As I sit here on a calm November afternoon, Bitcoin is trading right around the $90,000 mark. In yen, we are getting close to ¥14 million per BTC. Quite a number, huh? The Bitcoin market cap just overtook silver. Yes, silver. And the total crypto market cap briefly touched an all-time high of $3.01 trillion today.

The mainstream media have picked up on the feverish price action since the US election. Being mainstream media, they are making the mistake of reporting on it as a ‘Trump trade’. I have seen this on the BBC, the evening Nikkei news and elsewhere.

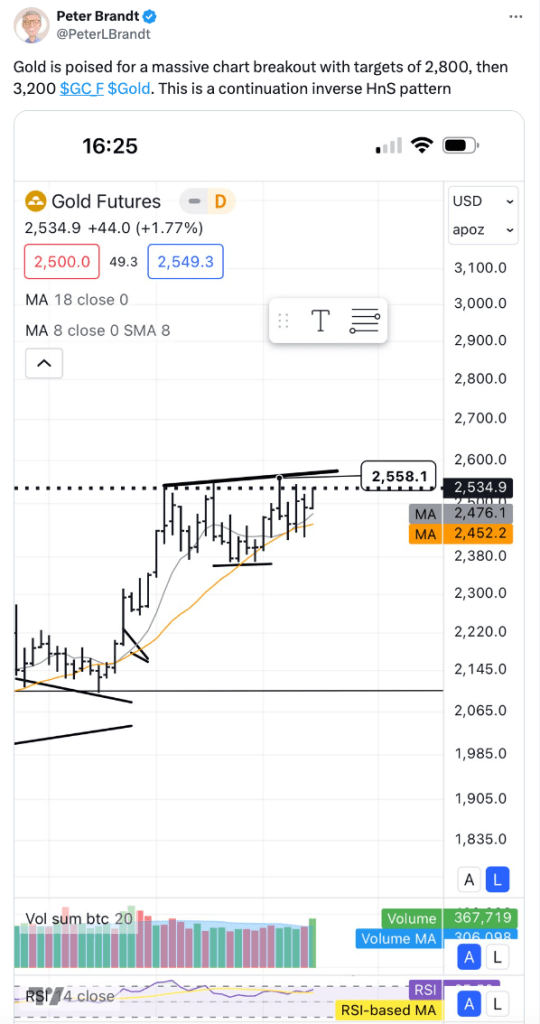

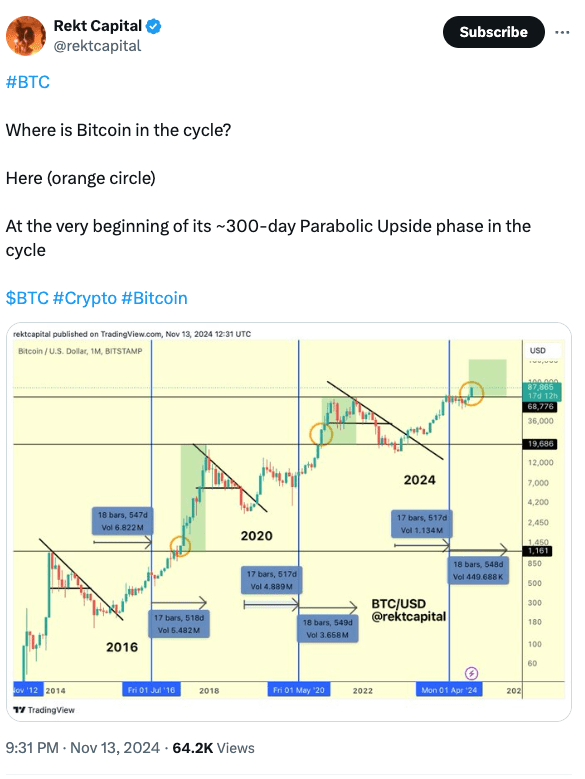

Here’s the first thing to note: the bull market was already in motion and primed to enter the parabolic phase. Trump was just a catalyst. It was going to happen anyway. Something else would have kicked it off if it hadn’t been Trump’s victory. If you think this is about Trump, you have missed the point.

That said, the incoming US administration is going to be far more crypto-friendly than the current one, which is something I covered in my previous post, Full Send.

I discussed bull market catalysts back in my October 2023 post: Bitcoin, Pump up the Volume! I was wrong about the US entering recession (so far), but that wouldn’t have stopped the bull market either.

