Last week, I posted about a possible correction in risk markets. A lot of things happen in a week these days! So, how do things look?

Bitcoin, which has a habit of leading big moves in stocks, made it down to $109k from a peak of $124k. That move appears to be done for now, and it’s consolidating at around $111k. Tech stocks wobbled slightly, but nothing major so far. Nvidia earnings are on deck tonight – that’s always a big event. No doubt the dominant chipmaker will kill it, but will it kill it enough? Expectations could hardly be higher.

I don’t see Nvidia earnings being bad enough to tip the market over. Maybe a couple of days of turbulence if they are not quite as spectacular as everyone hopes?

More importantly, Jerome Powell’s Jackson Hole speech was surprisingly dovish. Stocks rallied in the aftermath, and Bitcoin put in a massive green candle that was quickly retraced. Then yesterday, Trump moved to fire Lisa Cook. As crazy as that is, the market took it in its stride. Imagine if any other President had manoeuvred so brazenly to gain control over the central bank and bring rates down…

I ended my post last week hoping for a bit more euphoria before the chaos ensues. It’s looking like I might get my wish. Trump doesn’t want rates lower for nothing. He wants to pump the markets. Plus, his businesses own a ton of crypto.

Here’s an excerpt from that post last week:

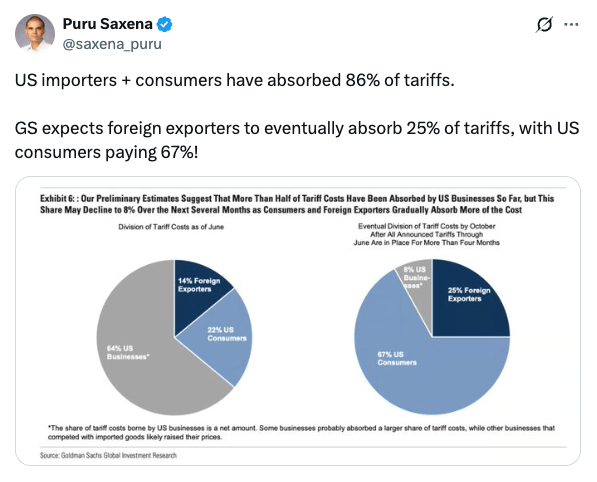

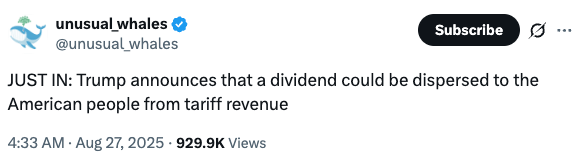

Where are the Robin Hood gamblers going to get their funds from when their cost of living keeps rising? Cash handouts from Trump? You can’t write anything off these days…

And then, today:

Well, well, well…

A few other observations

Remember Metaplanet? The haters have been running victory laps the past few weeks after Japan’s leading Bitcoin treasury company saw shares tank from their ATH of ¥1,930. Now it trades at ¥862. It’s no big surprise, however, I think few people realise that the treasury company mania didn’t end – it just moved elsewhere. Copycats have been popping up left and right. Also, stablecoins are the new hot topic.

Check out the recent price action on some of these tickers: 8105, 3853, 7422 – a ball of hot money is chasing them relentlessly, and most of this money likely came out of Metaplanet. Bigger names, like SBI Holdings (8573 ), have been pumping, too. (possible rate hikes and crypto behind this one) Monex Group (8698) is up big today on reports that it is considering issuing a yen-pegged stablecoin.

I’m not saying people should be chasing these names, but the hot money didn’t just go away. And don’t discount some of it coming back to Metaplanet in the next few weeks/months. They own the most Bitcoin, and Eric Trump (who is on the board) is coming to Japan soon. He’ll be keen to pump up the crowd.

The Japanese Prime Minister addressed a crypto conference in Tokyo this week. File that under ‘things I never would have imagined’.

We may be in the final innings, but that’s usually when the really crazy stuff happens…

Rate cuts? Rate hikes?

After Jackson Hole, the market is now thoroughly convinced that the Fed will cut in September. That outcome is being front-run already. There will be a revolt if Powell doesn’t follow through…

What will the BOJ do? No idea, but the consensus seems to be for a small, cautious hike.

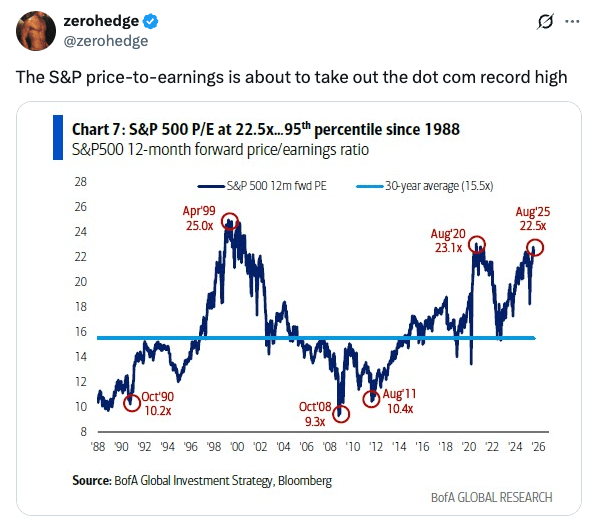

In the bigger picture, Trump is going to pump liquidity one way or another. That’s great news for risk assets in the shorter term and pretty terrifying on a longer time frame. The US doesn’t really need lower rates. If anything, inflation is likely to accelerate into the end of the year.

The pump could be spectacular. The dump is gonna hurt.

Plan accordingly. Keep your core portfolio in balance and otherwise leave it alone. Maybe take a critical look at your riskier satellite holdings and how you are positioned for what may be to come. If we get the pump, you know what comes next.

It’s going to be a wild ride.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.