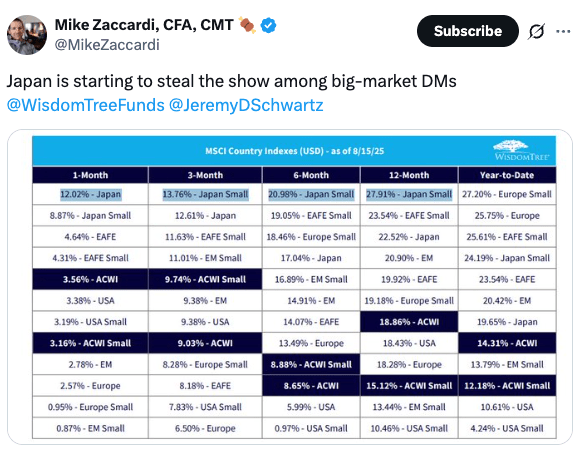

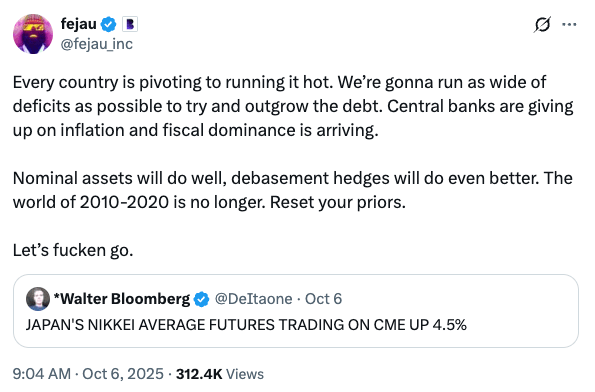

You can’t time the market. Except those times when you can. Last week, I wrote a post called Melt Up? Maybe I got lucky, but the meltup began right after and is now in full swing. Gold, Bitcoin and of course, Japanese stocks.

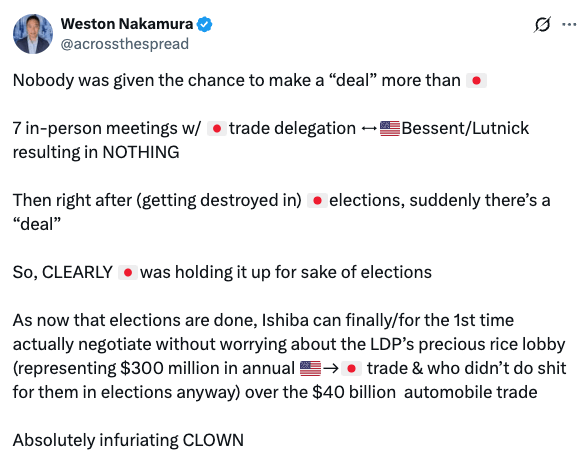

Not that I’m claiming clairvoyance here. I had no idea how the market would react to the LDP leadership vote. Generally, I discount politics as it has far less effect on asset prices than people think. At first, I thought the market reaction was relief that the younger, less experienced guy didn’t get in, but clearly it’s not that. It’s all about the new leader.

I won’t delve into political analysis. I don’t have any edge here. Takaichi’s economic stance is perceived as expansionary, and there seems to be an expectation that she will go full Abenomics on us. That remains to be seen, but here are a few observations:

- Taro Aso was clearly instrumental in getting Takaichi elected and will be a key figure in the administration. He opposes ‘modern monetary theory’ and argues for fiscal discipline. Watch the yen over the coming months to find out who is really in charge.

- When Abenomics was implemented, USD/JPY was at 80 and inflation was negative. Now we have the dollar at 152 and 3% inflation. It’s a very different world. You can’t just cut rates to zero and reimplement QE without inflation blazing out of control.

- The BOJ may not be entirely free from political interference, but it will make its own decisions. It may or may not hike at the next meeting, but it’s not going to go the other way any time soon. No doubt, Chairman Ueda’s job just got a little more complicated, though.

I’ll stop there. Prime Ministers don’t seem to last very long these days, so we should probably give it 6 months or so before expecting a clear indication of where this will land. For now, you can probably give up on any hopes of a stronger yen. And you’d better own stocks and hard assets.

The meltup continues. I joked about having a Nikkei ¥50,000 party on X, but I think we should do it. It may be soon, so get ready!

