up or down? The investor is more concerned about picking the best stocks to invest in.

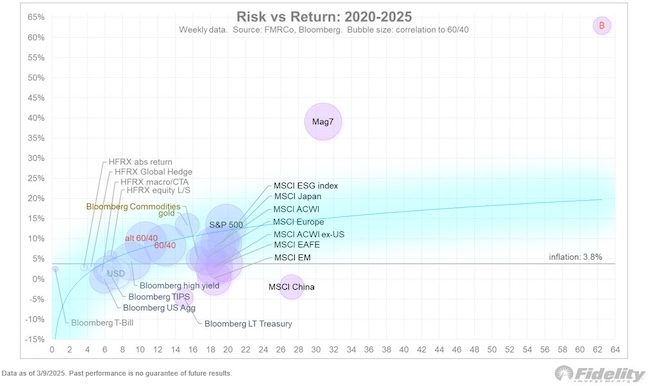

Of course, neither traders nor investors are limited to stocks only. Take a look at this absolutely insane chart from @TimmerFidelity

The chart shows the annualised volatility vs annualized return of various assets since 2020. Notice anything funny?

If you like the Magnificent 7 stocks outperformance, you’re gonna love Bitcoin!

Many will look at the asset in the top right corner and assume that is where the investing/trading ends and gambling begins. Those in the know will note the efficient frontier line you get when you own everything in the chart. My investing philosophy is that’s exactly what you want to do. The only question is how you weight each asset.

Just FYI, Paul Tudor Jones’ largest holding these days is the iShares Bitcoin Trust (IBIT). It’s around 4.5% of his total portfolio.

More from PTJ here in Facing inflation – the four assets you should own.

“Don’t be a hero. Don’t have an ego. Always question yourself and your ability. Don’t ever feel that you are very good. The second you do, you are dead.” – Paul Tudor Jones

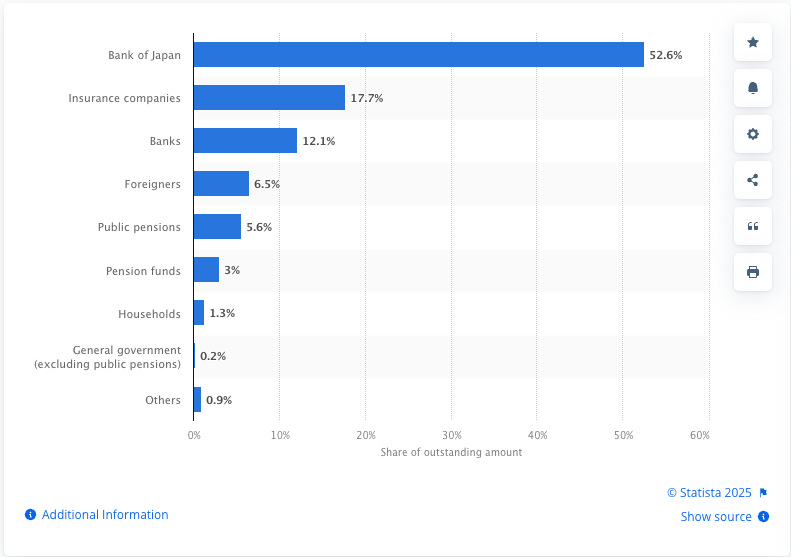

Finally, a somewhat sobering message. Two quotes so far stopped me in my tracks and made me think of Japan and its mountain of debt (although they were actually about another economy):

“And you are saying that people look at the deficit year after year and think, “Well, it can’t be so bad, the economy is strong,” and one day everyone wakes up. It is like having termites in the foundation of your house. You may not notice them until one day they gnaw away a big chunk and the house collapses. I don’t think anybody should take a large amount of comfort in the fact that things appear to be holding together.” – Richard Dennis

“If the economy starts to go with the kind of leverage that is in it, it will deteriorate so fast that people’s heads will spin. I hate to believe it, but in my gut that is what I think is going to happen. I know from studying history that credit eventually kills all great societies.” – Paul Tudor Jones

If you do not manage the risk, eventually it will carry you out.

Top image by Greg Montani from Pixabay

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.