Welcome to Part 5 of our series on property investing with Graeme. This time we look at the strategy to “flip” a property.

Flip Strategy

There are 2 ways of making money in property – cash flow or capital gains. Unlike the previous articles on cash flow strategy, a flip is a capital gains strategy where you buy a house cheaply, refurbish it to a good standard and sell it at a profit – you buy cheap and sell high.

This article will give an overview of the principles and practices of a straightforward flip. In this article we will not discuss big flips which need planning permission or architecturally-inspired reconfigurations. This article will give you the basics of a simple flip so you can decide if you want to go further down this business path. Questions to examine include: What are the suitable economic conditions for a flip? What is a suitable neighborhood? Who are the necessary team members? And what are the key calculations to confirm your target property works as a flip.

Don’t be a fish

A common adage in China is “A fish doesn’t know it swims in water.” This means a fish doesn’t truly know the environment it moves in. Many investors who flip are like fish, they just find a cheap house, refurbish it and then try to sell it. The problem is they don’t know the economic environment, they don’t know how much they can sell the property for, who will buy it, whether there are currently a lot of buyers in the market nor what type of refurbishment the typical buyer wants. As a flipper you shouldn’t be a fish so rule number one of a successful flip is, understand the environment you are working in.

Your first research is to check that the target property can definitely sell. Flips work best in warm and hot markets where properties are selling quickly. One property investor I know was flipping in Canada recently during the boom where wealthy Chinese wanted to move their money out of China and into Canadian real estate. To put it bluntly this is a wet dream for a property investor! Chinese investors were pouring money into the local property market and he was very successful. This is an example of a great market to flip in, however there are still many skills and techniques to learn as well as a lot of hard work in order to make your flip a success. So ask the question…what is pushing prices up in your area? (e.g. Chinese investors) or what is holding prices down? (e.g. too few mortgage products available). You need to know why flipping is a good strategy in your particular target area at this particular time.

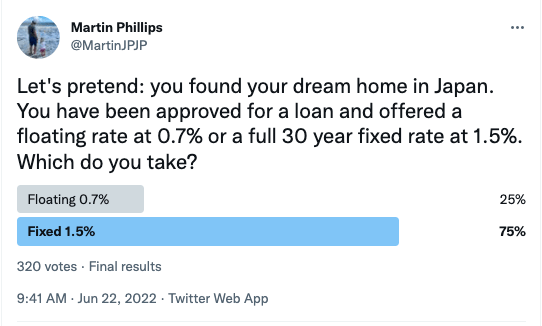

Another example of a good flipping market is a country where there are many mortgage products available. Many mortgage products means more people have the means to buy houses and therefore you have more potential buyers. You can find this information online or simply call a mortgage broker and ask “How many mortgage products were available 2 years ago? one year ago? and today?” You can also ask “How many products do you think will be available in one years time?” If the numbers are increasing each year it is a positive sign.

Key Question: How easy is it to get a mortgage?

Successful flipping is about supply and demand – not only the supply and demand of houses but also the supply and demand of mortgages.

Another quick way to understand the economic environment of your flipping area can be found on property websites. A decent property website e.g. Rightmove.co.uk (in the U.K) has maps that show a map of your investment area. Look at your area and find how many properties are actually for sale, then find how many properties are sold subject to contract (STC). STC means that a buyer and the seller have agreed a price and now the buyer is doing his due diligence i.e. getting a survey, confirming mortgages products available. If there are a number of STC properties in your searches that can be a strong indication that properties in your area are proceeding towards sale.

You find the STC statistics by looking at the top of the online map for number of properties for sale. Then check the STC filter and count the number of properties. What percent of properties are STC? The higher the percentage, the higher your chance of a successful flip. 10% isn’t very good. 40% is probably good (it should be noted that 25% of all STC’s fail mainly due to bad finance i.e. the buyer fails to get a mortgage, but this research is still a good indicator of the area’s overall economic environment).

Another question related to mortgages is: “Is my target property mortgageable”? This is crucial because most buyers use a mortgage. Even if you buy with cash, confirm you can get a mortgage on the property for the next buyer. If you are planning a reconfiguration of the property the mortgage may be denied if the property is a leasehold property, as you will need permission from the freeholder. Make sure you know the tenure of the property (preferably freehold) Ask this question to your mortgage broker and your solicitor.

