It’s pretty incredible that the US Federal Reserve has gone through a 27-month hiking cycle and US stock markets are at all-time highs. Unless you’ve been living under a rock during this time, you are probably aware that the main growth driver has been the intense hype surrounding artificial intelligence (AI) and more specifically, generative AI.

What is AI?

The Encyclopedia Britannica defines AI as ‘the ability of a digital computer or a computer-controlled robot to perform tasks commonly associated with intelligent beings’. The US company Nvidia says AI is ‘the capability of a computer program or a machine to think and learn and take actions without being explicitly encoded with commands’.

In March 2023, Bill Gates published a blog post titled ‘The Age of AI has begun’. In it, he says: ‘The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone. It will change the way people work, learn, travel, get health care, and communicate with each other. Entire industries will reorient around it. Businesses will distinguish themselves by how well they use it.

Technological revolution or a waste of resources?

I read a couple of interesting threads about AI last week. The first one by David Mattin considers the recent UK election as the last ‘pre-AI’ election we will hold. He sees a world entering a period of deep economic transformation that will change how we live and work and accelerate the process of scientific discovery. Rather depressingly, he expects this transformation to split society into two camps: enthusiasts/accelerationists, who want to lean into this new technology and sceptics/decelerationists, who want to resist the incursion of technology into daily life. This split is not hard to imagine when you look at how divided the Western world has been on almost every issue of late.

The second thread, by Ed Zitron, summarises a recent Goldman Sachs report on generative AI, which brutally dismisses Chat-GPT and its ilk as unreliable and power-hungry. The report concludes that generative AI is unprofitable, unsustainable and fundamentally limited. Moreover, the huge surge in AI-related stocks is a bubble that will soon burst. Original report here.

I don’t think my opinion on the first part is worth much, but I am not really interested in taking sides. There are clearly opportunities for massive positive change and there are also equally glaring risks. In a perfect world, these would be balanced sensibly but that world doesn’t exist. Things are about to get interesting…

As far as generative AI goes, time will tell. I think the most common complaint people have is that they don’t want gen-AI to write stories, produce art and know everything. They want it to do all the boring jobs that we humans don’t want to do and free us up to be more creative.

Investing in AI

From an investment standpoint, I don’t think AI can be ignored. It seems imprudent to dismiss the whole field as a bubble. However, if some parts of the industry are in a bubble, the key question is how long can the bubble continue inflating? As George Soros has pointed out, there is a lot of money to be made by rushing into a bubble. The tricky part is getting out before it bursts.

There are relatively few pure-play AI stocks to invest in. However, many great companies are using AI technology and making investments in AI. I have picked up a few below that I think are worth watching. This is neither an exhaustive list nor a recommendation to invest. Just some ideas to get you started so you can do your own research. (performance is quoted up to 15 July 2024)

Nvidia Corp (NVDA) and Super Micro Computer Inc (SMCI)

If I asked you what the best-performing AI-related stock is over the past 12 months, you could be forgiven for answering Nvidia. However, Nvidia has actually been beaten by a company it is partnered with – Super Micro.

The Motley Fool did a nice write-up on these two companies here: Essentially, they aren’t really competitors, they complement each other. NVDA designs graphics processing units (GPUs) which, among other things, are used for AI model training. SMCI designs servers and it takes Nvidia’s GPUs and other components to make them and sell them to its clients. These are what some people refer to as ‘pick and shovel’ investments in AI.

Year-to-date performance: NVDA +159.4% / SMCI +215.8%.

Microsoft Corporation (MSFT)

Of all the big-name tech companies, Microsoft is perhaps the most bullish on AI. The company is accelerating its own AI commitments and has invested some $13 billion in OpenAI in a partnership that dates back to 2019. Microsoft has integrated all of its generative AI assistants into a single AI product named Microsoft Copilot. Copilot offers both free and paid versions and is integrated into a wide range of Microsoft applications providing access to Chat GPT-4 and DALL-E 3.

Investors can keep up with Microsoft’s AI developments here.

Shares are up +21.2% in 2024 so far.

Arm Holdings ADR (ARM) and Softbank Group Corp (9984)

Majority owned by Softbank Group, Arm Holdings was listed on the NASDAQ in September 2023 and has quickly established itself as a major force in AI. The company architects, develops and licenses central processing unit (CPU) products and related technology which semiconductor companies and original equipment manufacturers (OEMs) rely on to develop their products. 99% of smartphones run on Arm-based processors and Arm has shipped 287 billion chips to date.

