You might have noticed an uptick in articles covering bonds recently. In particular, bond yields and bond auctions. Bonds are confusing, and it’s often easier to just go and read something else, but you might be getting the sense that something is happening in the bond market. Like it’s trying to tell us something.

If you need a refresher on bonds, feel free to read my post, Bond investing – a simple guide.

The market always finds something to worry about, and usually, those worries are temporary. This year alone, we’ve had inflation, stagflation, recession, tariffs, and trade wars, and the sky hasn’t fallen yet. But now the market is worried about bonds. And it’s not just worried about US treasuries. The same concerns surround UK gilts, Euro bonds, and Japanese government bonds.

Here’s a Reuters article about record yields on Japanese long-dated bonds.

This week, the US 30-year treasury yield has been flirting with the closely watched 5% level. Last Friday’s Moody’s US credit downgrade got things rolling. Then, on 21 May, there was a weak treasury auction, and the 30-year closed at 5.09%.

As yields move inversely to price, rising yields indicate that investors are selling bonds. The weak treasury auction, like recent weak gilt and JGB auctions, illustrates a lack of appetite for new bonds. So why are people so worried about bonds these days?

It’s the debt, stupid

At 237%, Japan is the heavyweight champion in debt-to-GDP. The UK is at 96% and the US is at 124%. None of these figures is encouraging. Japan is clearly not paying that back. The UK economy is in disarray, and you may remember Liz Truss almost blowing up the bond market in September 2022.

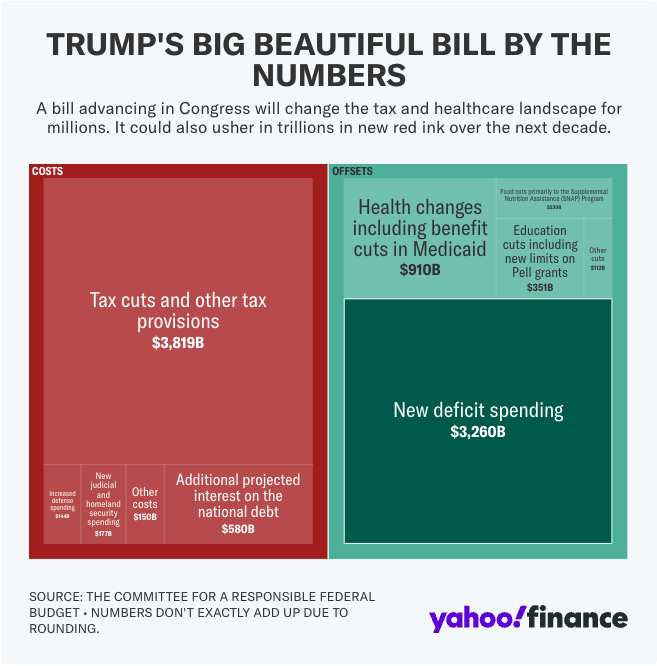

Trump talks a lot of smack, but his big beautiful tax bill is only going to inflate the problem over time. Anyone who believes he is going to cut deficit spending lives in MAGA fantasyland.

The bond market clearly doesn’t like it.

Is it happening?

The macro-heads I read are all fixated on yields, deficit spending and the massive risk flashing in the bond market. But is something really going to break, or is this just another worry that will soon make way for the next thing?

I’m not going to macro larp here, and I dislike doomers, so here’s a solid thread from Capital Flows on why we could be at an inflection point. It’s recommended reading for anyone trying to get their head around the current situation.

The tldr: Central banks are behind the curve – surprise! Meanwhile, banks are issuing debt like there’s no tomorrow. These big credit deals are feeding money into the economy and preventing a slowdown in growth. When central banks fall behind in a credit cycle like this, bond markets can crash because growth and inflation rise while everyone expects a recession.

Does this mean I should not own bonds?

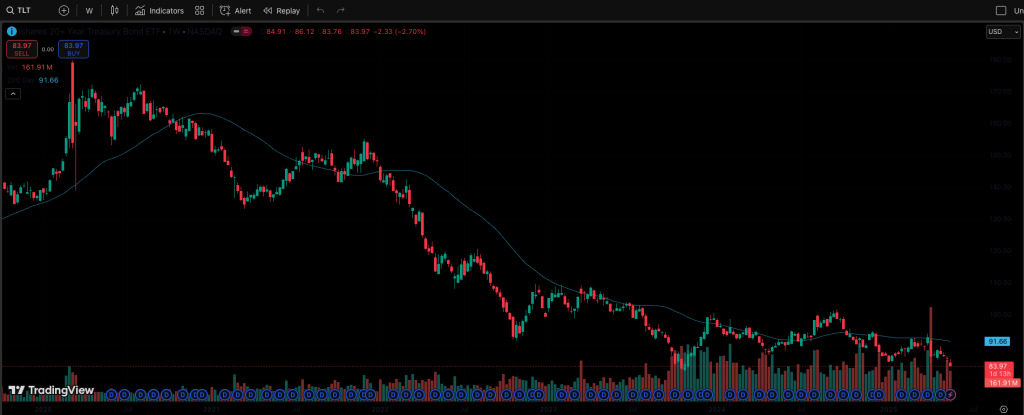

This is an important question. For traders, the trade is definitely sell long-term bonds. (TLT)

For investors with a diversified portfolio, should they be dumping their bonds and buying gold, copper, bitcoin, etc? I don’t think so. This is short-term tactical thinking and only for people who know what they are doing. By nature, a strategically diversified portfolio is always going to contain some assets that aren’t doing so well. Right now, it’s just the turn of bonds. Unless your time frame has changed dramatically, you can just sit tight.

Big developed economies losing control of yields is a scary proposition, and they are likely to do whatever they can to kick the can down the road and avoid the pain. Just last month, a surge in treasury yields caused Trump to back down on tariffs, remember?

Is this why Bitcoin is ripping?

It’s one of the reasons, yes. BTC is fundamentally a release valve for macro liquidity (I was dying to say that, but I got it from Capital Flows too!) What it means is, the more liquidity that gets pumped into the system, the higher the BTC price goes.

Here’s the Capital Flows report to read if you want to geek out on that one: Bitcoin Strategy – The Macro Liquidity Release Valve

BTC is also going up because it’s at that stage of its own 4-year cycle. But it’s funny how that seems to align so well with global liquidity cycles. There’s probably a bit of mileage left in this bull market yet!

Right now, let’s enjoy the all-time highs. It takes me back to this post from February 2023: Do you want to be right, or do you want to make money?

Sometimes you get to have both.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.