Running it hot

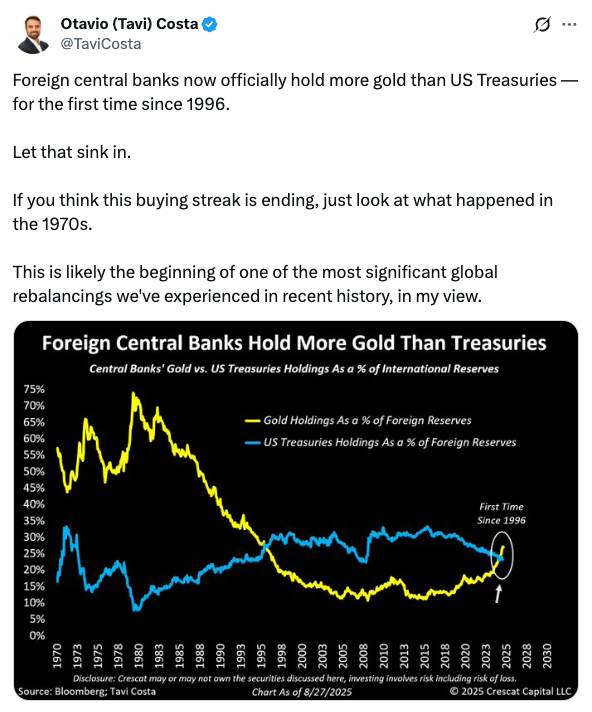

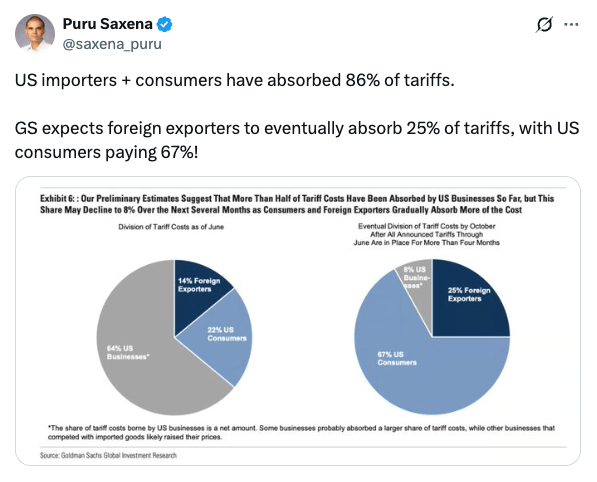

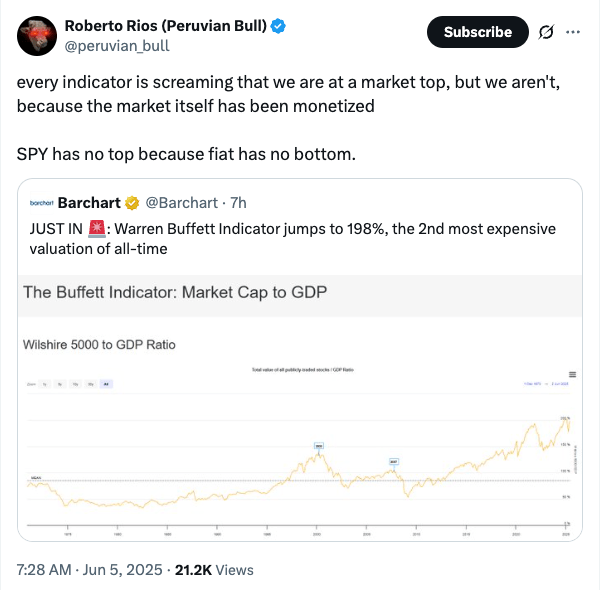

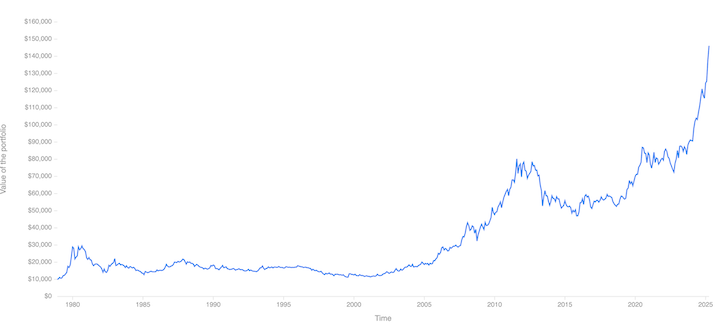

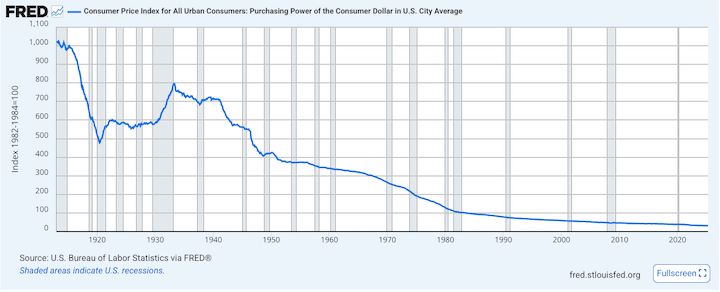

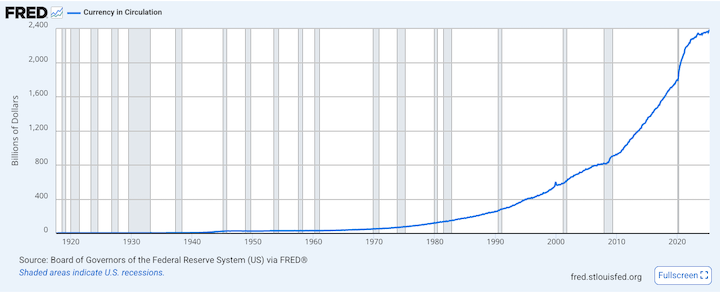

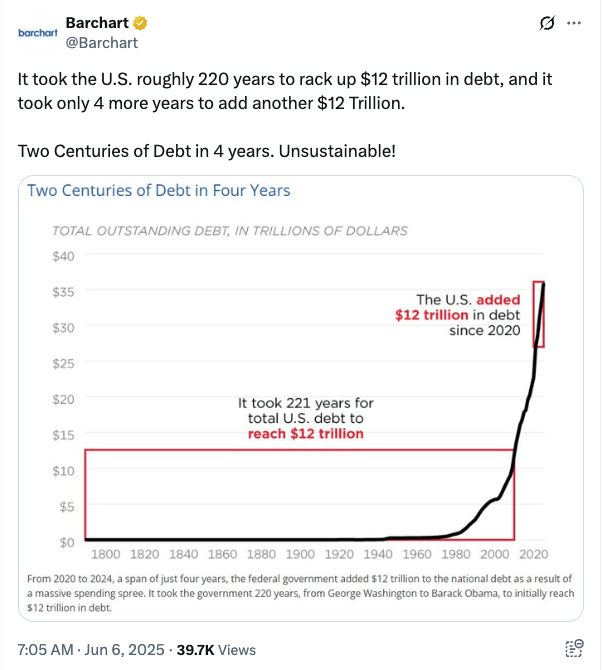

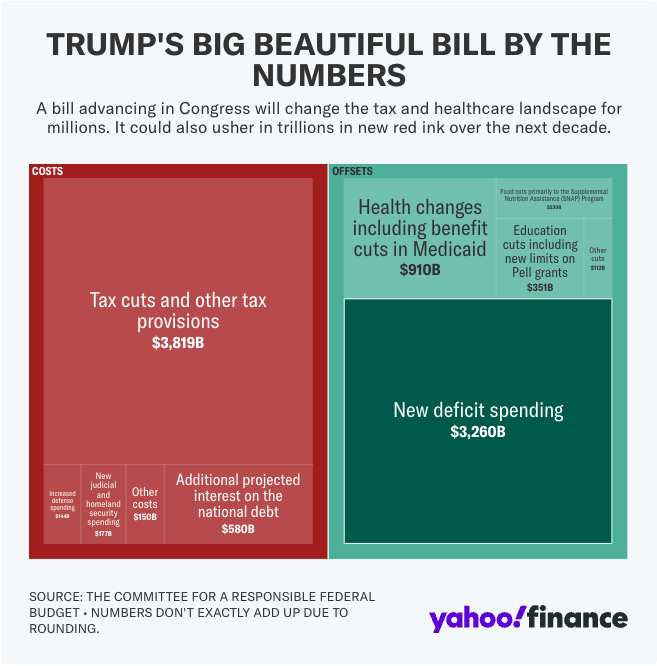

If you are seeing posts and mentions about the ‘debasement trade’, it’s no wonder.

I’ve been harping on about monetary debasement for some time. People seem to be getting the idea. I’m seeing more and more people who don’t own gold capitulating and buying it at all-time highs. They should have owned it earlier, but that doesn’t make them wrong for getting some now.