Using online websites is a quick way to sense the local flipping market and you can compare other areas by using the maps on property websites to get a sense of all your potential investing areas. Most importantly, while you are online check the Done Up Value (DUV) of the properties in your area (how much has a similar property in good condition sold for). The DUV is vital information because this is the price you can expect to sell your property for. Find the DUV by looking for recently sold, similar properties nearby. Look at the photos and description to check the property has the same number of bedrooms and similar layout and was sold in good condition.

Don’t be a fish, means you must know your area. Your flipping area may well be different to your cash flow area because a flipping area is an area where house prices are higher and you have found the worst house in a good neighborhood. The need for refurbishment is how you have managed to drive your buying price down.

As an investor I like to buy rental properties between 40K – 80K (GBP) but a flip property is typically 100K-150K. This higher price bracket means bigger margins and therefore a bigger cushion in case of financial risk. If, for example, the refurbishment costs increase by 5k and your sale is 5k under expectation then your profit on a cheaper property will be wiped out. Despite these losses your margins on a bigger property are more likely to still yield a profit and therefore you focus on higher price properties in order to protect yourself.

Another important area question to ask is: Typically how long is a property on the market for in this area? six weeks? six months? three years? You want to be able to sell quickly. Ask your local estate agent “If I brought you a house that you could sell tomorrow what would it be? Where would it be and what would it sell for in good condition?” Spend time with estate agents, talk to at least three different agents and explain your strategy. Where do they all agree is a good flipping area?

Furthermore get a map of the area and, with agents, identify schools, transport hubs, retail parks…or drug dens, anything that will positively or negatively influence the area. Also note any long streets in your area. If you are buying on a long street sometimes one end of the street has higher prices than the other end and so the asking prices on the same street could be significantly different. Make sure you are paying the price that corresponds with the correct end of the street. Talk to local agents and ask: “Is the market slower or busier than one or two years ago?” Confirm what one agent says with at least two other agents.

Don’t just talk with agents, get onto the streets and talk with everyone in your area: taxi drivers, shop owners, locals in the street, ask “How’s business doing compared with two years ago?” Get online and gather information about your area – any long term improvements in the area? New hospital? Hotels? A nearby port development? Other transport developments? What are the shops like on the high street? Any boarded up commercial units? If so what percent are empty? Read the local newspaper and build your area knowledge. Is your area on the up, down or staying steady?

Ride the Wave, Don’t Create it

As you talk with local agents in your area identify who is buying houses. Is it first time buyers? Is it families? Pensioners in search of bungalows? Who most likely is going to buy your house? One popular strategy is to flip bungalows to pensioners because often this segment of the population are downsizing and have a lump cash sum from the sale of their larger family home and therefore they will buy with cash. So ask yourself the question would a bungalow strategy work in my area because ideally you want a cash buyer to circumnavigate the extra hassle and slowness of the mortgage industry. Your buyer could even be your business partner, but you need to understand not only how warm the market is, but who is making the market hot so that you can cater your property to their desires. e.g. Ask your agent “Do the buyers want plastering on walls or wallpaper”? “Do they want carpets or lino on the floor”? “Does the market want 2 or 3 bedrooms”? Factor all these points into your search for the right house to buy and flip. The principal here is “Ride the wave, don’t create it”. Find out what buyers in your market want and go along with that. Ask your agents: “What are the main criteria a typical buyer is looking for”? Another key practice is to approach five local agents for done up value of your target property. If 4 agents say 150K but 1 says 130K disregard 130K, however if 3 agents say 150K and 2 say 130K then you need to consider 130K.

You could even pose as a buyer and view houses on the market that the agents say are good examples of what the market wants. This will give you a good idea of the quality of refurbishment that is typical in your neighborhood. In other words let the current market give you the answer to your refurbishment questions. A lot of beginner investors worry about the standard of refurbishment, which is sensible because you want to attract buyers however you can simply get the answer from other good properties in the area – Find the best property in your area and copy it!

