Remember when everyone thought a Trump presidency would be business-friendly?

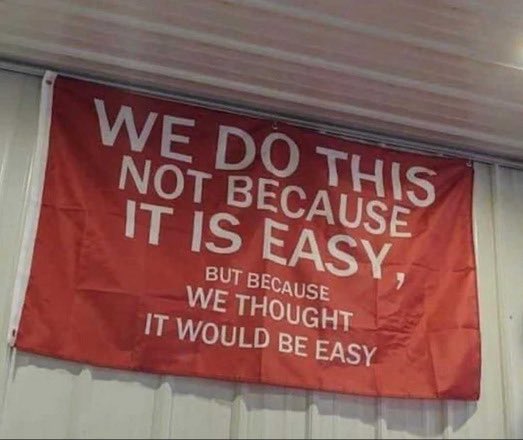

I admit to belonging to that camp initially. Stocks soared the first time he was elected, when most people expected them to tank. They also ripped between the election and the beginning of his second term, as people bet on a golden age of deregulation. Remember all the tech CEOs at the inauguration?

And then the madness began.

I’m not interested in getting into political commentary, but I will say this: it really couldn’t have been handled much worse. Anyone who has read Chris Voss’s book knows that you don’t start a negotiation with belligerence and threats and expect everyone to come meekly to the table. Anyway, my opinion doesn’t matter. The markets have spoken. So far, Trump 2.0 has been an unmitigated disaster.

Wall Street is openly disussing a “Sell America” trade. The great dealmaker must hate that one. It’s happening, though – look at treasury yields, look at the S&P 500, look at the dollar. And look at gold!

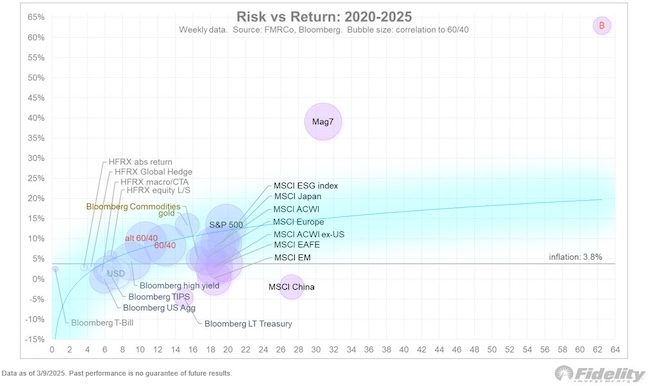

Gold isn’t just a safety trade here. It represents a stampede away from USD-denominated assets. European and emerging market stocks are also seeing inflows, but they come with their own risks as the haphazard tariff ‘negotiations’ blunder ahead.

So what happens now?

Is America really done? Does gold go up forever?

No and no are the short answers. However, the world is clearly changing before our eyes. Here’s an excellent thread summarising Howard Marks’ recent comments on what is happening. Like it or not, globalisation made a lot of things cheaper. As countries become more inward-looking and focus on domestic production, prices will rise. America is still expected to outperform in the long run, but it will need to work harder to attract capital. It is no longer the obvious go-to market, at least while all this chaos is raging.

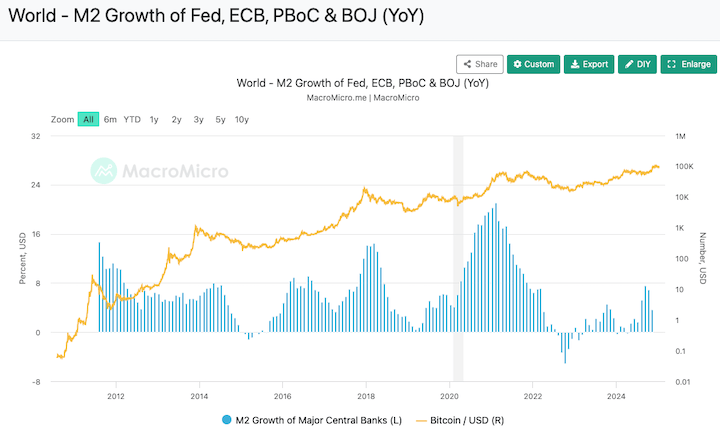

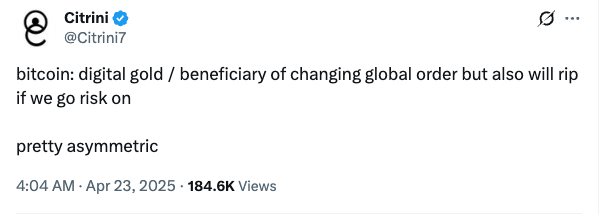

Can gold still go higher? For sure, but it’s starting to look like Bitcoin does in blow-off top phases. Weekly cycles also suggest it is close to a top. If you’re a long-term diversified investor, continue to hold it. If you’re looking for the next trade, then digital gold is where it’s at.

Even the macro guys are starting to agree that Bitcoin looks good right now. This article from @fejau_inc puts it all together nicely and is a must read.

Here’s the conclusion from that piece for easy reference: “And so, for me, a risk-seeking macro trader, Bitcoin feels like the cleanest trade after the trade here. You can’t tariff bitcoin, it doesn’t care about what border it resides in, it provides high beta to a portfolio without the current tail risks associated with US tech, I don’t have to take a view on the European Union getting their shit together, and provides a clean exposure to global liquidity, not just american liquidity.

