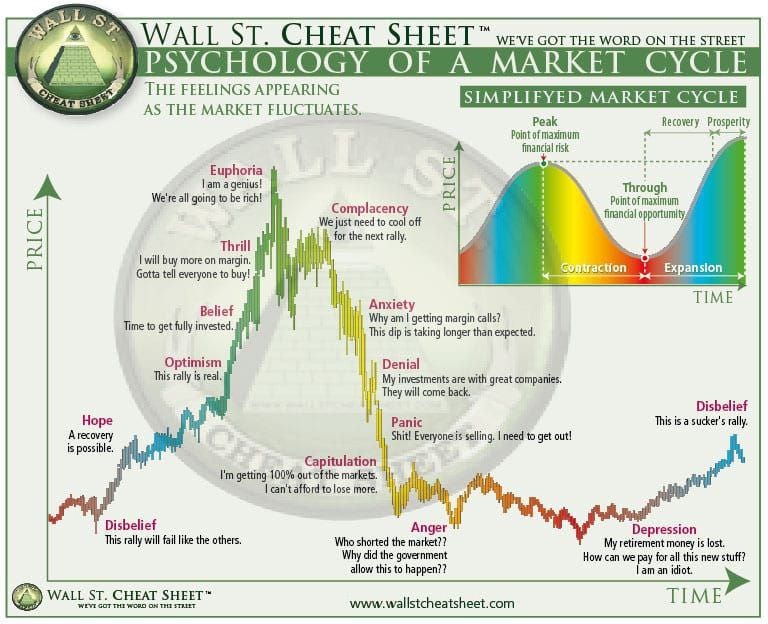

“It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine–that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.” – Jesse Livermore, in Edwin Lefèvre’s “Reminiscences of a Stock Operator”

We are so back!

Little more than 6 weeks after Donald Trump nuked markets with his “Liberation Day” blusterf**k, stock indices are right back where they started. Congratulations on surviving! The circus is far from over, but it feels like we just went through boot camp on how to operate under this administration. My personal goal from now on is to ignore every word the man says and focus on what actually gets done. There is way too much noise!

Anyway, check in on the doomers. They probably need to come out of the bunker, touch some grass and catch some Vitamin D.

The great dealmaker is in Saudi Arabia now, doing deals, I presume. Note the presence of Nvidia’s Jensen Huang among the tech CEOs there with him – I would not bet against that company to emerge from the chaos stronger than ever.

So what’s going on?

Checking on the news, Nvidia isn’t the only AI/semiconductor play catching a bid. Advantest, Tokyo Electron and Disco are all perking up too.

Softbank Group is also on the rise after posting its first full-year profit in four years.

Department store operator Mitsukoshi Isetan announced an expected net profit of ¥60 billion for the current fiscal year, up 14% year-on-year. Those tourists must be spending hard while we plebs struggle to buy rice!

Things don’t look so rosy for the Japanese auto industry, though, with Honda and Nissan crumbling under the uncertainty around tariffs. There is more than tariffs at play here as both have struggled with sales in the US and China. The two companies abandoned plans to join forces earlier this year and who knows where they go from here. Nissan is clearly worse off and will shut 7 vehicle plants and cut 20,000 jobs globally.

Gold rush?

Meanwhile, The Mainichi reports that gold investment is booming in Japan. Investors appear to be snapping up everything from coins and bullion to used gold accessories. They are also buying gold funds and ETFs for the NISA accounts.

Come for the global recession fears, stay for the long-term debasement of the yen!

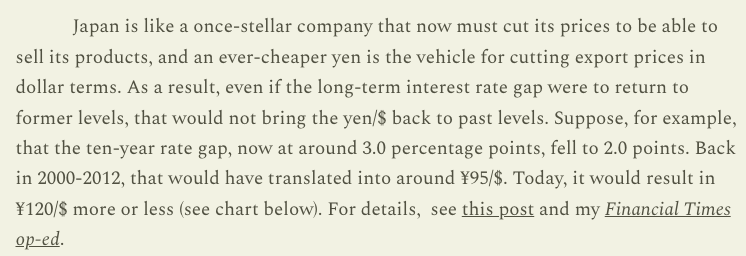

USD/JPY is back around ¥147 after the BOJ needed a breather from raising rates. If they are planning to wait for some respite from global economic uncertainty before hiking further, we will be back in the ¥150s soon.