As you walk the streets of your investing area, when you get an opportunity make sure you talk with neighbors who have good houses. Bring your business card and introduce yourself. Say you are planning to buy a property here and want to make it really nice. It is surprising how friendly and interested people can be. There have been many times when I’ve had a good, long chat with a neighbor and they have invited me in for a cup of tea. Often they have had refurbishments done so ask to see the quality of the builders work, ask about the quality of their builders work, get contact details of the builder, ask about satisfaction with work, cost and time frame of the work. If you are a beginner and don’t yet have a good builder sometimes local people can provide the solution to that issue and many others. One of the skills of an investor is to get good at having cups of tea with people you’ve never met before (of course you should always be safe and it may not be recommended for women to do this alone). Let people in your investing area help you and remember, ride the wave don’t create it.

When you start viewings and engaging directly with your flip area, set up a database and record each offer and then reoffer every three weeks. Your flip database should include date of viewing, address, type of property, DUV, refurbishments and cost of the refurbishments.

Flipping Figures

The basic flip calculation is simple but crucial. It is amazing how some investors love to do complicated calculations when the essence of knowing at what price your flip works is straightforward.

The Flip Calculation

DUV – profit – refurbs – other costs = Maximum Purchase Price.

So try this quick calculation – DUV is 100K, desired profit is 12K, refurbishment cost is 10K and other costs are 4K. What is your max purchase price?

And one more – DUV is 150K desired profit 25K, refurbishment 20K, other costs 7K. What is your max purchase price?

The key questions are:

What is the property’s DUV?

What is my intended profit?

How much are the refurbishments?

What are my other costs?

What can I buy it for?

15K profit is good for a small 2 bedroom property. 10K profit is ok if the process is easy, and your first flip should be easy as you are testing the market, your systems and your team’s ability to deliver. The purpose of your first flip is to make a fair profit and learn, learn, learn so that you can do bigger flips more safely next time.

One of the core principles of a professional investor is: You make your money when you buy. You must buy at the right price and you know the right purchase price based on the flip calculation above. Be accurate with your Done Up Value. Check the DUVs online and check with at least 3 agents. Remember that agents like to over price to make you feel good about the property so challenge them if you think their DUV is too high. Let them know you have done your research and you are no fool.

Bizarrely some amateur investors spend a lot of time refurbishing a property without a sense of their end profit!! Make sure you know your profit required. Regarding profit, many professional investors look for 10%-20% of the done up value on a simple flip. Don’t be greedy, be realistic and get the property sold quickly. The problem with a flip is that it is intense work. A flip is a type of trading and this is an active, cash strategy that takes effort and we only make money once. Some investors don’t even consider flipping as a type of investing but more like a well-paid job. Sometimes we get emotionally attached to the property therefore we want an even higher price than is reasonable. When we get greedy we often don’t get the property sold.

So once you have your overall flip calculation, plan your project in detail and understand what you’re involved in. What exactly are all the costs? How much are your solicitor fees (about £1k in the UK) How much is your survey (about £500 in the UK) How much tax will you pay? Is that stamp duty, council tax or capital gains… or do you have a strategy to legally avoid paying any tax? Will you buy in a limited company or as an individual? What are the buying, holding and selling costs? What are the agent’s selling fees? Will you buy with a mortgage, cash or another source e.g. bridging finance? What is the cost of borrowing? e.g. 100k at 4% (this is an example of a holding cost)

Do your calculations, arrange your finances and team, then put in your offers and buy. Furthermore consider what’s the exit strategy if you cannot flip? Remember from article 4 that you need a second exit. If you cannot flip how much will it rent for? Some smart investors buy a property, do it up, rent it until the market is hot and when prices are high they sell. They are combining the cashflow and capital gains strategy based on market conditions. Remember a smart investor always has a second exit.

Master Your Refurbishments

Miscalculating refurbishment costs is the second big mistake investors make. Even good investors get this wrong and suffer for it. Most people only get involved in a property transaction one or two times in a lifetime therefore most people don’t know the real cost of materials and labor so they pay too much.

As much as possible make refurbishment costs simple. Some investors like to have 3 types of refurbishment costs – 5K,10K and 15K.

