I am reading “When Genius Failed: The Rise and Fall of Long-Term Capital Management”. It’s the remarkable story of a ’90s hedge fund comprising a group of big-brained academics, including Nobel Prize winners, who were so convinced that their models were infallible that they built a gigantic book of highly leveraged derivative trades. Even if you’re not familiar with the story, you can imagine how that ended.

The smart money doesn’t always win.

One of my favourite books is Jon Krakauer’s “Into Thin Air”. LTCM is like the hedge fund version of that cautionary tale. Hubris and leverage are a dangerous combination. The academics somehow convinced themselves that they had modelled out every outcome, and even if things went bad, there would always be enough liquidity to get out of their positions. Of course, ‘one in a million’ events happen more frequently than we expect, and when they do, nobody is around to buy what you desparately need to sell.

At least we learn our lessons, right? Well, LTCM blew up in 1998, and it was only 10 years later that Bear Stearns, which was closely linked to the fund, faced its own meltdown.

There’s a lot to be said for keeping things simple. Viva le dumb money!

Wait, isn’t this site supposed to be SMART Money Asia?

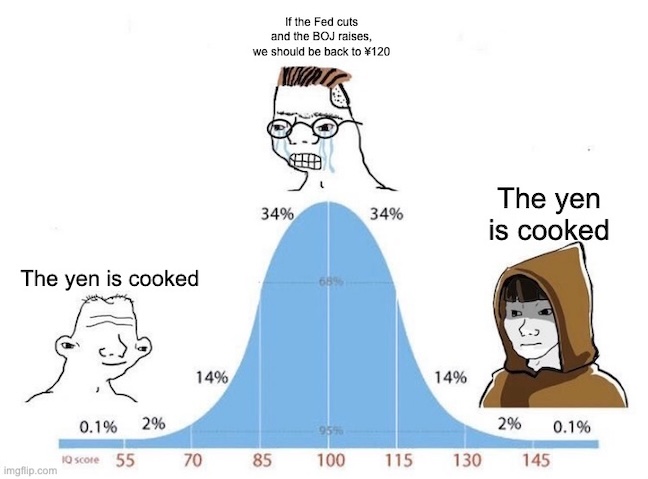

This is easily the greatest meme ever created. It applies to so many areas of life, and none more than investing. The LTCM guys were just too far out on the right of the curve that they no longer lived in reality.

Generally, the smart money and the dumb money follow the same strategy. They buy risk assets and sit on them. In my previous post, Liquid Refreshment, I covered how tech stocks and Bitcoin are the two things that outperform currency debasement. And what do the Robinhood degenerate gamblers do? They buy Mag 7 and IBIT and print money. When these assets dip, they buy more! What are the older, wiser retirement accounts buying? NASDAQ and IBIT, by the looks of it!

Wait, is the diversified portfolio guy telling us to just buy tech stocks and Bitcoin?

I have always said, if it’s a meaningful amount of money, you should have a core diversified portfolio weighted toward your base currency for about 80% of your wealth. You can allocate 20% or so to satellite holdings to take advantage of opportunities for higher returns. This is where you can go hard on tech stocks, gold, commodities and Bitcoin/crypto as you wish.

Overthinking and mid-curving are the killers. See my post, It’s going up forever, Laura, on why dumb money wins in the end.

I see that USD/JPY is back at ¥150. Let’s do the meme:

Simple!

Of course, mid-curve guy is right. Short-term, barring any crazy events (which happen a lot!), the yen should strengthen against the dollar. However, if you are doing long-term planning and trying to figure out how currency could affect you, it’s pretty clear that the country with the worst debt/demographics profile is going to lose against the country with the global reserve currency.

Plan accordingly.

Trump wants rates lower, and Powell won’t play ball. So, Trump and Bessent will find ways to work around Powell and add liquidity regardless. This is bullish for stocks. If there is some kind of panic and a dip in stocks in the meantime, they will turn on the fire hose. Back up the truck and buy the dip!

The TSE apply pressure to listed companies to improve their governanace and return capital to shareholders – it’s a great time to own Japanese stocks if you have a JPY base currency need! (not so great if you don’t, see above)

Every four years, Bitcoin goes down around 80%. Then it spends about a year floundering around and recovering slightly, and the next two years in a powerful bull market. If it goes down 80% next year, you swing like Happy Gilmore!

See how it works? Dumb money stays winning!

Have a great weekend.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.