It’s a slow week for stocks in Japan, with the market losing ground in part due to the selling of names that went ex-dividend on 29 September, and also out of concern over a possible US government shutdown.

29 September was the cut-off date to receive the next dividend for many Japanese stocks. Prices are often driven up before the ex-dividend date, only to fall after it has passed as investors sell, safe in the knowledge that the next dividend payment will be delivered. It’s really a non-event for long-term holders.

A US government shutdown could lead to a delay in the release of key economic indicators such as jobs data. How can we possibly know when to panic sell our stonks if we don’t know how many jobs were added/lost last month in the USA?

Despite the relative gloom, the focus for Q4 is increasingly on a potential melt-up for markets as liquidity continues to flow. Tech stock valuations are admittedly high compared to the 20-year average. However, compared to the last 5 years, the premium is significantly lower. People looking for the bursting of the AI-driven bubble may have to wait a while longer. This article suggests that Wall Street strategists, including Jim Paulsen, are starting to look at high valuations as a kind of “new normal”:

“There’s something weird going on with valuations from what they used to be — that is, there’s an upward trend in the valuation range,” said Paulsen, who now writes a Substack newsletter called Paulsen Perspectives.

Will gold keep going?

People keep asking me if gold can keep rising. The best answer I have is: unfortunately, yes. Gold ripping to all-time highs, while exciting for goldbugs, is not a good sign overall. There’s a distinct lack of trust in governments and central banks to manage their debt and spending situation.

The dollar certainly doesn’t like it:

As for the yen? Well, the dollar index is down almost 10% YTD and USD/JPY is still at 148. If you are waiting for a stronger yen, you’d better hope the BOJ gets back to raising rates soon. Your mortgage won’t thank you if they do, though…

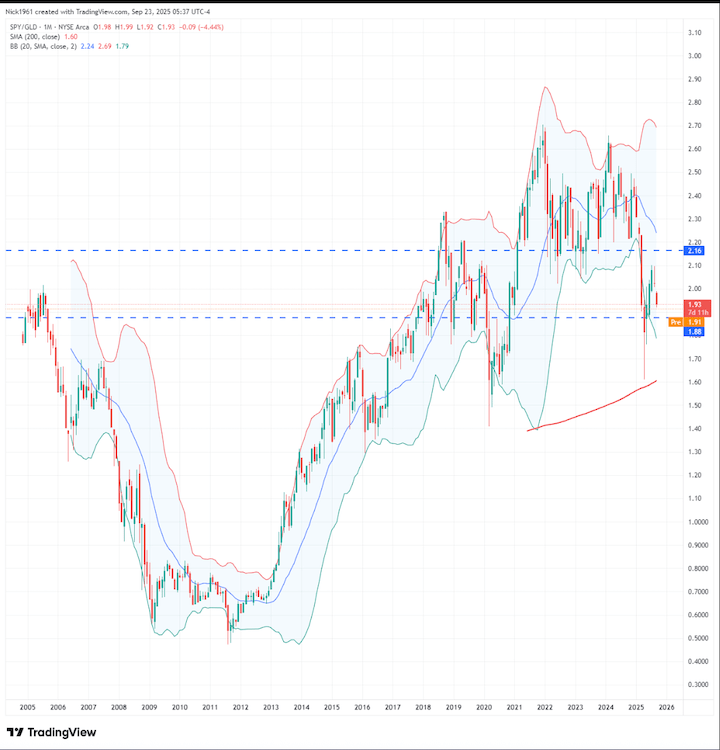

Talking of gold, here’s a chart for people to really hate on!

That came from this post by Nick G: “The price of equities is completely unchanged since 2005. All that has changed is the value of the denominator.”

So, priced in gold, the S&P 500 went nowhere since 2005. All “gains” were just the dollar losing value. And that includes dividends, apparently!

No wonder people are hyper-gambling on crypto and tech stocks…

Here’s an interesting (perhaps triggering) opinion piece on financial repression and why you want to own gold, silver and Bitcoin in the face of what’s still to come.

Speaking of which…

All eyes are on Bitcoin now as we enter Q4. If stocks remain strong into year-end, what will Bitcoin do? No price predictions from me, but I see a melt-up before a melt-down. This year’s theme has been long-term holders (who bought at rock bottom prices) enthusiastically selling to institutions that are hungry to secure their share of the network. If the OG’s put a pause on selling, look out above.

I’m hearing lots of talk of an extended cycle, a move to a 5-year cycle, and even a supercycle. I heard these same things in October 2021. I’m not saying the theory is wrong, but it was very wrong last time. I’ll believe the 4-year cycle is no longer relevant when I see the evidence. Until then, sign me up for a Q4 meltup followed by a treacherous 2026.

Quantum Leap?

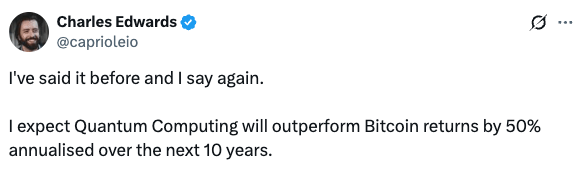

I wrote a post in late 2024 about Quantum Computing. Almost nobody read it. Very few people are discussing QC or even aware of what it is. For me, it’s turning into a no-brainer satellite holding. Incredibly volatile, but with massive potential. Don’t bet the farm, but maybe study up a bit?

Here’s a nice thread by Charles Edwards on the subject. And yes, QC poses a future threat to Bitcoin, which will need to be addressed.

The Quantum stocks have risen significantly over the last couple of years. There will be scary drawdowns for sure, but likely more meltups to come.

Stay cool.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.

One thought on “Melt up?”

Comments are closed.