Markets are not looking so hot right now. I really hate to be bearish, but it’s becoming unavoidable.

Last week, Bitcoin made its first daily close below $100,000 in 188 days. Then yesterday it closed below the 50-day moving average on the weekly chart. This is always bad news for bulls. Some of the people who were telling us the 4-year cycle is over are still holding out for a reversal, but they are probably grasping at straws.

We are so done. Thank you for playing.

I know it’s unlike me to be so negative, but when a situation changes, it’s important to confront reality quickly. Crypto is heading into a bear market, and it’s right on schedule.

Initially, Bitcoin is acting as the pressure release valve as investors lose faith in an overheated risk environment. You will note how, over the last week or so, Bitcoin is lower when you wake up. Asia propped up the price in the daytime, and then America sold hard while we slept. Now Asia is selling, too.

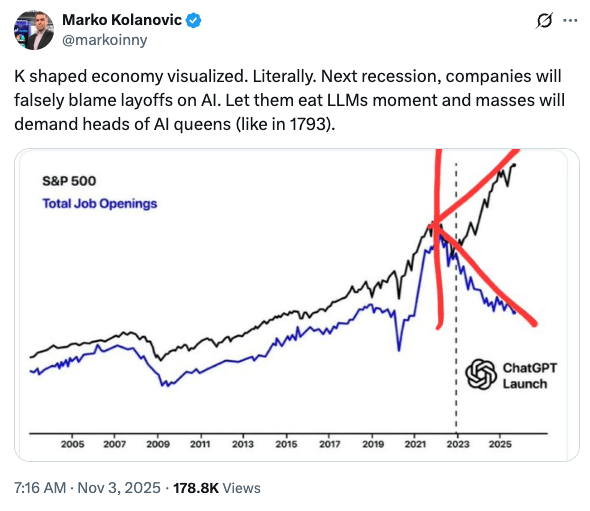

Worse still, BTC tends to lead equities, and in my humble opinion, BTC is heading lower.

Stocks are already wobbling. In particular, the AI trade is coming under increased scrutiny. Nvidia earnings are due on Wednesday. I don’t think there are numbers big enough to satisfy the masses this time, although the numbers will likely be impressive regardless.

I talked about Michael Burry in my last post: In this economy?

Burry put on his Nvidia/Palantir short and then closed his fund. Now he doesn’t have to worry about investors trying to pull their money when the market moves against him. People are debating whether he is actually any good at calling this stuff, which is a valid question. It’s such an obvious trade that you wonder if it can really be that simple, especially with Trump there to pump the markets every time they stumble.

But it doesn’t look great to me. In the short term, at least, I’m siding with the bears.

Time preference is key

It’s ok to be bearish, but the big question is: over what timeframe?

BTC is a good starting point for this discussion, as it is highly sensitive to both global liquidity and overall risk sentiment.

When Bitcoin topped in November 2021, it was just as the Federal Reserve pivoted to begin a brutal tightening regime. Interestingly enough, in November 2025, the Fed is going in the opposite direction. In fact, the market was pricing in a further rate cut in December until the US government shutdown delayed the data and muddied the waters. Uncertainty around rates is a huge factor in sparking the sudden loss of appetite for risk.

The liquidity picture for 2026 actually looks pretty rosy. Trump is effectively going to gain control over the Fed, and he has the midterm elections to pump the market for. On the flip side of that lies a slowing US economy.

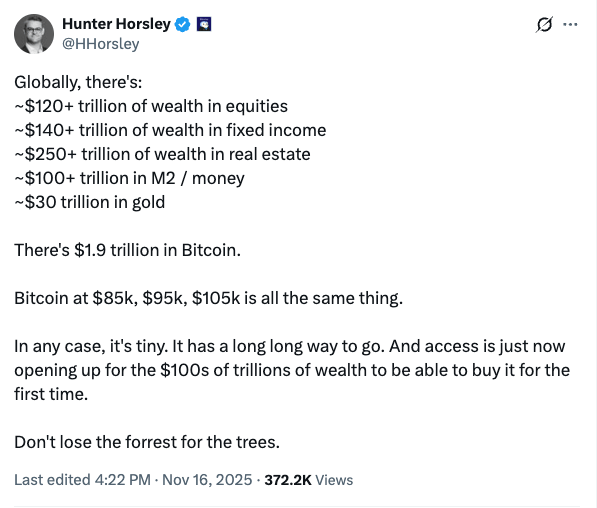

Bitcoin’s level of institutional adoption was meagre in 2021/2022. In fact, it turned out the industry was on the brink of collapse. And collapse it did: Terra/Luna, Celsius, Blockfi, 3AC, and, of course, FTX all fell during the bear market.