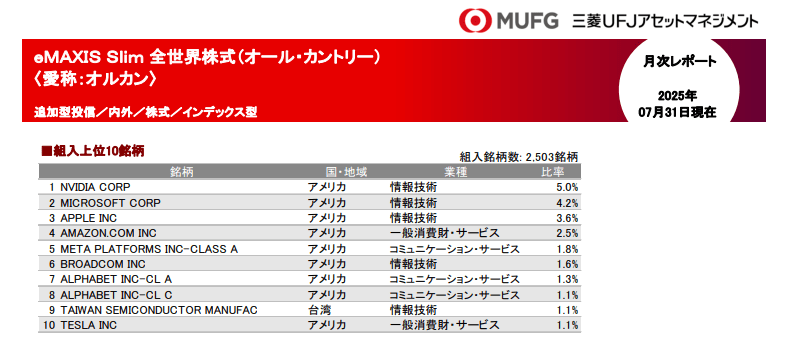

Reminder: if you run a diversified portfolio, you will already have a 5-10% allocation to gold. You don’t have to play catch-up. People who only own stocks are learning this now.

Take a look at this silver chart from Kevin Gordon’s post:

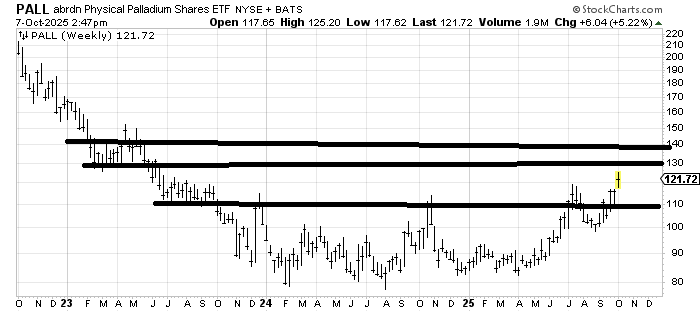

And Helen Meisler posted this palladium chart in response:

Is that going where I think it’s going?

Here’s Paul Tudor Jones again:

Blanket recommendations are generally not a good idea, but if I had to put my current investment thesis in a nutshell, it’s this:

A diversified portfolio matched to your base currency and risk profile with satellite holdings in debasement assets.

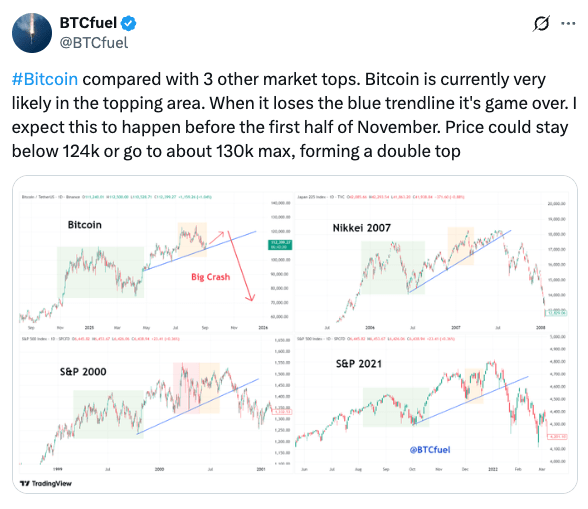

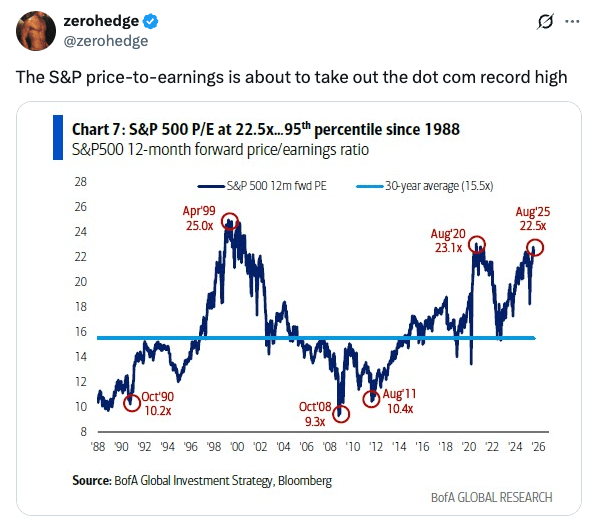

Top signals?

A few weeks back, I wrote a post on spending money well. Just this morning, I found a great post from Ben at Retire Japan on the subject in my inbox.

It’s clearly a sign that people’s portfolios are at all-time highs. We should probably be a little careful about getting too greedy, but it’s a wonderful time to consider how to get joy out of the money we have worked for and taken risk to grow.

I ordered the orange iPhone. It’s due to be delivered in early November. I wasn’t planning on becoming a walking top signal, but maybe I’m about to…

See you at the Nikkei ¥50,000 party!

Top image by Mate Holdosi from Pixabay

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.