I hope you are enjoying Obon and the summer holiday. After a market crash and a Nankai Trough earthquake warning, things feel a little calmer this week. Hopefully, there won’t be any more ‘big events’ in August other than the local matsuri.

However, September is approaching and it feels like that will be the time to get locked in and focused. So here are a few thoughts as we speed into the last four months of the year!

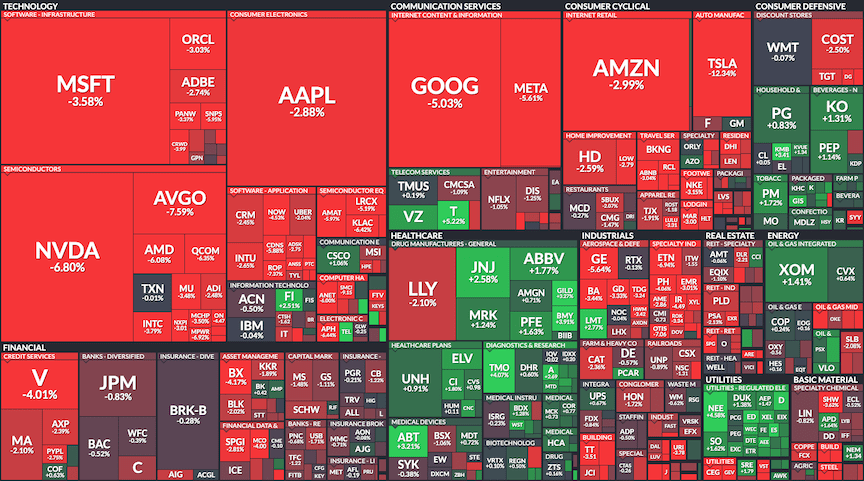

US markets

There is a slew of economic data coming out of America this week, with the Producer Price Index (PPI) coming in a little softer than expected last night. CPI is tonight and another soft print will heighten expectations of a Fed rate cut in September. Toys will be thrown if Chair Powell does not deliver, but I’m also becoming a little more cautious about the outlook for stocks if he does go ahead and cut. History favours a recession scenario at the end of a hiking cycle. A lot of effort has gone into the soft landing narrative, so we should be on our guard. No reason to make adjustments to long-term investments but things rarely go as smoothly as the crowd expects.

That said, the completion of the US election will remove a lot of uncertainty, regardless of who wins.

Yen / Japan stocks

After starting August with a bang, the Bank of Japan has swiftly backed down from any plan to raise rates again this year. They got as far as 0.25% and the stock market melted down. They didn’t even get to the bond market jitters part of the project. I would love to hear from anyone who can explain how the BOJ will go about a meaningful tightening from here. Imagine what rates at 0.5% would look like. How about 1%?

I just saw a Bloomberg headline that said that PM Kishida is stepping down in favour of a leader who is supportive of the central bank’s efforts to normalise policy. Best of luck to whoever picks up that poison chalice!

Let’s just call BS, shall we? You can’t normalise a ponzi.

Nonetheless, if the Fed does begin to cut, the yen should strengthen. I don’t know how far it will get. 130? 120? 100? It doesn’t matter, because once that cycle is over it is only going the other way. You can save the bond market or the currency and no one is sacrificing the bond market.

I have said it before but I’m nothing if not a broken record: if you are going to spend your future money outside of Japan, you should forget about those alluringly cheap Japanese value stocks and get your money out of yen and into your base currency while you have the opportunity.

If you are here for the long haul, by all means, have at it. In the shorter term, Japanese stocks should do ok and I would even be tempted to look for names that will benefit from a stronger yen. Exporters that did well under the weak yen don’t seem such a great idea going forward.