The picture is very different now. US Bitcoin ETFs have almost $120 billion in assets under management. $72 billion of that is in BlackRock’s IBIT alone. What’s more, the Trump administration is pro-crypto. This is not an industry on the brink of collapse any more. It’s just going to need to take a breather for a while.

Plan for the worst

The typical bear market drawdown from the peak for Bitcoin is 80%. So, worst case, we are going back to $25,000. Ouch! Not pleasant at all, but I would not bet against this outcome.

If ETFs and institutional adoption, plus a favourable liquidity cycle count for anything, which I think they do, we may not go that low. Personally, I’m not really interested in bidding $90k. I’ll get interested at lower levels. $50k seems a bit more like it. (this is my finger in the air, best guess if you are wondering how I got this number)

Here’s a little perspective:

What about stocks?

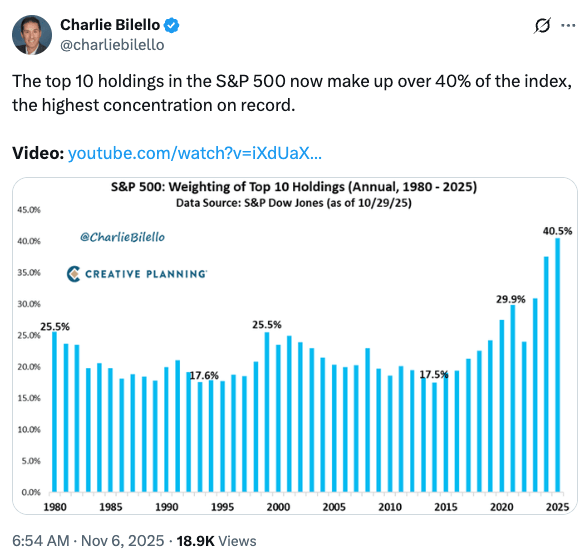

Nvidia’s P/E ratio is around 53. Investors are willing to pay that amount for each dollar of the company’s earnings. I probably don’t need to tell you that future earnings expectations are a little on the high side. The Magnificent 7’s average P/E ratio is around 28 to 35. Those expectations may well be due for a sharp adjustment.

The other 493 stocks in the S&P 500 are not looking so bad, although they could get dragged down somewhat in a Mag 7 correction.

Global stocks, Japan included, are unlikely to emerge unscathed, but we could well be looking at an interesting buying opportunity.

Personally, I kind of like the idea of reducing US exposure (particularly Mag 7) and increasing Japan. The only problem is then you get trapped in yen. Finance Minister Katayama is making the usual concerned noises about exchange rates, while taking absolutely no action to counter the yen’s decline. Real interest rates in Japan remain negative, and as long as they persist, the currency will continue to struggle.

Negative real rates are a boon for stocks, though. If rates somehow ever turn positive, it’s time to rethink.

All in all, it comes down to where you are in the financial planning process. I covered this in the Burry post, but here it is again in simpler form.

I see three key stages in the personal finance journey:

- Accumulation – spend less than you earn and invest the difference into stocks and other high-growth assets. If asset prices decline, don’t panic and keep buying. In fact, buy more if you can.

- Diversification – a mix of protecting capital, whilst continuing to accumulate. The key to knowing when to diversify comes down to three factors:

a) The data tells you – you hit your number and simply don’t need as much risk any more

b) You become conscious of the amount of money you have at risk and start thinking about what to do

c) Asset prices are considerably higher than the average price you paid when accumulating. Despite the wobbles, we are still in this zone for anyone who has been accumulating for a while. It may not last much longer, however…

3. Distribution – you begin living off the income generated from your accumulated assets, or simply spending the money

If you are in stage 1 or 3 and are properly allocated, a stock market correction should not bother you too much. If you are at stage 2 but have not diversified yet, the current window of opportunity may be about to close for a while. Don’t panic, but perhaps give it some thought.

Personally, I have been selling stocks that have done well over the short term, particularly tech/semi/AI-related stuff. A few Japanese tech stocks I owned got a big boost when PM Takaichi was elected and are probably due for a reality check.

In other business

My next casual meetup, billed as the Nikkei ¥50,000 party, is on 26 November from 7pm at Hobgoblin Roppongi. Everyone is welcome. You don’t have to talk about investing, and you don’t have to drink unless you want to. Some of us may need to!

Before you ask, yes, the event will go ahead even if the Nikkei is below ¥50,000. That is an achievement unlocked, and I’m sure we’ll be back above that level in due course.

Don’t get too bearish!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.