Our family just came back from a weekend break, which was my treat in celebration of our stellar investment returns. Note: don’t tell your significant other how well your portfolio is doing unless you are prepared to spread some of the winning around! We had barely been back home for 5 minutes when the doorbell rang and a new pair of boots was delivered. She bought those herself, so no complaints from me, but you can see how this goes.

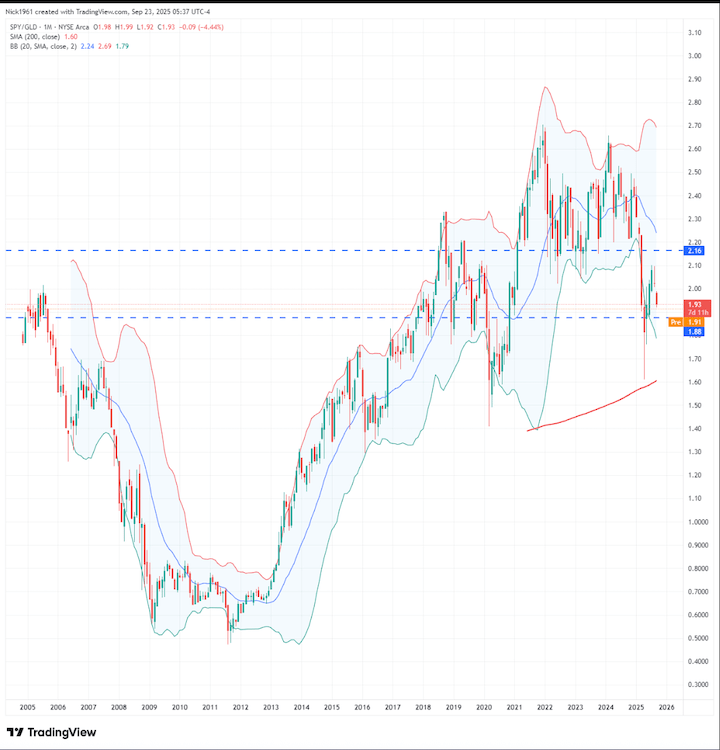

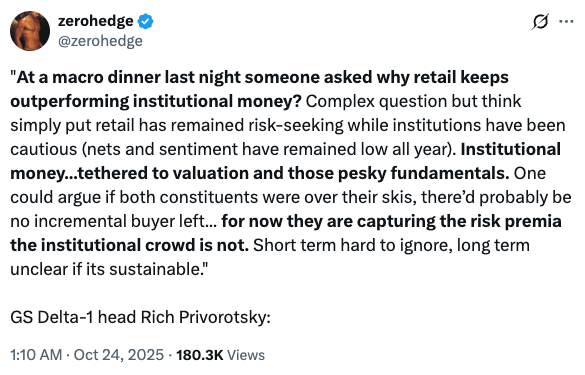

Even the stock market is enjoying a little retail therapy.

In case you’re not familiar with the term, retail in this case means individual investors: regular people, you and me. One theory is that covid is behind this surge in retail-driven performance. Stuck at home with their stimmy checks, regular investors learned to buy the dip, and it’s been working for them ever since. Stocks, crypto, gold – whatever retail jumps on goes up. Institutional investors look on in bewilderment, stuck with their risk models flashing warnings as the market leaves them in the dust.

It may not be healthy, but these are the cards we’ve been dealt. And with the Fed expected to cut a couple more times this year while simultaneously ending its balance sheet runoff, it’s hard to find a compelling reason to ease off the gas. Trump has even been talking about handing out money from tariff proceeds to the public. Can you imagine?