This market regime is what Bitcoin was built for. Once the degrossing dust settles, it will be the fastest horse out of the gate. Accelerate.”

Meanwhile, the Financial Times reported that Howard Lutnick’s son, Brandon is cooking up a $3 billion Bitcoin acquisition investment vehicle with Cantor Fitzgerald, Softbank Group, Tether and Bitfinex. Reuters summary here.

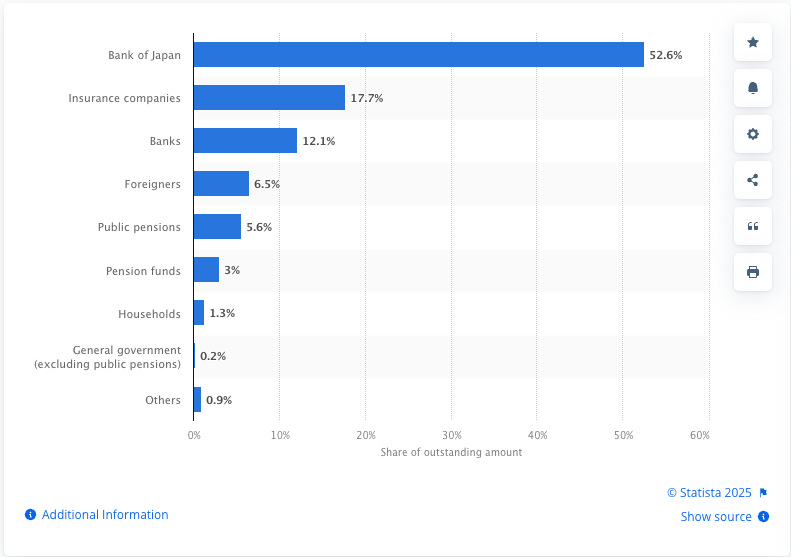

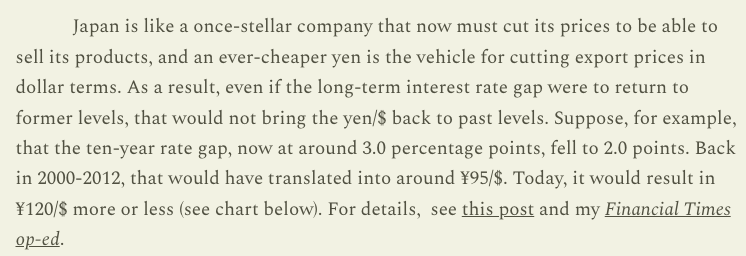

Is the yen strengthening going to hold?

If you are looking for proof that capital is flowing out of America, it’s right there in the exchange rate, currently around ¥142 to the dollar. It’s quite possible the yen could strengthen further from here, but beware the orange man running his mouth. If Bessent can put the gag on him for a while and they get a few wins on the board in terms of trade deals, then the picture can change very quickly.

Yes, I’m aware that the typical trade deal takes around 18 months to complete. Most likely Trump extracts a few concessions from the major partners, including Japan, and declares some ‘tremendous trade deals’. Then he can move onto pumping the markets back up before the mid-terms.

Long term, I believe the yen is cooked. Nothing has changed there. Short term, we could be at ¥120 just as easily as ¥160 in a month or two. Who knows?

So, sell America or not?

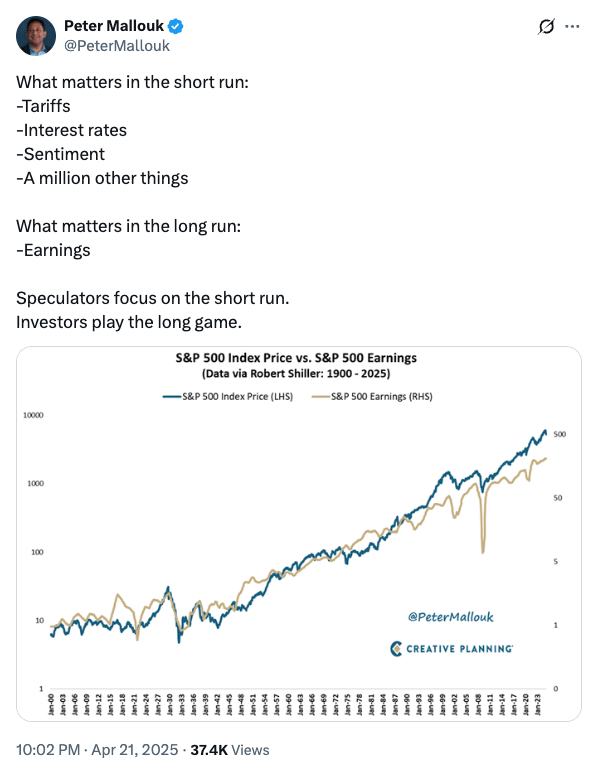

Traders gotta trade, and right now the trade is sell America for anything else you can lay your hands on. For long-term investors, I would view cheaper US asset prices as an opportunity to accumulate. Don’t change your monthly investment allocation too hastily!

Top image by Mediamodifier from Pixabay

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.