The hot summer months usually mark a quiet period for markets, but there are no signs of a lull so far this year.

While the upper house election last weekend likely had a limited impact on stocks, the trade deal announced shortly after certainly got things moving. The Nikkei 225 index surged over 3% on 23 July and is creeping up on ¥42,000 as I type today.

Shigeru Ishiba may have lost his ‘mandate from heaven’, but the Japanese auto industry is saved!

Perception really is a funny thing. Automaker stocks surged yesterday as investors cheered a 10% ‘reduction’ in US import tariffs from the 25% touted by Trump. However, before Trump took office, the tariff on cars was 2.5%. So there has actually been a 12.5% increase. Trump’s big stick negotiation tactics may be crude, but they appear to be working.

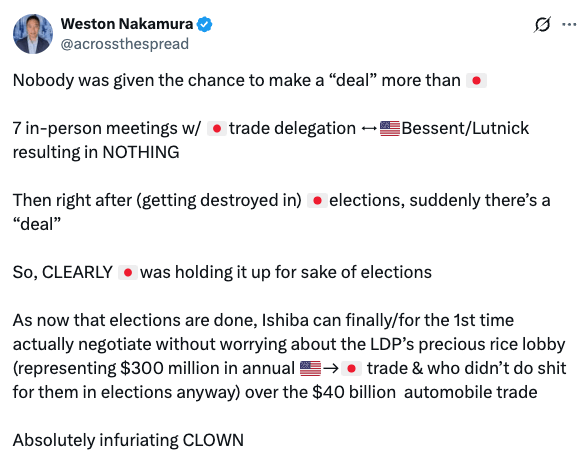

By the way, Weston Nakamura isn’t buying the coincidental timing of the trade deal announcement.

Probably the biggest pressure release for markets will be the end of tariff uncertainty. If Trump can secure a similar deal with the EU, then we are likely through the worst of it.

He’ll still have to come up with a pretty big distraction from the Epstein files, though, so we should stay on our toes.

Anyway, moving swiftly on

I find a lot of people struggle to understand the concept of currency debasement. If this is you, I highly recommend this episode of Forward Guidance with Raoul Pal and Julien Bittel:

You only actually need to listen to the first 10 minutes to get the picture, although it’s all good stuff.

A quick summary:

- Governments restructured their debts after the ‘debt jubilee’ that followed the 2008 financial crisis, forming an almost perfect 4-year liquidity cycle

- We’re in the 4th year of that cycle now, where the larger part of the debt is due

- The liquidity that gets added never really gets taken back and is rising at a rate of around 8% per year

- That is about the rate of debasement of fiat currency

- If you divide an asset by the rate of global liquidity, you find out it’s true performance vs debasment

- The S&P 500 is basically flat, same with other countries’ indexes

- Gold is also flat, as it should be

- The only assets that outperform debasement are tech stocks and crypto

Governments are now just servicing their debt. i.e. paying interest and not repaying the principal. GDP is falling due to the declining birth rate and shrinking labour force. And so, governments are debasing currency to pay for the debt.

Until political parties appear that are willing to tackle this problem, elections and politics are pretty much meaningless when it comes to investing. And, of course, no party wants to deal with the giant elephant in the room as it will mean years, likely decades of pain. That’s the reality. If you don’t want your spending power to get eroded over time, you need to be invested appropriately.

Now, should you only own tech stocks and crypto? Clearly not. But, in my humble opinion, you would be crazy not to have an allocation to them.

Incidentally, the Bitcoin 4-year cycle dovetails remarkably neatly with the 4-year liquidity cycle. I have come to realise that this is also not a coincidence. In fact, BTC lags global M2 money supply by around 90 days. Here is Julien Bittel’s chart of projected M2 from back in May:

Are you surprised that BTC is now near $120k? You shouldn’t be!

Now imagine if the Fed cuts rates in the next few months…

As long as that M2 line keeps going up, expect risk assets to follow. If you see it turn down later this year, that’s the purest signal possible that the Bitcoin bull market is nearing its end.

Inject that chart directly into my veins!

If you want to get deep into the weeds on liquidity, Arthur Hayes writes some entertaining posts. His latest is here. Be warned, Arthur is a liquidity/crypto uberbull.

Meanwhile, here in Japan, stocks are in celebration mode. I don’t see any reason to fade the mood, although my bullishness is always tempered by the fact that I’m living right here next to the canary in the debt/demographics coalmine.

You can only worry so much, though. Stay cool, and if the world ends, it will probably be a great time to buy stocks!

Top image by Jonas KIM from Pixabay

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.

One thought on “Liquid refreshment”

Comments are closed.