5k is a fluff and buff.

10K is a fluff and buff and new kitchen.

15K is a fluff and buff, new kitchen and new bathroom.

In reality it is not that simple but this is a starting place. Have a rough figure you will pay for the refurbishment in your head and sharpen that number by getting a builder to walk through the property with you when you get close to agreeing a price with the vendor. Alternatively you could get a surveyor to survey the property and draw up a list of refurbishment works and then get a quote from three builders to ascertain the costs. Whatever you decide, it’s important to remember that when you’re beginning, it’s crucial to have a professional identify the repairs necessary. Even the most advanced investors do this and benefit from it.

You should always hire professionals for your flips, however on your first few flips be heavily involved – walk the property with the builder, do grunt work such as stripping out the property, filling the skips, grouting and helping to prepare paint for the painter. Learn the cost of your materials. Be involved to know:

- the refurbishment process.

- the costs.

Refurbishments are very important to get right yet this is where a lot of investors pay too much or don’t do a good job and therefore don’t get the selling price they need. Refurbishments are a crucial part of property investing and we will explore this important topic in a later post but for now here are some basics:

The Four Stages of Refurbishing

- Clear out property

- First fix

- Second fix

- Snagging

There are four main phases of refurbishing and the first is clearing out the property and preparing it for the tradesmen to do their jobs.

When you clear out your property you will probably need a skip or two to remove the waste. This is grunt work you can help with. If the property is empty, ask the seller if you can start this work even before you have completed the sale process. Get to work quick!

First fix means putting the skeleton of the house together: wiring, copper piping, door frames, then the plasterer comes in and plasters the walls, then plumber comes in to do any plumbing work.

Second fix is when each of the tradesmen comes in to finish their jobs. The finishing work includes sockets in the walls, the boiler is connected and pressurized, doors in doorframes, radiators on walls etc.

Second fix may include installing a new bathroom and kitchen and finally carpets. Get the building lit up with low energy bulbs. Stage the property in neutral colors e.g. beige, magnolia and white. Then get the building warm and breathing and ready for carpet day. Carpet day is the final day of refurbishing. When you put the carpets in and do a final check (snag). Now you’re really ready to take your property to the market.

The first time you do a flip I would suggest getting the head builder to organize all the workers, check safety conditions and do the administration. This job is called project management and we will explore more in the refurbishments article. As you get more skilled you can do the project management yourself as this will save you money but for your first flip hire a professional project manager and watch and learn.

When you flip a property you want to create a “Wow” factor. At the very least make sure all the rooms are smart and done to a good standard. In particular focus on the kitchen and bathroom as these are the two rooms that really sell the property. Make them smart and light. How can you maximize light in these rooms? For example if the kitchen looks onto a walled yard, paint the yard wall white to reflect natural light into the room. A good flip looks smart and sharp because this will attract buyers.

Flow Like a River

The principle of flow is important in relation to your time, money, systems and your property layout. Make sure your property has flow. This means the property is easy to move through. If you cannot move quickly through the property what are the solutions? Is there a stud wall that needs to come down? Is it worth it? On a larger scale, does the neighborhood flow? Can traffic move easily through it? Is there parking available on road or off road?

The principle of flow is also relevant to your financial situation. When you are borrowing money to buy a property and have time pressure, for example bridging finance with expensive costs for late repayment, you need to be careful of exceeding this time frame. Get a loan for longer than you anticipate you need it. If you plan a flip for six months get a loan for 9 to 12 months.

Time Flow starts before buying the rundown property. When you get close in negotiations i.e. the agent says you just need to increase your offer by 2000 or 3000 this is the time to get your team ready. Get your tenders active and ask 3 tradesmen from each skill (electrician, plumber, plasterer) to visit the property and give you his fees. Then choose one, (later we will discuss how to choose your build team).

Take control of the deal and when you have a deal you choose the contract exchange day. On a project always ask the seller for keys access. This means you get access to the property between exchange of contracts and completion of the sale. This can mean you have one extra day to start work or based on your agreement one extra month!

