I watched the David Beckham documentary on Netflix a while back. I highly recommend it, even for Liverpool fans like myself!

One thing that struck me was his beekeeping hobby. Of all the things a guy like that has money to spend on, he is clearly getting a lot of joy out of keeping bees and producing honey. The reason I remember this is that I met up with an old friend not long ago and he gave me some of his homemade honey. He has a full-on beehive that he is working on with his kids. What a great way to spend time and money!

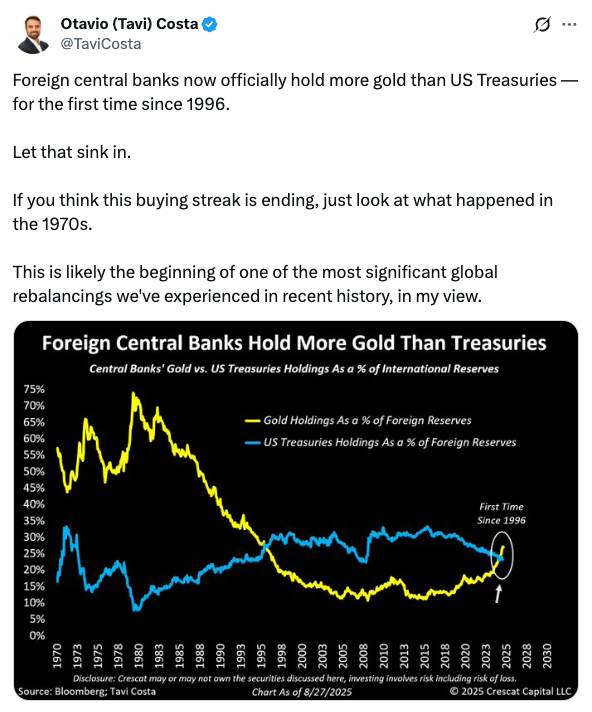

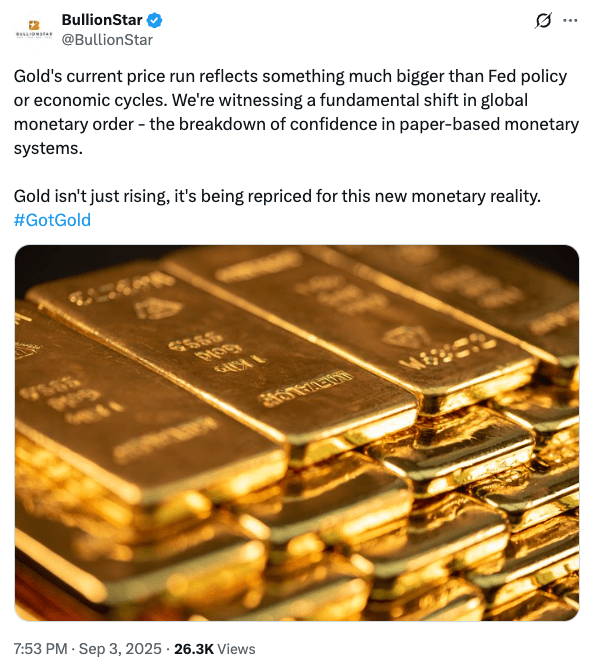

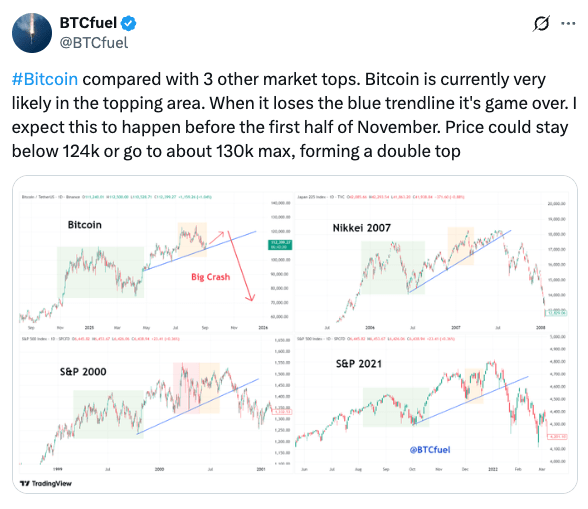

I recently saw a few posts about spending money well. It’s something that Ben at Retire Japan has discussed, too. Many of the posts I saw were from crypto bros discussing how to spend their winnings from the bull market. (yes, this is a sign we are near the top!)

The fact is that many people who are good at saving and investing (or trading crypto) struggle with actually enjoying their money. I think it requires a shift in mindset to spending as an investment.

