I came back from the gym this morning and found my wife at her desk.

“Wow, my stocks are up again!”

This is good news.

“But why are they going up so much? News on the economy doesn’t seem so great.”

I begin an explanation of how low interest rates have finally reignited inflation in Japan and fueled a boom in stocks. And despite the recent rate hike by the Bank of Japan, real rates remain negative, which means the price of things, including assets, will continue to rise.

Her eyes quickly glaze over, and she goes back to work. I put some coffee on. Then I begin writing this, in case someone is actually interested!

USD/JPY is at ¥157. GBP/JPY is ¥210!!!

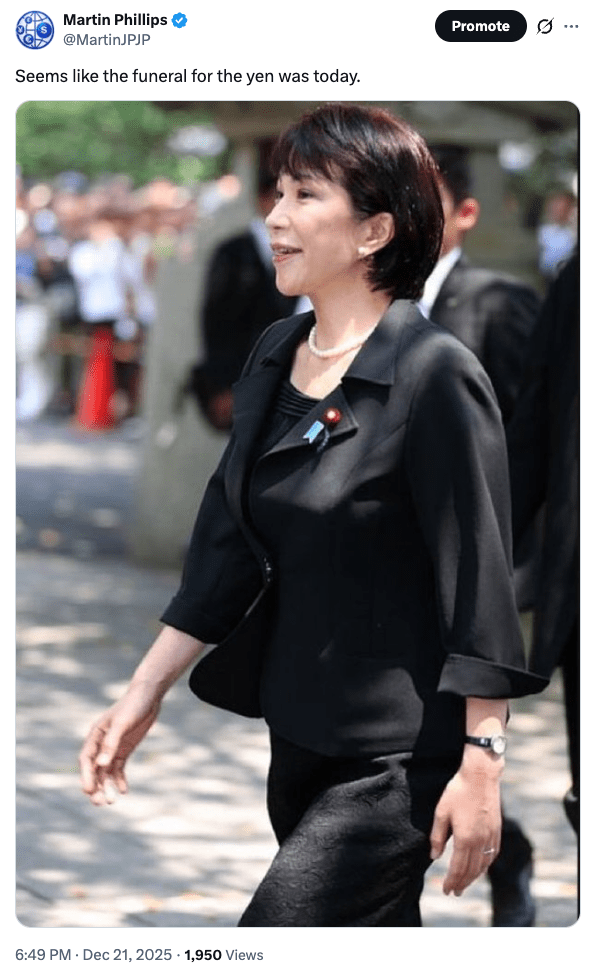

Last week’s BOJ rate hike was viewed mainly as an effort to prop up the currency. But it seems unlikely to halt the slide back to ¥160. Could we go further than that next year?

Here’s a quick reminder about the bind the central bank finds itself in, from my January 2023 post How screwed is the yen?:

The BOJ is caught in a spiral of rising bond yields and a falling yen. And between the bond market and the yen, it can only save one. The programs you would have to enact to save the yen are the exact opposite of the programs you would have to enact to save the bonds. To save the currency, you have to raise rates. To save the bond market, you need to keep rates low.

Last week’s rate hike was a band-aid. Many were hoping for at least a short-term bounce in the yen, but it didn’t come. The BOJ can’t manage an aggressive hiking cycle without destroying the bond market and taking down the banks, pension funds and insurance companies that own the bonds.

Nobody wants to say it, but further devaluation of the yen is the only option. And the new Takaichi administration is implementing policies that will only accelerate the decline. (Japan Diet enacts 18 trillion yen extra budget for PM’s expansionary stimulus)

¥160 and beyond is firmly on the table.