Flow is important because delays are remarkably easy. Delays could include planning delays, utility delays, builder goes bust, legal issues with the contract, mortgage broker fails to do job on time either for you or your buyer, solicitor goes on holiday without telling you etc. Always check with all your workers that they will be around for the whole flip process.

Try to be three deep with your tradesmen. Three deep means having back-up tradesmen for each task, (preferably two back-ups). If your first tradesman suddenly gets divorced or sick or goes on holiday you want somebody else to get in there and do a good job, quickly. Flow of workers is important and so is the right order of workers – organize start and finish dates in the property. After each tradesman finishes make sure property is swept out, clean and dry and ready for the next tradesman.

Have all your workers dates lined up. If your tradesman causes delays say “You’ve given me a price you’ve shown me your schedule and your profits. If it overruns I have serious fees to pay.” Get a specific day for finishing the project, “I would like the building finished by 5:30 PM on X day in X month.” Remember your relationship with the tradesmen – you are the client and they should respect that.

Make sure your tradesmen are flowing into the property on time. Check with them several times before the project that they know their start date and duties. Give a bonus to your tradesmen if job is done well and done on time. This increases their motivation and helps flow. Incentivize your tradesmen! While you incentivize your tradesmen you should still have a contingency for time and money and throughout the process remember to keep an eye on the quality of the works. Are these refurbishments good enough to attract buyers in your area?

Even with professional investors delays still happen. When you encounter a delay it is important to compartmentalize the problem, learn something from it and maintain your long-term vision. Think positive, can these delays be good for your taxes!?

A flip, from start to finish, can easily take six months and the process includes:

1. Check area and economy

2. Viewings and offers (know 2nd exit)

3. Buy (exchange and complete)

4. Refurbish (at least eight weeks)

5. Viewings (loads of them)

6. Buyer gets mortgage (weeks or months)

7. Sell

Selling

As soon as you’ve bought the property put a For Sale sign outside it. This will give potential buyers weeks or months to stop and have a look.

Interview 3 or more agents for the sale. If you have an agent who regularly overvalues note this, and the same if another agent regularly undervalues. Ideally when buying you want an undervaluing agent and when selling an overvaluing agent so you can buy cheap and sell high. This means you may change agent in the buying and selling process.

When advertising use the phrase “fully refurbished home”. The word “home” carries more positive emotion than “house” or “property”.

Ask your estate agent “How are you marketing my property?” Do they use Facebook or other SNS avenues as well as the usual agent website and advert in the shop window? Do they use the largest property websites which take all properties on the market from all agents?

As the viewings increase, call the agent every Friday and ask “How many viewings this week? “What was the reaction, what was the feedback about the property – good points and weak points?” “And how many buyers did we get this week?” Keep a database of this information for current use and future deals.

When a potential buyer makes a suitable offer always ask the buyer “Are you buying with cash? If mortgage ask “Are you sure you have all the documents for the mortgage company?” Incentivize your buyer to get the mortgage as quickly as the mortgage broker says is possible e.g. 400 pounds discount on the property. This action encourages flow and more importantly you will quickly know if the mortgage fails and you can get a new buyer ASAP.

One final cost I’m going to suggest is a buyer incentive. In most markets a smart investor will drop his selling price. Some investors will sell for 5-8% below the DUV because they want to give a buyer’s incentive so the property doesn’t hang around on the market. In great markets e.g. foreign investors piling into the market with more money than sense or a market with a lack good properties for sale you don’t need to do this. However to complete your flip strategy I would recommend giving a buyer incentive which means you should recalculate your maximum purchase price.

One final truth about flips. I know investors who simply don’t go hunting for a flip because it is an opportunistic strategy. Most investors prefer cashflow because the cashflow strategy is like a steady salary that gives you more stable financial freedom, unlike the uncertainty of flips. However sometimes when you go hunting for fish you catch a shark and a smart investor may see that a flip strategy will work even if that wasn’t his original strategy. For me personally a flip is a back up strategy however I will be the first to admit there are investors who make good money from the flip strategy in a hot market.

To summarize, the 3 most important points I hope you have taken from this article are:

- Know your area and market very well.

- Buy at a great price according to the flip calculation

- Manage your refurbishments very well and with a trusted build team.