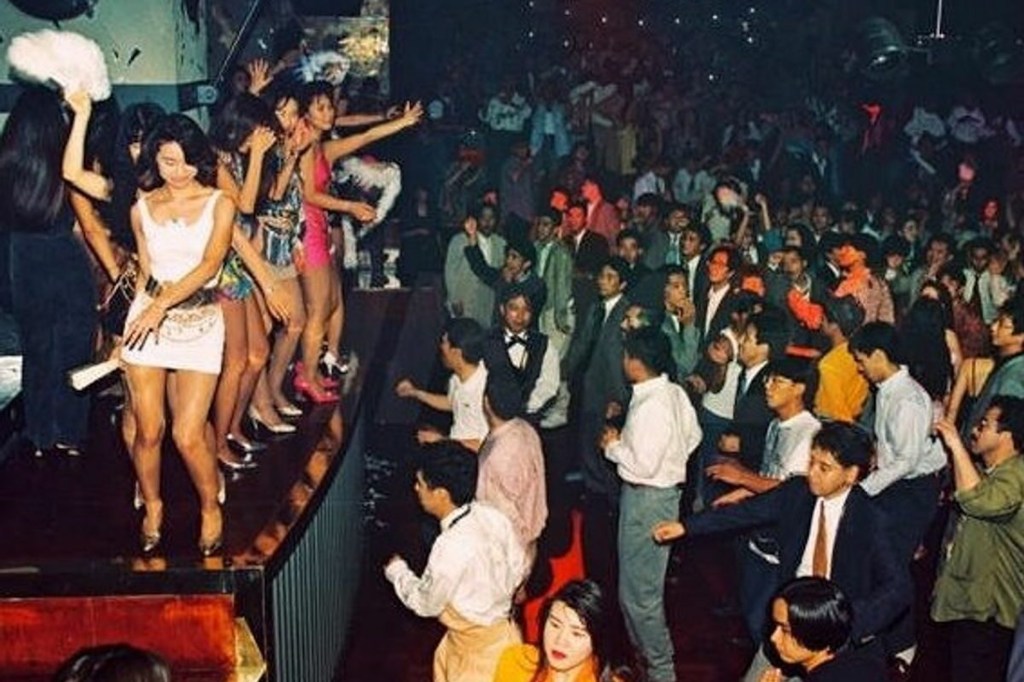

Getting hard

With the US election looming, the cynical among us would be watching out for a liquidity boost to pump up the US stock market. Rather than the Fed, we should probably be looking at the treasury to provide the liquid refreshment. This ‘Bad Gurl Yellen’ piece by Arthur Hayes goes deep into the fountain of liquidity that is about to spring forth. In short, the treasury needs to lower the debt-to-GDP ratio, and it will do so by issuing yet more debt.

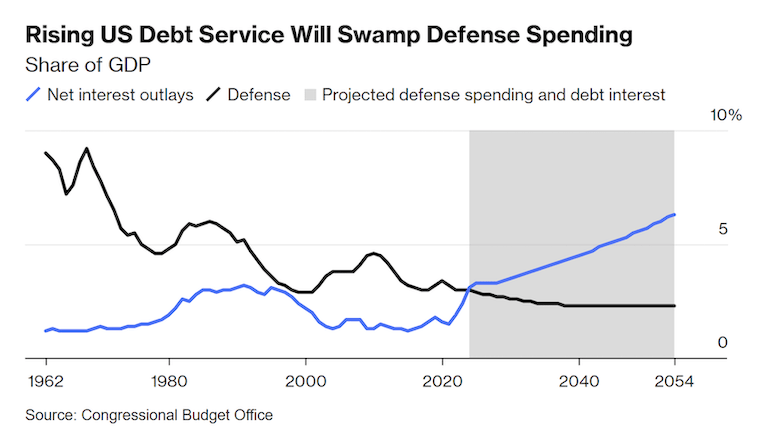

The Congressional Budget Office projects that interest payments on America’s debt will total $892 billion in fiscal 2024 and rise significantly in the next decade.

If you are wondering what that looks like, get a load of this chart:

Tell me you’re gonna print more money without saying you’re gonna print more money…

I wrote about currency debasement and and how to protect yourself in Harden up your assets! If you are looking at stocks to plough your hard-earned money into right now, that’s one way to do it but maybe there is a better option.

