Following our interview on property investing with Graeme, here is a second post from him with some practical advice on how you can actually get started and research your investing area:

In the previous post we discussed SAP (Strategy, Area, Property) and how a serious investor starts by identifying a clear strategy. We will return to the topic of strategy, however you’re probably saying “OK, strategy is important, but for now just give me some actionable advice to help me get into my investing area and find good rental properties and good agents to manage my houses.”

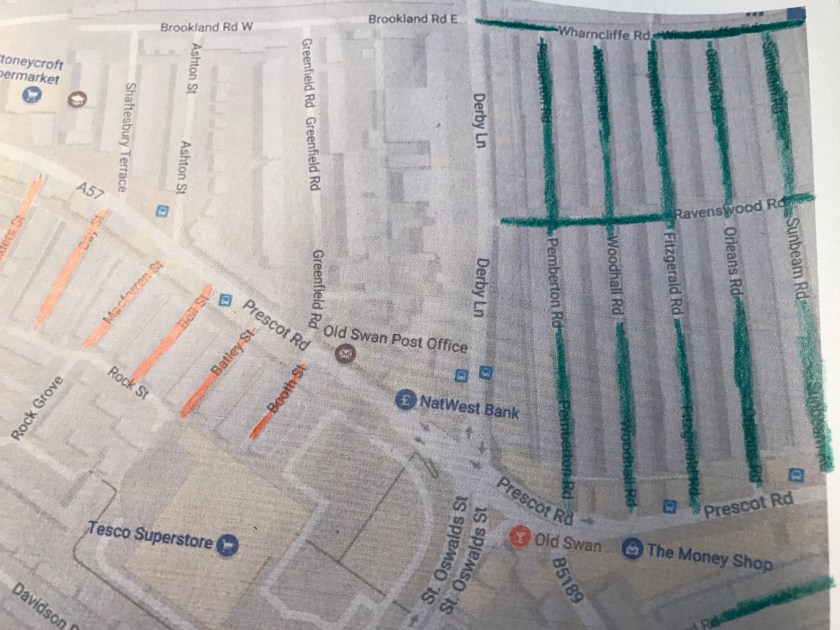

Know your Area! – The Green Pen/Red Pen Game

To make money from property you need to know your area because if you buy in the right area, most likely good tenants will move in, pay the rent on time, take care of your house and stay a long time. Needless to say, buying in the wrong street is more likely to result in voids, bad tenants and arrears. So how can you learn about your area quickly?

The average investor goes to the estate agent and asks them for info on the local area. The problem is that the estate agent will sell you almost anything, regardless of whether the area is going up, down or stagnating. Estate agents just want to sell and only focus on a property’s good points so that they make money. Instead, first go to a lettings agent and bring a photo-copied map of the area, a green pen, and a red pen. Get the lettings agent to highlight in green all the streets on the map where property can be easily let, i.e. the desirable streets.

The exact words to say to your lettings agent are:

“If I were to bring you a house in a decent street, that you could rent today, where would it be”?

Notice the language we are using. The phrases make it sound as if you are helping them. Agents get time wasters everyday who ask random questions but take no action, so you want to separate yourself and make it clear from the start that you are here to do business.

Also ask the lettings agent specifically what type of house is in demand? (2 bedrooms, 3 bedrooms, apartments, properties with gardens etc) and why?

After they have shown you the good streets then ask them to highlight any dodgy streets with the red pen so you know the places that are best to avoid. Even if there are no rough streets in your area, it is still worthwhile getting to know which are the most desirable and least desirable streets and why.

I suggest doing the green pen/red pen game with 2 or 3 lettings agents to cross check you are getting the right info. You are also interviewing the lettings agent to see how much they know and whether you want to work with them in the future. In short you are quickly gathering accurate information about your area while doing a job interview.

So, now you should know which properties are renting fastest, in which streets and why.

Next, go to your local estate agents, show them the green streets and ask “What properties do you have for sale in these streets?” Once you have the estate agent’s list of good properties, take that list back to the lettings agent and say “Is this the kind of property you mean?”

How much rent will I get for it?

What kind of tenant (unemployed, student, family, young professional, retired) will want this property?

Is there anything I need to do to the property to get the maximum rent?

What are your fees as a lettings agent?

By doing this you are double checking your information and gleaning extra nuggets of wisdom about your investment area.

There are 2 Ps in the word property

In the previous post we talked about using the bank’s money to buy property and this is called OPM (other people’s money). In this article we are using other people’s knowledge (OPK), and this expert knowledge can be gleaned in a single day, preferably face to face but, if necessary, by phone.

OPM and OPK when combined are very powerful tools for building a successful property portfolio. From OPM and OPK comes one of the most important property investor mantras and it is this:

“There are 2 Ps in the word property. The first P is for property and the second P is for people.”

The importance of having the right people on your team cannot be underestimated to your net worth. Property is a people business. It’s all about the people we interact and transact with. Build good relationships with the right people, understand how they operate and know how to talk with them.

If you want to have a good relationship with your agent, you need to understand their system. For example, when you go into the estate agent, ask specifically to speak with the agent who deals with investors. Usually the young, inexperienced, agent is put front of shop. You want to navigate around them and talk with the experienced agent who knows the area and the business inside out. They may well be at the back of the room or have their own office off the main shop floor. It is this person you want to do business with and make your offers to.

This post has provided advice on how to build your area knowledge and how to work with agents. You might not be ready to put in offers but for now grab your pens and maps and get out there asking the right questions!!

In the next post we will examine the goal of any serious investor. How can you buy property without using your own money and how do you calculate what the right offer is?