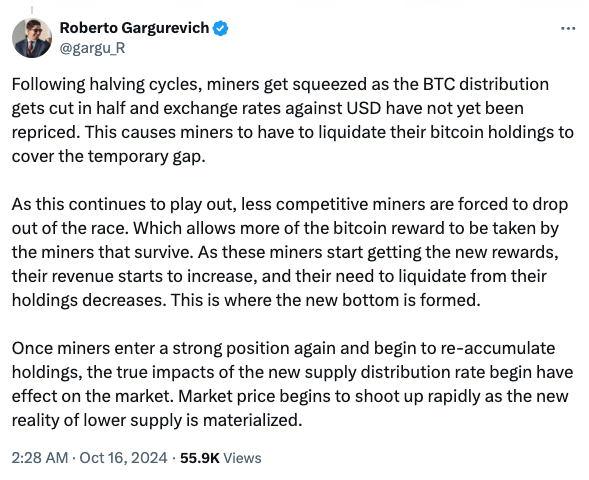

Here is an excellent explanation of how the halving, which took place in April this year, squeezes miners and eventually leads to a surge in price:

The key takeaway: the bull market mania phase was going to happen regardless. Trump was a catalyst. Central banks entering a rate-cutting cycle was a catalyst. They lit the fuse, and now we get to watch the fireworks.

So, when do I sell?

Take it easy now. The decisive break of the 2021 cycle top was only a week ago!

We need to be careful who we listen to when things go parabolic. One week in and crypto ‘analysts’ are already calling the top.

It’s been interesting to note that over the past week, during Asia daytime, price has tended to dip. People are taking profit at these levels. Some of these people probably bought the 2021 top, of course. Then overnight, when Blackrock and the other ETFs start buying, price moves up again. ETF inflows for the first 3 days of this week totalled $2.4 billion. Retail FOMO is only just getting started.

Some have lamented how people are now going to pile in and end up buying high and getting stuck holding the bag. Yes, that’s what is going to happen. It happens everywhere when the price of an asset shoots up. It’s not limited to crypto. Your job is not to join the legions of people who make this mistake.

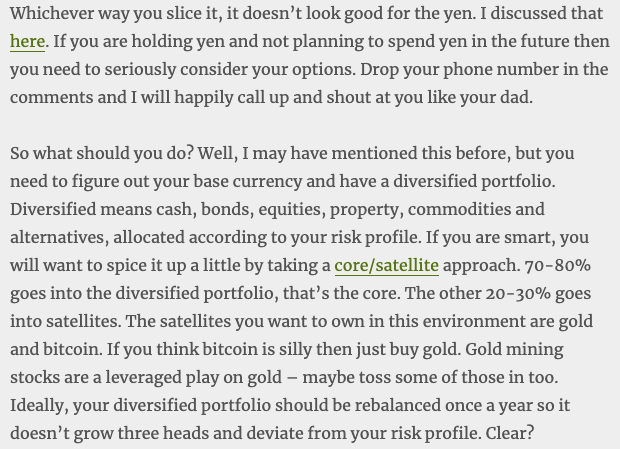

Study this tweet. Ponder it. There’s a whole chapter of George Soros’ best-selling book in those 6 words. (look up reflexivity from ‘The Alchemy of Finance’)

An asset may start to rise due to fundamentals, an economic or political event, a drag on supply, or whatever. Once it starts going up, people notice and react to the price, pushing it higher. This can get extreme during bull markets and bubbles.

Things are about to get silly. Focus.

Professional traders and investors are generally very good at buying low. Research shows that they are mostly pretty average when it comes to selling high. It’s actually really difficult. Sell too early and you regret leaving money on the table. Wait too long and you get fixated on the all-time high and start willing it back up there when you should be hitting the exit.

It’s hard. Don’t let anyone tell you otherwise.

You are not going to sell the top

Accept this. It’s not going to happen.

So, what to do?

Have a plan

Are you even going to sell? Bitcoin is going way higher over the next 10 years. It’s perfectly acceptable to hodl and ignore all the noise. You don’t have to complicate matters. If that’s your plan, it’s a good one. Please enjoy doing something else!

Many intend to sell during the bull run so they can accumulate more in the inevitable bear market that follows. That requires a plan of action. I can’t tell you exactly what that plan should look like. It’s an individual thing. But have a plan.

Some people need to build a spreadsheet. Some just need a few calendar reminders. Here are some general pointers:

Avoid round numbers – everyone wants to sell $100k. Yep, they did in 2021 too. The market does not owe you a particular number. Your favourite analyst says we are going to $125k – giddyup!!! This is how people screw up. Waiting for a number that never comes. Your favourite influencer says the bull market will run until February 2026 – red flag!!! Don’t get sucked into this kind of thinking. Nobody knows anything.

I would be much more willing to bet that BTC reaches $1 million sometime in the future than I would to bet on it reaching any particular number in the next 10 months.

