One down, one to go. With the FOMC resulting in a dovish cut, we now await the BOJ meeting next week. So, how are things shaping up for the end of the year and 2026?

The Fed delivered the expected 0.25% rate cut. It was accompanied by cautious commentary on next year, without really turning hawkish. Pretty much a goldilocks result for markets. Stocks rallied into the close, while Bitcoin pumped to $94k before quickly retracing. The Fed’s dot plot and 2026 outlook seem wildly irrelevant given where things are going after Powell’s term ends.

Does anybody need that stated more clearly? The next Fed chair will be appointed by Trump and will do his bidding. Their primary function will be to cut interest rates. End of story.

Leaping into the future, it will be fascinating to see if a post-Trump Democrat administration will work to reinstate the Fed’s “independence”. I bet you they won’t…

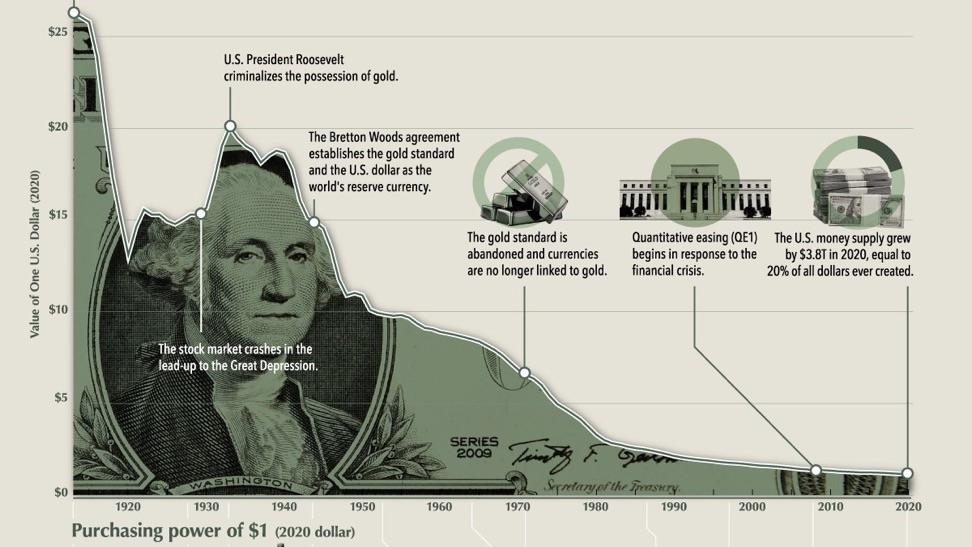

Anyway, I digress. The US is moving toward financial repression in 2026. Inflation allowed to run hot, and interest rates forced lower = Negative real rates. Negative real rates are a stealth tax on savers. It’s how the government reduces the debt burden.

It’s not good. But it’s what is going to happen.

Americans who own assets will be fine. Those who don’t will struggle.

Lots of liquidity, equities up, hard assets up, and a weaker dollar.

So, Bitcoin to the moon, right?

Hmmm, given what I wrote above, we are looking at the perfect environment for Bitcoin. The macro gurus, who are relatively new to Bitcoin, are declaring the 4-year cycle dead and preparing for new all-time highs in 2026. Except that’s not what usually happens. October marked a picture-perfect 4-year cycle top. It doesn’t get any clearer. The bottom should be around Oct/Nov next year.

I’m long BTC and happy to be proven wrong, but I think there is pain to come. I think we will see $40-50k, and buying Bitcoin when stocks are pumping will seem like the dumbest thing a person could ever do with their money. Sentiment needs to be broken before we run again.

And yes, I will buy at those levels. Until then, there isn’t much point in thinking too hard about it.

As for stocks…

The midterm general election is in November. Sometimes the most obvious outcome is the correct one.

Is the BOJ going to spoil the party?

The BOJ is signalling a hike. It’s been reported in the Nikkei. It’s pretty much baked in and would be more of a surprise if it didn’t happen. I don’t think it’s going to shock markets. It might strengthen the yen a little, but it probably won’t be earth-shattering. See my post on the Yen Carry Trade from last week.

Japan, of course, is already at negative real rates. That should support the Japan equity bull market. It only sucks if you don’t own stocks…

I have the flu. That’s as much brain power as I have this morning. Time for a lie down.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.

Discover more from Smart Money Asia

Subscribe to get the latest posts sent to your email.