Last month, I read a fascinating article about punters in the NFL. What was particularly surprising is how Australians now dominate punting in American football.

I looked up the word ‘punt’ and it has four distinct meanings: a narrow, flat-bottomed boat, to kick a ball upfield, to speculate or gamble and the basic monetary unit of the Republic of Ireland, before the Euro.

You can probably guess which one I’m interested in.

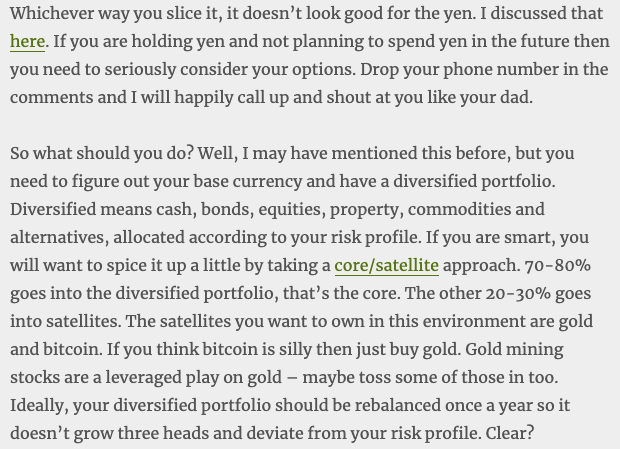

As regular readers will know, I favour a core-satellite approach to asset allocation. The core is a diversified portfolio, mainly denominated in your base currency and matched to your risk profile. Satellite holdings give things an extra spice, or maybe even, an extra kick. If 20% of your investments are in satellites, that 20% may also be broken down into traditional assets, such as commodities, niche stock market sectors – such as biotech, or alternatives. You may even want to take a small portion of the 20% and have a punt on something truly speculative. Imagine if you took a punt on AI a few years back.

The art of the punt is to find a candidate for the next megatrend and allocate a small amount of your wealth to it. If you are wrong, it’s money you can afford to lose. And if you are right, the returns are asymmetrical.

Megatrend: a long-term, large-scale shift that can impact economies, industries, and the way people live. Megatrends can be driven by technological advancements, demographic changes, or global policy shifts. Some examples of megatrends include: the rise of the internet, the ageing population, the shift to renewable energy, rapid urbanization, and technological breakthroughs.

That overview came from Google’s AI, by the way.

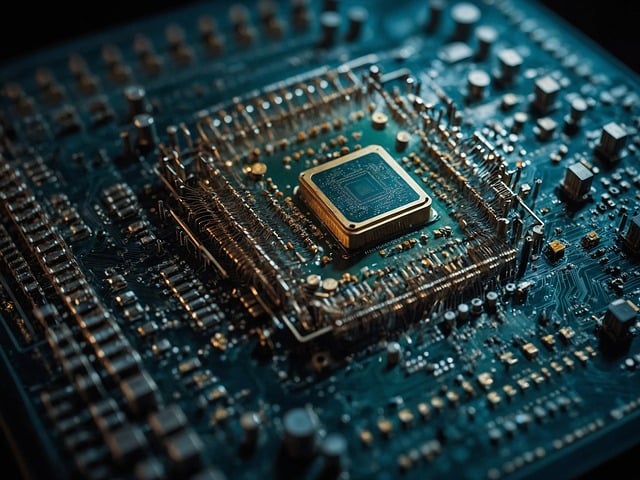

Earlier this month, Google caused a stir when it introduced Willow, a state-of-the-art quantum chip. Willow has been in development for 10 years and has reached the stage where it can ‘perform a standard benchmark computation in under five minutes that would take one of today’s fastest supercomputers 10 septillion (that is, 1025) years — a number that vastly exceeds the age of the Universe.’

Does that sound like a megatrend? It sounds like a punt to me! The key thing about technologies like this is that the pace of development is exponential. Nothing happens for years and then massive progress is made in a short period.

A few years back, a friend dragged me to a quantum computing seminar. He was attending to show support to one of the presenters. My friend is a finance pro and I’m a pretty good generalist and I remember clearly how, about a minute and a half into the presentation, we looked at each other like, WTF?????

Needless to say, I will not attempt to explain how QC works. Do your own research, as they say!

Here’s a nice friendly BBC article to get started with.

And, here’s a great thread by Charles Edwards. It helpfully identifies four stocks that punters can buy if they want to get exposure. They are IONQ, RGTI, QUBT and QBTS.

Please note: This is not investment advice. These stocks are a punt! You should not put a large chunk of your net worth into them. Also, they have gone up a lot since the Willow announcement. They will exhibit a ton of volatility and there will probably be better entries in the future. Funnily enough, three of them were down big just last night. I have seen threads detailing how QUBT barely has a business. Three of them might amount to nothing. Maybe all four companies will go bankrupt. However, one of them might develop the ChatGPT of quantum computing.

So, buyer beware. Do as much reading as possible and, if you decide to get involved, only play with money that is truly available for a punt. There is no need to rush into anything and you don’t need to invest a lot to spice up a well-diversified portfolio.

And, unless it’s really your thing, don’t go to any quantum computing seminars!

Top image by benzoix on Freepik

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.