Wakey wakey

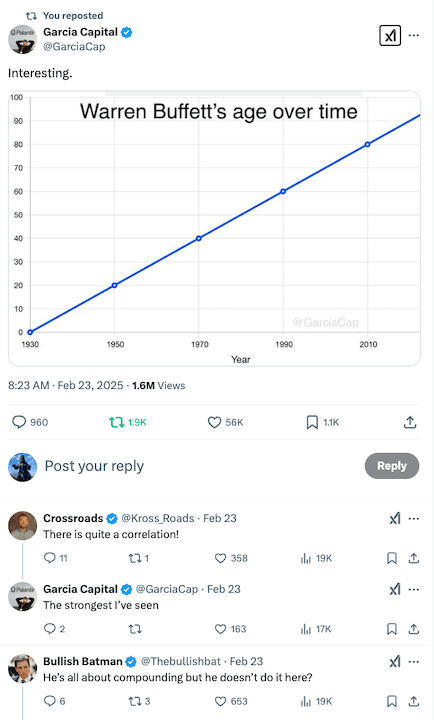

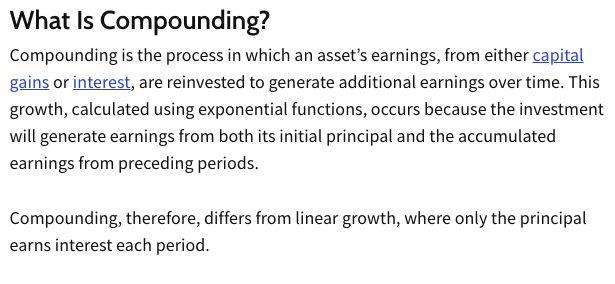

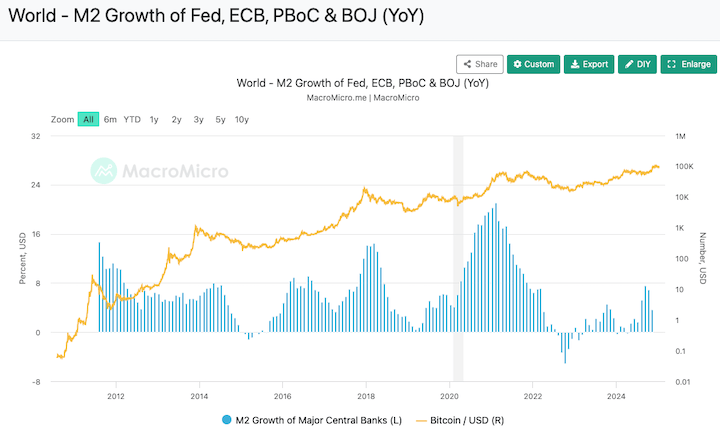

“If you own crypto, I can’t stress this enough: the best thing you can do is go to sleep for about 3 months. Block out the noise.” – I wrote this in my opening post of the year in January. There have been many dips and ‘it’s so overs’ since then, and yet here we sit in mid-May with Bitcoin back over $100k.

It’s probably time to start paying attention again. Metaplanet is creeping back towards the highs. I sold half of my holding in the run-up in Jan/Feb, and it’s looking like time to start averaging out the rest. Maybe take out half in the next few weeks and save the rest for Valhalla?

Even Ethereum has woken up!

Alts have been battered in the dips. With a tidal wave of ETF inflows, BTC dominance shows no sign of slowing down. Alt holders would like to see the orange coin break the all-time high and then chill for a while. Will they get their alt season? The exit is narrow and it won’t be open for long…

Where does BTC top? Gun to my head, I say we get a run now, followed by a quiet summer, then one more assault on the summit in autumn.

However, if you are looking to take profit, don’t listen to me or any other people on the internet. Nobody knows anything. The smart money is scaling out already. Execute your plan.

If you are a long-term BTC investor, and for at least part of your stack you should be, all you gotta do is sit tight!

Top image by Pexels from Pixabay

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.