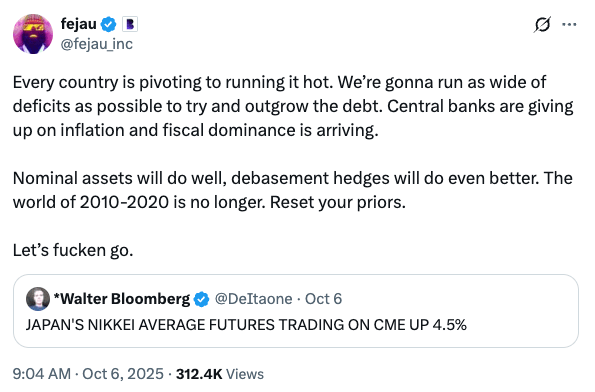

We’re only halfway through January, and it already feels like we have lived through a year’s worth of crazy news. Maduro has been ousted, Iran is in turmoil, Mexico and Colombia are on alert, the Europeans are mobilising to protect Greenland, and the chair of the Federal Reserve released a video accusing Trump of bringing criminal charges against him because he refused to bend to his will and lower interest rates quickly enough.

And, despite all of this, many markets are near all-time highs. There really has never been a world leader capable of instigating so much chaos, whilst simultaneously making markets stand up and dance for him.

If you are not convinced by now that Trump is going to pump liquidity and juice the stock market as hard as he can this year, I don’t know what to say.

Likewise, Prime Minister Takaichi. With such a strong approval rating, calling a snap election seems like a calculated risk. The market reaction tells you everything you need to know about her economic policies. Yen down, stocks up. She is going for growth, and that means yen debasement and more inflation coming.

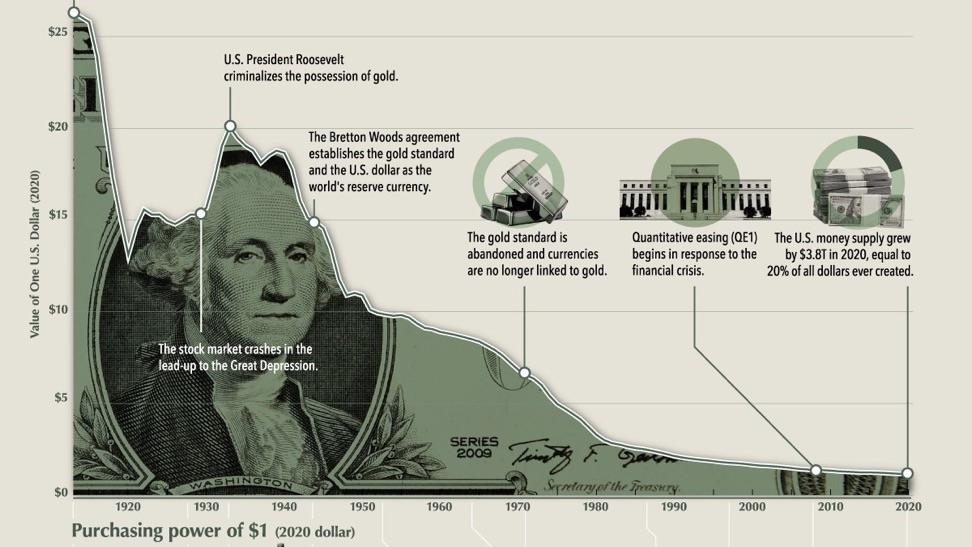

Metals are sounding the alarm on all of this. Bitcoin is also finally starting to respond. The debasement trade is far from dead.

Here are a few thoughts on where this could be going:

Stocks

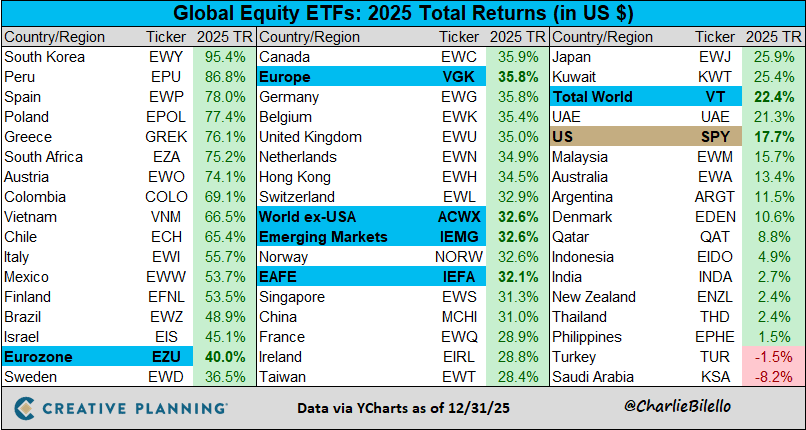

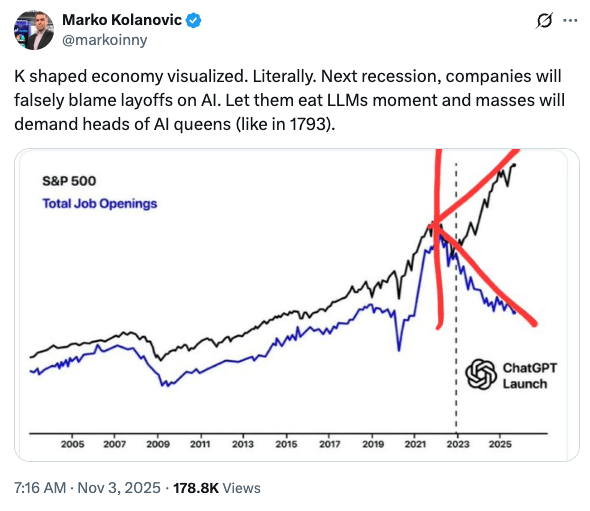

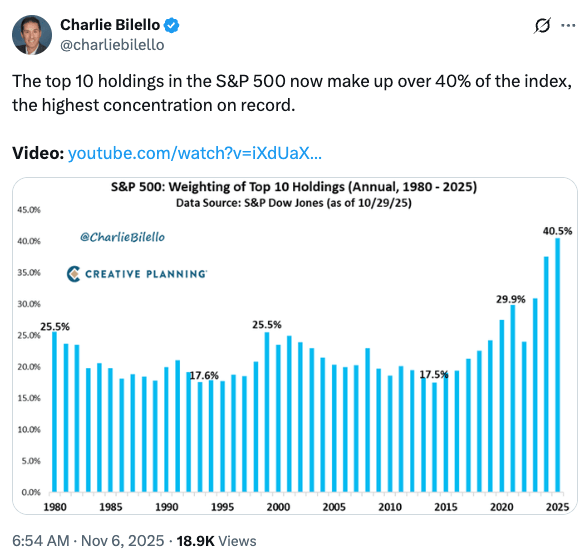

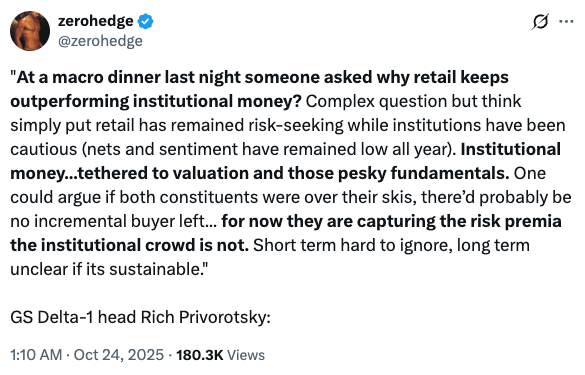

Mag 7 appears to be cooling somewhat, allowing the S&P 493 to catch up a bit. I’m even hearing American commentators discuss emerging markets. This is probably healthy, although the AI trade is by no means over and data centre spending is not slowing down.

Taiwan Semiconductor reported Q4 earnings this week that beat analyst expectations. Trump just announced a trade deal with Taiwan that will boost investment in the US semiconductor industry, and the deal sees the “reciprocal” tariff rate on Taiwanese goods drop from 20% to 15%.

The biggest short-term threat to stocks is the U.S. Supreme Court’s expected ruling on the legality of the Trump tariffs. If the court rules against these duties, expect all kinds of confusion.

Longer term, it’s hard to be bearish with Trump preparing to install the next Fed chair to do his bidding and midterms looming.