In Q4 of fiscal 2024, Arm reported its highest-ever revenue of $928 million, up 47% year-on-year. Shares are up +216.5% since listing and +136.3% year-to-date.

Softbank Group has had its ups and downs but is recovering in 2024. Led by the charismatic and controversial Masayoshi Son, Softbank Group has aggressively invested in a broad range of fields including robotics, AI, real estate, e-commerce, telecoms and more. It would be fair to say that the company has backed more than its fair share of losers, but Arm is proving to be one of its better bets.

AI stands at the forefront of Softbank Group’s vision and strategy so investors should expect the heavy investment in AI-related companies to continue. CEO Masayoshi Son says: ‘We are heading for an AI revolution, and we will be the investment company for the AI revolution’.

Softbank Group shares are up +81.1 % so far in 2024.

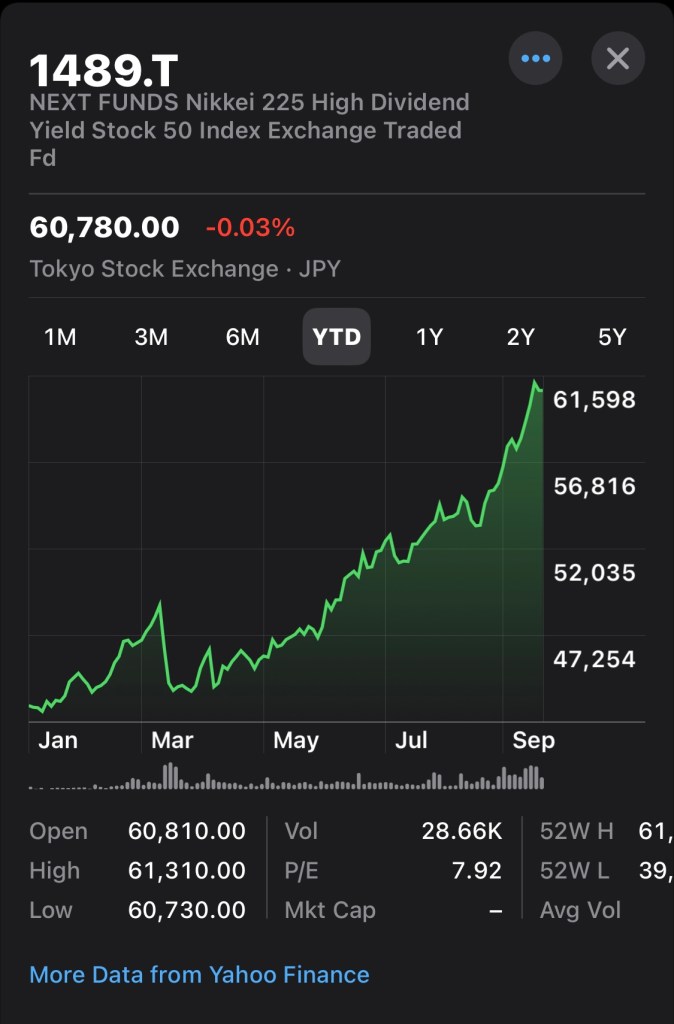

These are just a few ideas to get you started. There are many more companies involved in AI that are worth considering. Both Amazon and Meta are making huge investments in AI. Arista Networks (ANET) AI networking has driven impressive returns over the past five years. In Japan, NEC Corp is developing a range of AI technologies under the banner of ‘NEC the Wise’. And, of course, the huge boom in semiconductors has largely been driven by demand from AI.

The majority of investors will already have a larger allocation to AI-related stocks than they probably realise. Any S&P 500 or NASDAQ tracker will have significant exposure, so it isn’t always necessary to make an effort to dig out the next big name.

As for timing, returns over the last 3 years have been extraordinary. It remains to be seen if this is a bubble that is soon to burst, but sudden deep corrections can occur at any time. If you are a long-term believer in the AI narrative, there is no rush to pile money into the space in one go. Dollar-cost averaging is a solid strategy, and so is adding on significant dips.

Whether you are allocating passively or building a portfolio of AI satellite holdings, things are going to get interesting and maybe just a little weird.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.