- Spending isn’t the opposite of saving; it’s about aligning money with values

- A well-chosen expense can yield returns in happiness, health and memories

- Maybe you can consider a “joy budget” alongside your savings and investing goals

With that in mind, I have pilfered, borrowed, adapted and brainstormed some ideas on how to spend money well:

Experiences worth spending on

a. Travel and exploration

- Hardly an original idea, but we Japan residents are blessed with an abundance of options for holidays and weekend trips, not to mention first-rate public transport if we don’t want to drive

- Consider seasonal highlights such as autumn leaves, cherry blossoms, and summer matsuri

- Don’t let the weak yen stop you from having fun; you can take a beach holiday in Okinawa or snowboard in Hokkaido without even breaking out the passport

- If you want to go to the next level, look into getting a holiday home in the mountains or on the coast

My one piece of advice as a parent of young kids: when you book that family-friendly hotel trip, you need at least two nights. Otherwise, you don’t get to check in until 3pm, and then you have about 2 hours to have fun before it’s dinner time, bath time, bedtime. And then at 10am the next morning, they kick you out! Some places will let you use the facilities before check-in, but for those that don’t, you need the extra night so you can enjoy a full day of fun!

b. Unique cultural activities

- Tea ceremony, ikebana, calligraphy, martial arts

- These are one-of-a-kind experiences not easily replicated elsewhere

c. Learning and growth

- Hire a coach for your hobby. Whether it’s tennis or language study, why not accelerate your learning?

- Online learning: from Excel basics to digital marketing and investment banking, Udemy offers a course for nearly everything. It’s also very affordable compared to going back to school!

- Don’t forget to Invest in Yourself – Expat Leaders Leap is on November 14-16 (arrange a call with me if you want to know more)

d. Health and wellness

- Gym memberships

- Onsen/spa retreats

- Preventative health check-ups

e. Time-saving conveniences

- Hire a cleaner, either regularly or spot cleaning for the bathroom, kitchen, air-con, etc. That kitchen extractor fan gets gnarly!

- Cooking service – we use this one as my wife and I both work. We have a lady come once a week for three hours, and she cooks around four meals. Then we just set the rice cooker and heat up the food after work

Material possessions that add value

a. Home comforts

- Good quality mattress and pillow

- Ergonomic desk chair, if you have a home office/study

- Artwork – buy some nice paintings to hang in your home

- Kitchen gadgets

- Home gym equipment

- Home sauna – yes, some people have done this, and in a Japanese house! (not my thing, but it’s a baller move)

b. Clothing and gear

- Throw out all your socks and underwear and buy new ones

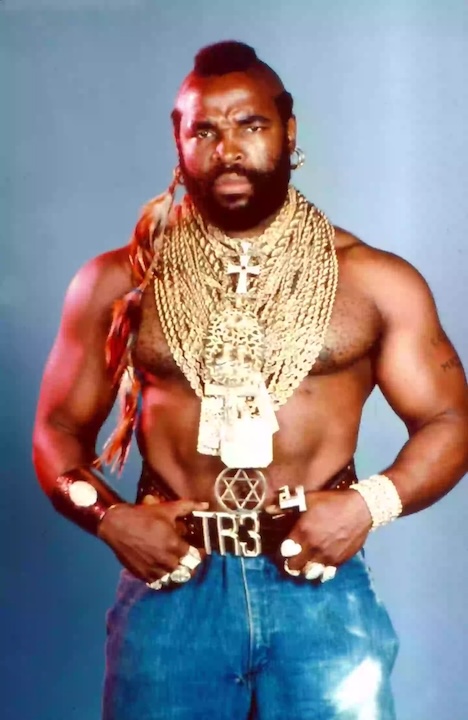

- Upgrade your wardrobe – go full American Psycho if you have to!

- Decent rainwear

- Nice winter coat

- High-quality shoes

- Get that Omega Speedmaster that Noah Lyles is wearing! (I just noticed this watching the World Athletics Championships, although I don’t think I can bring myself to spend that much on a watch…)

c. Tech upgrades

- Upgrade your Zoom set-up – nice camera, microphone, lighting (this is high on my list right now)

- That new orange iPhone (yes, I am tempted…)

- Noise-cancelling headphones for train commutes

Personally, I’ll pass on those smart home devices. Tech companies are spying on me enough already!

d. Hobby investments

- Musical instruments, art supplies, outdoor gear

- Sports equipment (new golf clubs, yeah!)

Spending on relationships

- Host dinners or gatherings – throw a party!

- Trips to visit family, or to fly them to you

- Join clubs or networks to expand your circle

- Date nights (where’s the best babysitter service???)

Random other feel-good stuff

- Take private cars to the airport instead of lugging all your stuff on the train

- Keep your haircuts on a tight schedule, keep it fresh instead of waiting until it gets shaggy

- If you’re not into personal finance/investing, hire someone to help (coaching service here!)

- Buy some Bitcoin for a young family member in the next bear market and keep it for them (substitute for gold or stocks if you prefer)

Some of the best lifestyle advice I ever came across was from Jim Rohn. He published an audio book called The Art of Exceptional Living in 20023 (CD or cassette, yes, it’s old school! I’m sure you can find a digital version somewhere)

I still listen to it now and then. It’s important to remember that it’s not the money, it’s the style that counts!

Being good with money is not just about saving; it’s about knowing how and when to spend. The best spending aligns with your values and enhances your life. Use your money not just to build wealth, but to build a life you will look back on with joy.

Did you find anything interesting? What else have you got? Please feel free to drop other great suggestions for spending money well in the comments.

And, finally, a disclaimer: none of this is spending advice. Do what makes you happy. I will not be responsible for arguments with your significant other following the purchase of any of the items mentioned above!