It’s been another interesting week. ‘Big Short’ legend Michael Burry returned to X to call out the AI bubble, posting charts that question whether the ongoing mega AI capex boom really matches demand. Burry pops up every now and then to predict disaster, and his hit rate post-2008 is not all that spectacular. However, he followed up by filing his investment firm’s 13F 11 days early, showing that he is short 1 million Nvidia shares and 5 million Palantir shares.

Money where his mouth is.

The market took notice and US tech stocks tumbled on 4 November. Japanese stocks followed suit, with Softbank Group dumping almost -17% over 2 days. This comes at a time when the US government shutdown is blocking the liquidity faucet and tightening things up considerably.

Crypto didn’t like it either, but hey…

Predictably, President Trump issued some positive comments about stocks and Bitcoin overnight, and the situation calmed down. Every time I think this market is ready to begin its descent into hell, I’m reminded that the guy in charge of America has a vested interest in keeping it above ground…

Clearly, Burry is hitting a nerve with AI bubble enjoyers. Here’s a great thread from Marko Bjegovic covering why he is probably correct.

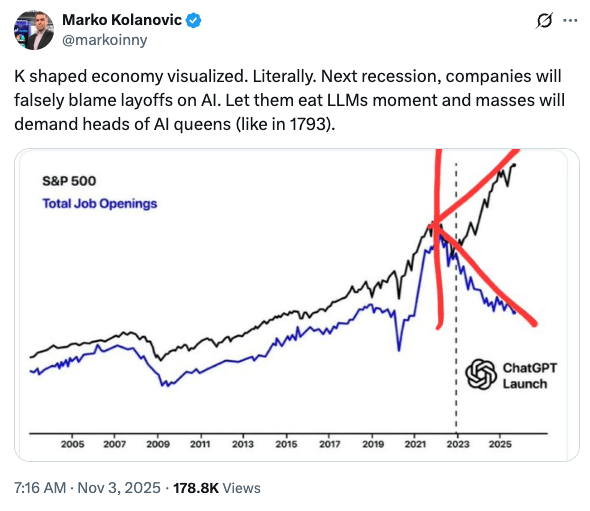

The ‘K-shaped’ economy

You are probably hearing this term lately. The K-shape represents the latest expression of wealth inequality. Essentially, high earners and large corporations are getting richer as asset prices rise, while low-income households and small businesses, the lower leg of the K, are struggling to get by.

High-end products are selling, while companies like Chipotle are finding their customers poorer and less inclined to visit.

Here’s another way of looking at the K-shape, from a different Marko:

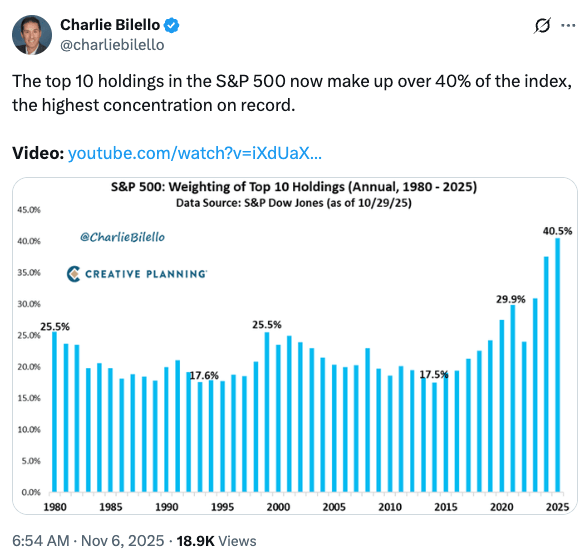

Speaking of liquidity and the AI bubble, Ray Dalio just posted about how the Fed is stimulating at an odd time. I’m not sure the Fed is really beginning QE, as he says, but it is certainly ending QT, cutting rates and taking an expansionary stance. This is something it would generally do when the economy is in trouble. Instead, the backdrop for the Fed’s easing is high asset valuations, a relatively strong economy, inflation above target and abundant credit. Not to mention a bubble in AI-related stocks – the elephant in the room, so to speak.

The Trump administration is taking a bold and probably reckless bet on growth, and particularly AI growth. What could go wrong???

Time to take profit?

We’ve been talking about a melt-up before a melt-down, but that’s by no means guaranteed, and we’ve already melted up a lot.

Stock investors, belonging to the top leg of the K, have done very well, but are now faced with a choice: remain invested and ride through the bubble or protect capital. As Michael Burry experienced in 2008, bubbles can keep inflating and punishing shorts for a long time before they finally pop. Younger investors can probably handle the drawdown, provided they are disciplined enough not to sell the bust. We all know the drill when panic hits: as the last desperate few capitulate, central banks will cut rates, stimulate, and markets will surge back over the next 12-18 months.

People who are getting closer to spending their investment money should probably think more carefully. There may not be a better opportunity to take risk off the table and diversify for some time. Nobody ever went broke taking profit, especially around all-time highs.

For people in between, US treasuries are holding up as a safe haven as well as anything else at this time. Spreading some of the risk also serves an often overlooked purpose: offering the opportunity to rebalance and buy the bottom in stocks if we do suffer a crash. I stand by my belief that anyone with a meaningful amount of money should be well diversified at a time like this.

The stock market is not the economy

Here in Japan, we are enjoying the Nikkei holding above the ¥50,000 mark. That doesn’t mean we escaped the K-shaped economy. In a rare quiet moment the other evening, I was thinking about Japan’s economy and why interest rates don’t seem to go up much. Aside from the rich asset holders, many people are struggling. Wages still lag inflation. 5kg of rice is almost ¥5,000. The lower/middle classes do not have a lot of money to spend.

Fewer people spending money is bad for the economy. The general expectation seems to be that interest rates will rise gradually. They certainly won’t rise quickly. Higher rates would mean higher interest payments on government debt. PM Takaichi is focused on growth, not inflation.

Should we really expect a meaningful rise in interest rates? I simply can’t see it.

If rates can’t rise, then the yen remains weak, prices increase, stocks and Tokyo property appreciate, and low-income families continue to struggle.

If all this is true, then what’s the trade?

Own dollars, own financial assets, own hard assets, and be kind…

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.

One thought on “In this economy?”

Comments are closed.