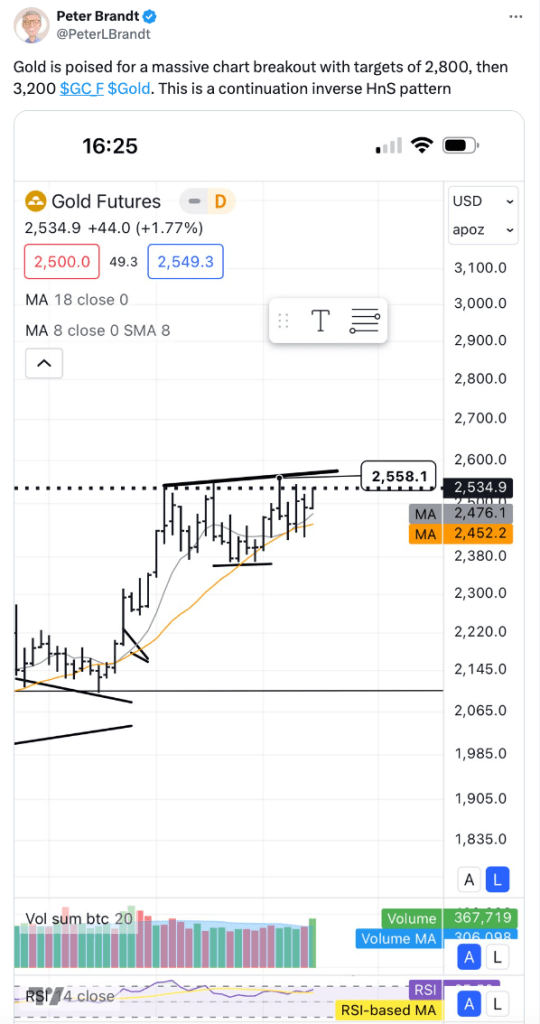

As you can see, some technical traders are getting excited about gold. JP Morgan agrees, arguing that the structural bull market remains intact and forecasting an average price of $2,500 in Q4 and $2,600 in 2025. Geopolitical tensions, rate cut expectations, central bank buying and ETF flows all point to elevated gold prices – report here.

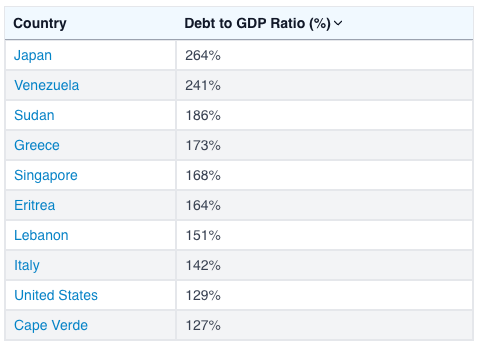

Of course, those are short-term targets and the real point of owning gold is to protect against currency debasement over time. Remember, this is what you’re up against:

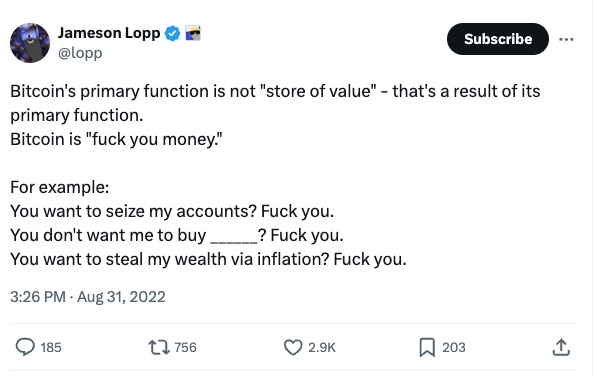

Digital gold

Ever the broken record, allow me to point out once more that the boring phase of the Bitcoin bull market is drawing to a close. We probably bounce around for a few more weeks, maybe even a couple of months. The timing is difficult to predict but I expect significantly higher prices by the end of the year. And more to come in 2025. If you are thinking of getting on the train, you don’t have long left…

Despite a reshuffle of the Democratic nominee, pretty much everything I wrote in the Bitcoin bull market update still stands. All aboard!

If you are still trying to get your head around the hardest asset on the planet, the presentations from Michael Saylor’s keynotes are a great resource.

Don’t say I didn’t warn you!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.