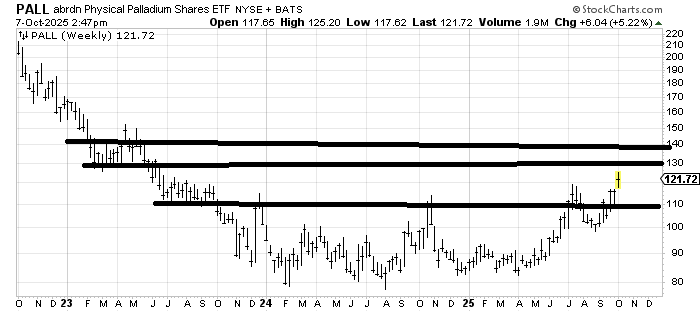

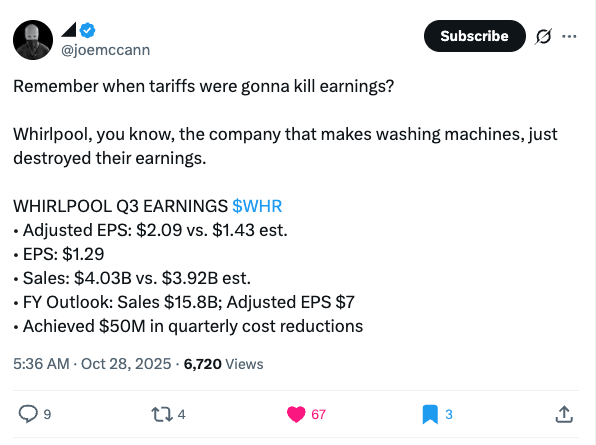

An interesting tidbit:

Maybe retail is buying washing machines, too!

It would be rude not to do this! I’m looking at late November, maybe 26th, 27th or 28th. I’m open to suggestions on the venue, but my basic rule is that it must be a cash bar, so we don’t have to worry about whether everyone turns up to cover costs or fiddle around sorting out the bill. What do you say? If you don’t live in Tokyo and have been thinking of taking a trip, well…

Send me a message, email, DM or whatever if you want to come along. Will mostly plan this on X, so keep an eye on this thread.

We’ve been talking about an end-of-year melt-up for a few weeks now. So far, so good. I noticed the Nikkei Asia already started talking down the likelihood of a BOJ rate hike later this week. You can pretty much take that to the bank, right?

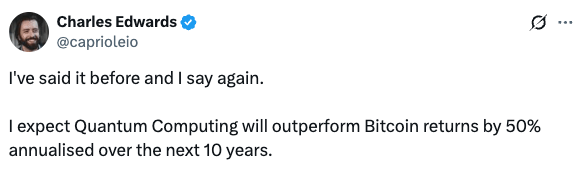

Is the Bitcoin 4-year cycle over?

After the most vicious deleveraging event ever just a couple of weeks ago, the crypto market has recovered. Yes, retail bought the dip once more!

There has been a wave of speculation over whether the 4-year cycle is still intact. It’s fascinating, actually, as crypto-natives have been hyper-trained on this narrative. It’s probably the reason Bitcoin is not significantly higher right now. Long-term holders have been unloading, while retail ETF buyers continue to accumulate. Many of the new investors have no idea what the 4-year cycle is and just have a monthly allocation set up for their account.

Price agnostic.

Felix Jauvin makes a pretty good case for the end of the 4-year cycle in this thread.

Felix is awesome, and I love his Forward Guidance Podcast, but time will tell. 2013, 2017 and 2021 were all followed by a nasty bear market. Yes, Bitcoin wasn’t a macro asset like it is now. Yes, you can make a great case that liquidity is rising, and the boomer ETF buyers will keep buying. I really want to believe, you know! But let’s just say I’m ready for anything. Warren Buffett hates crypto, but his quote about finding out who’s been swimming naked when the tide goes out could have been written for the industry. All we need is one good leverage flush to start the dominoes falling, and we all get a chance to buy at $50k again. Don’t think it can’t happen.

At least it will give these guys something to chirp about.

These guys are great! They’ve done zero work, but they will gladly tell you how Bitcoin is too volatile to be investable.

Well, BTC has closed above $100,000 for 172 consecutive days now. If you wanted to sell, you have had plenty of time to do so. If 2026 is a bear market, make sure you ignore these nitwits on their victory lap and back up the truck.

Melt-up before the melt-down, though, right? I’m yet to see real euphoria in crypto this year. Remember the images of people lined up on the street to buy gold a week or so ago? That’s what we’re looking for. We’re not there yet.

It’s a busy week with the Fed meeting, BOJ and Trump on the loose in Asia. I don’t know when the next dip will come, but you can bet that retail will be ready to buy it!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.