This is all very depressing, I know. However, I imagine many of us will be looking to allocate money to NISA, etc, next year and need to begin thinking what to do with it. I haven’t made any decisions myself yet, but I’m beginning to put together a list of themes that will influence these decisions:

Themes for 2026

- Japan’s base interest rate is 0.75%, inflation is around 3%, so we have a real rate of negative 2.25%

- The BOJ can maybe squeeze in one more hike to 1%, so real rates could go to negative 2%

- This is still very accommodative monetary policy and will support asset prices

- The weak yen will persist and perhaps go beyond 160

- Rice isn’t getting any cheaper, and people’s spending power will continue to decline

To be clear, I’m not in the doomer “Japan has reached the end of the road” camp. Japan is the world heavyweight champion of muddling through with extraordinary monetary policy. There’s still a lot of road to kick this can down. However, those who do not own financial assets will struggle. It’s not going to be pretty.

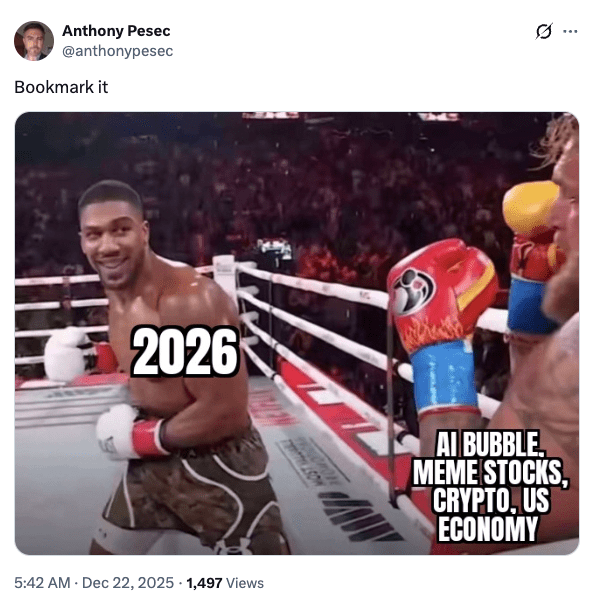

Outside Japan, things could get pretty spicy, too.

Better have a plan to not get knocked out!

A few additional themes:

- Trump’s new Fed pick will likely force lower rates

- Trump will want to pump the stock market ahead of the midterms

- However, the AI trade will continue to come under scrutiny

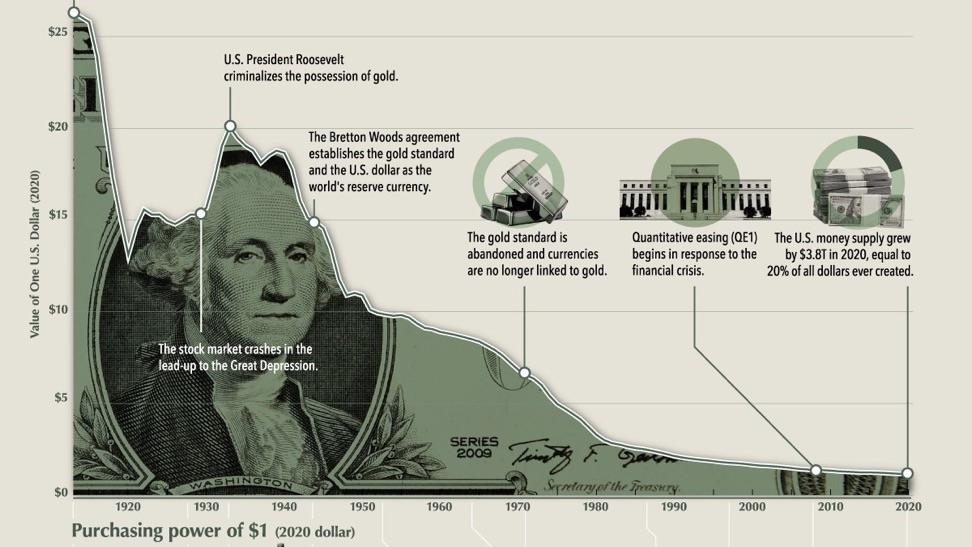

- The debasement trade is very much still in play – own hard assets

- Bitcoin bear market – an opportunity to accumulate

I will think on this some more and come back with a plan for 2026 in the next few weeks. Let’s see if the yen breaches the ¥160 mark before the year’s end.

Thanks for reading. Wishing you all a wonderful Christmas!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.