Average out – the chances are you didn’t buy all of your Bitcoin at the stone-cold bottom of $16k. More likely, you bought little by little during the bear market and the early bull market. Dollar-cost averaging is a great way to buy a volatile asset. It’s also a great way to sell a volatile asset. Exiting a little at a time over the coming months means you will get out at an average price, which is a lot better than round-tripping the whole bag back to the bottom. You might even sell the top on one of those orders!

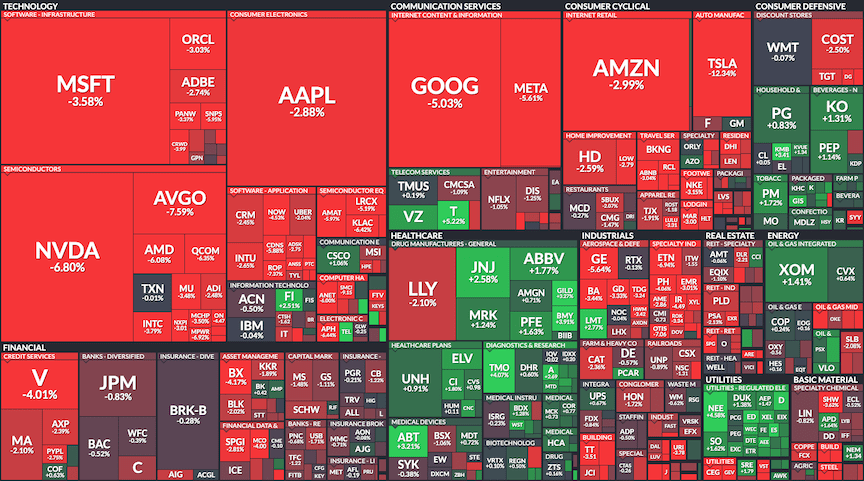

Alts go first – I stressed this in my previous post: Bitcoin and crypto are not the same thing. Any non-Bitcoin crypto asset needs to be aggressively sold when things get crazy. That means ETH, SOL, SUI, dogs, cats, squirrels. Whatever crazy coin you got yourself into that is destined for the moon. It’s going to crash 90%. And then it’s going to get cut in half again. Most meme coins are going to zero. (don’t worry, Doge will survive!)

Sell catalysts

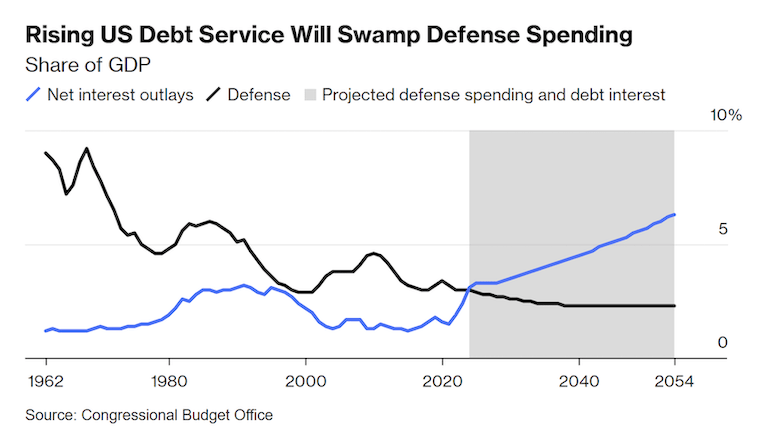

The 2021 bull market peaked at $69k in November of that year. At that time, crypto influencers were loudly calling for a push to $100k by around February 2022. Euphoria reigned. Meanwhile, Jerome Powell and his pals at the Fed were just getting to grips with the fact that inflation was not going to be transitory like they thought. Bitcoin rolled over as it became apparent we were about to enter a rate hike cycle. Maybe we would have got $100k without it, maybe we wouldn’t. I wish I could say I correctly identified this glaring top signal, but I didn’t. I know one or two traders who did, but we are talking about a very small minority.

Just like there are catalysts that ignite a bull market, there are events and conditions that usher in the bear. Whilst averaging out, look for the signs. Averaging out may well require selling on both sides of the cycle top.

The number one thing to look out for is euphoria. When everyone thinks we are going up forever, take cover.

Don’t forget the tax man – assuming you did a great job and averaged out, you should end up with some handsome profits. But don’t rush out and buy the lambo just yet. Remember, you are going to have to declare your winnings and pay the man. Many a successful trader has fallen into this trap and ended up in debt.

Reinvest – make sure you reinvest profits for the future. You don’t have to lump it all back into crypto. Splitting part of the gains into a well-diversified portfolio is a smart move. Past bear markets have seen Bitcoin drop by around 80% from its peak. Start getting greedy again when we get to those levels.

Enjoy the ride – bull markets are fun! Laugh at the memes, smile at the gains, take profits and just beware of euphoria.

Or simply never sell.

Top Image by starline on Freepik

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.