I guess the thing that could derail the Japan bull market would be the LDP performing poorly in the upcoming election and Takaichi being forced out as a result. Conversely, expect another yen down/stocks up surge if she wins a clear mandate.

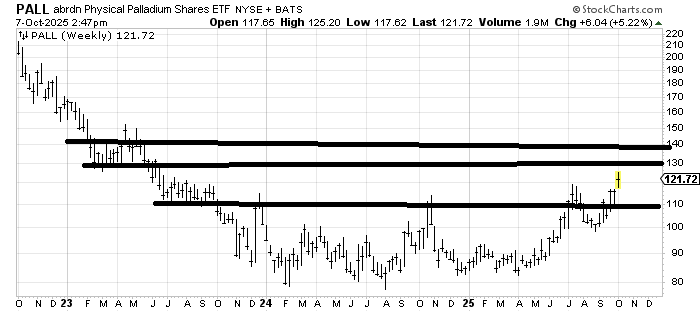

Metals

The metals trade may not be done, but it’s surely in the late innings. People are starting to ask about copper and palladium. A while back, I put some of my old savings plan into a gold mining fund, and when I checked yesterday, the thing has more than tripled. Half of that went right into bonds for the time being.

If you’ve been in metals, well done! I have no idea if it’s over, but it’s not a bad time to trim some exposure.

There was a report on the 10pm news two nights ago about precious metals: Gold and silver jewellery are selling well in Japan. Dentists are losing money on 銀歯 (silver fillings), which are actually made from a mix of silver, palladium and gold. One dentist interviewed said that some people are even trying to sell their fillings! People are walking around with a hedge against yen debasement in their mouths…

If you are thinking of getting into silver right now, that’s FOMO.

The metals people on X are starting to sound like the crypto bros in a bull market. There are definite signs of euphoria, which means the reversal will likely be brutal when it comes.

Bitcoin

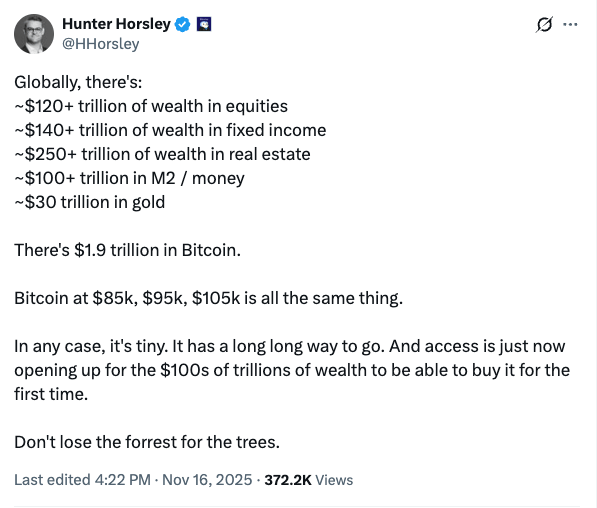

I’m talking Bitcoin, not crypto, as I can only think of a handful of coins that might do well IF Bitcoin gets back over $100k.

There’s an ongoing debate about whether the four-year cycle is dead. I’m not convinced it is, but at the same time, the liquidity backdrop for Bitcoin looks ridiculously good.

Here’s my best effort at a cheat sheet:

If you own Bitcoin, I’m assuming you are long-term bullish. If not, what the hell are you doing in it? I remain bullish on long time frames.

If you believe the 4-year cycle is alive and well, and 2026 will see the usual brutal bear market, prepare some dry powder. The chance to accumulate cheaply is coming.

If you think we bottomed already, you want to accumulate as much as you can under $100k.

If you’re not sure, DCA is the way. Just buy a little at regular intervals and pay as little attention as possible to short-term price fluctuations.

Fidelity Digital Assets’ 2026 Look Ahead is worth a read if crypto is your thing.

Ray Dalio’s lookback on 2025 is also interesting.

Hopefully, that provides some food for thought. Funnily enough, this post from October 2024 still holds up pretty well: Facing inflation – the four assets you should own.

I don’t see a lot of fiscal responsibility coming out of America and Japan in the near future. Long live the debasement trade!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.