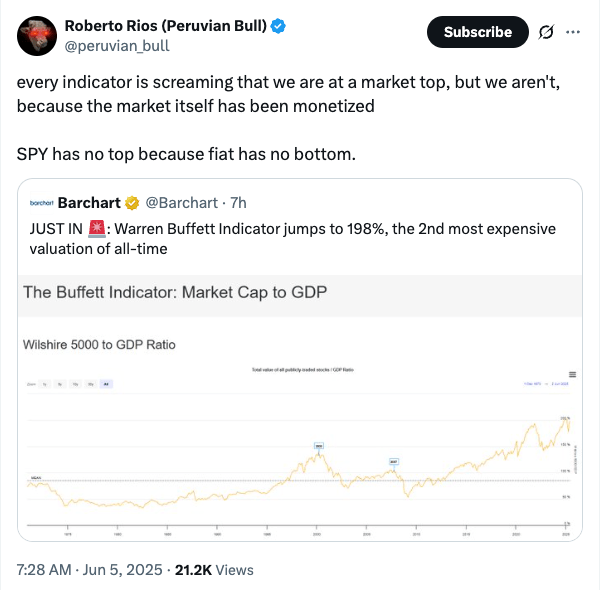

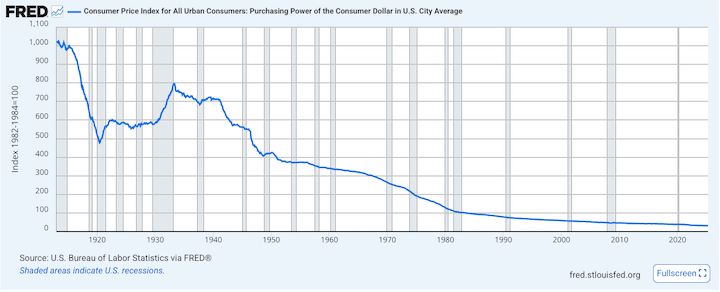

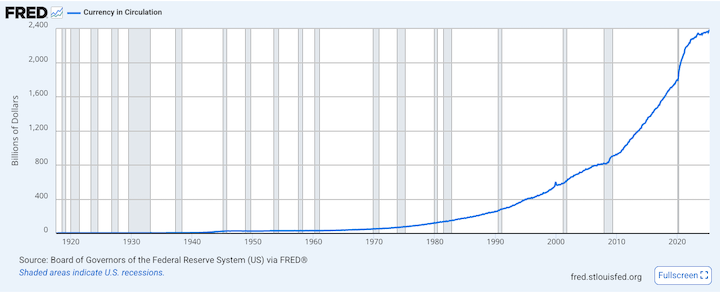

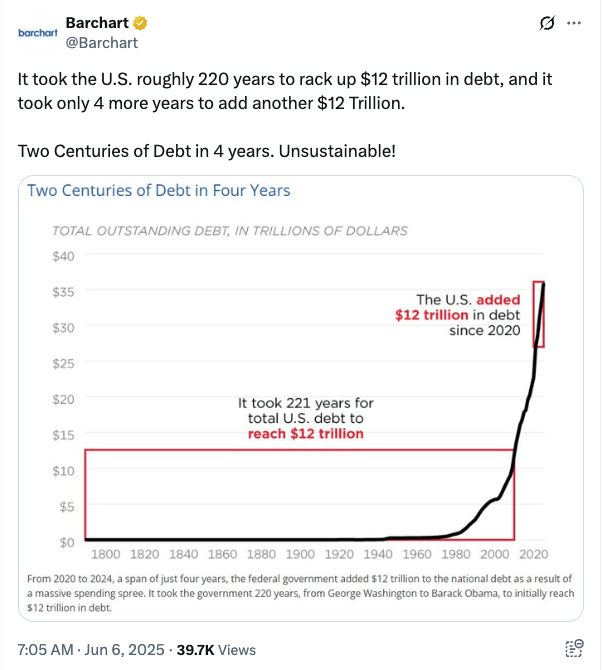

You may have noticed a theme in my last two posts: markets have no top, because fiat has no bottom. If fiat money is programmed for debasement, then assets priced in fiat are equally programmed to increase in value over time.

We just got another example this weekend. When America struck at Iranian nuclear sites, the stock market was closed. However, crypto trades 24/7. Sure enough, Bitcoin dumped from $103k to $99k as everyone geared up for full-scale war. Then, this morning, after Iran’s token retaliation and the announcement of a ceasefire, it popped back above $105k.

Gotta be quick to buy those dips!

I have learned through experience that trying to trade geopolitical events is a waste of time. Unless you work at the Pentagon, you have zero edge. By the time you are positioned for a particular outcome, the situation has already shifted or resolved, and the move is done.

Case in point:

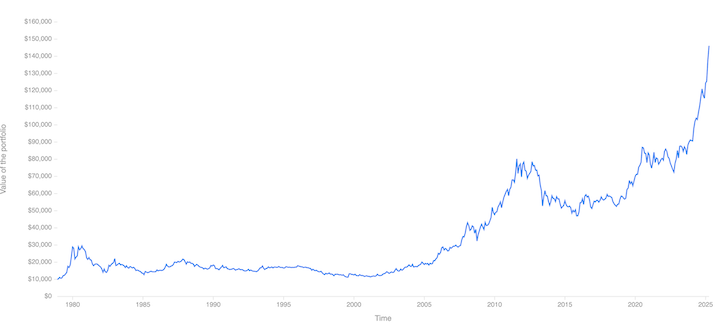

These events usually have far less of an impact on markets than people expect.

Or, as the kids like to say these days: Nothing ever happens.

That chart is a little hard to see, I know, but you probably get the picture. All these ‘big events’, and the stock market just goes up and to the right. FYI, it came from a 2016 blog post called A history of share prices by Kieron Nutbrown, former head of global macro fixed income at First State Investments in London.

Investing can pretty much be summed up as a long-term bet on the nothing ever happens narrative. The only gauge you need to watch is global liquidity. When that rises, asset prices go with it, and it’s going up forever, Laura.

In other news

Obviously, you can’t take the ‘nothing ever happens’ narrative too literally. Lots of things happen, but mostly they don’t have much influence on the big picture.

Japan is perhaps the most ‘nothing ever happens’ country in the world! Considering the absolute mess Western governments are in, it’s neat how Japan just keeps chugging along. Nobody expects leadership to get better, and people have pretty much accepted that electing the ‘other guys’ will just mean more of the same, but with less predictability.

However, things do change! On 25 June, the Financial Services Agency meet to discuss the possible reclassification of digital assets. (article here) If this goes ahead, it could mean that crypto will be taxed like stocks and could also pave the way for Japan-based crypto ETFs.

When I posted this article on X, I was met with comments about how this discussion has been ongoing for years, nothing ever changes, blah blah. But, I actually think it may happen this time. The FSA is well aware that the current classification doesn’t make a lot of sense, and the election of Trump and his positive stance towards digital assets appear to have motivated the powers that be to get with the program.

Time will tell, but my bet is that this goes ahead and is implemented from 2026.

If I’m right, this will probably be the pin that pops the Metaplanet bubble. The whole reason for buying a Bitcoin proxy was to avoid BTC gains being taxed as income. Take that away and demand for the stock should fall, although maybe not until next year, when it is actually implemented.

Until such a time, the Bitcoin/crypto proxy companies will likely continue to trade feverishly. A few weeks back, Beat Holdings (9399), a company formerly known as Xinhau Finance, jumped on the bandwagon and announced a Bitcoin treasury strategy. Bizarrely, they are buying the BlackRock IBIT ETF rather than Bitcoin itself. Not so bizarrely, they updated their website to look just like Metaplanet’s! The stock went vertical shortly after the announcement and is now bouncing around like a ping pong ball. Expect more of these before the year is out.

Something sensible

I am mostly out of Metaplanet and have just kept a relatively small holding in case Q3 gets as crazy as I think it might. So I now have some dry powder to allocate over the summer. Needless to say, this money will be going somewhere more sensible. With the USD/JPY still trading at ¥145, I will keep most of this in yen for the time being.

I came across this list of Noteworthy DX stocks from METI. These are companies identified by METI as being at the forefront of digital transformation. I already bought a couple of names from here and will perhaps add to them over time if they work out.

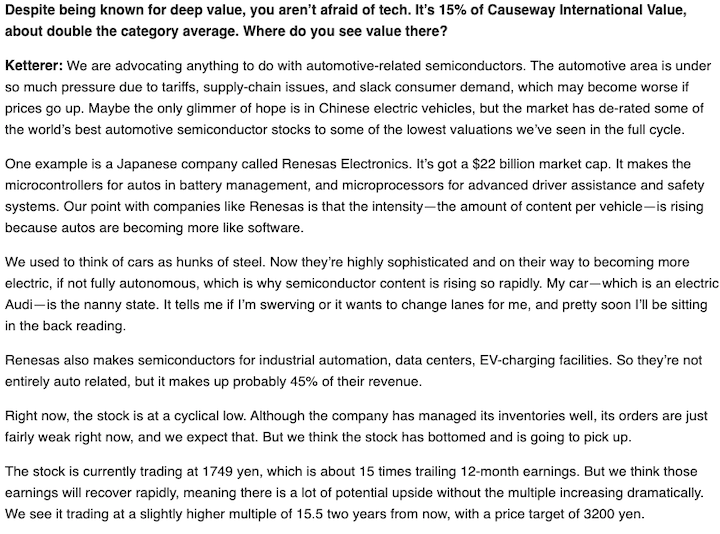

I also started a position in Renesas Electronics (6723) after reading this article. There were some interesting comments in there.

Luckily, Renesas doesn’t seem to have suffered any damage from its US partner Wolfspeed announcing that it is going into Chapter 11 bankruptcy…

Nothing ever happens, right?

Top image from Freepik

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.