This post contains affiliate links.

One of the major obstacles to wider Bitcoin adoption has always been the issue of storing and spending coins. Fortunately, it is getting easier to do both.

I bought my first Bitcoin on Xapo in 2017 and have been storing part of my holdings there ever since. Back then, Xapo served as both a super safe custodian wallet and a trusted platform to buy, sell and store Bitcoin. In the last few years, it has become much more than that.

There are many ways to manage Bitcoin storage, but here is my strategy:

- Do not leave Bitcoin sitting on an exchange

- Learn how to self-custody securely

- Diversify risk by storing some BTC with a trusted custodian

Bitcoin purists will likely agree wholeheartedly with points 1 and 2 while vociferously objecting to point 3. That’s fine; I get it. However, I live in a wooden house in an earthquake-prone country, and I’m not entirely comfortable having all of my BTC in one place.

Also, I like to have the option to spend some of my Bitcoin or borrow against it if I want to. That’s not so easy to do with the keys sitting on a hardware device.

Furthermore, I value having a functional USD account. I have plenty of experience with offshore banks, and none have been as easy to use as Xapo Bank.

That’s why I’m still using Xapo Bank today.

Xapo Bank’s history

Xapo was first founded in 2013 and provided a secure cold-storage product using a distributed network of physical bunkers. Yes, you read that correctly! Xapo combined cutting-edge key technology and good old underground physical vaults to protect its clients’ coins. In 2021, Xapo expanded its services, founding Xapo Bank. Headquartered in Gibraltar, the company is licensed as a bank and Virtual Asset Service Provider (VASP) by the Gibraltar Financial Services Commission.

Xapo Bank’s services

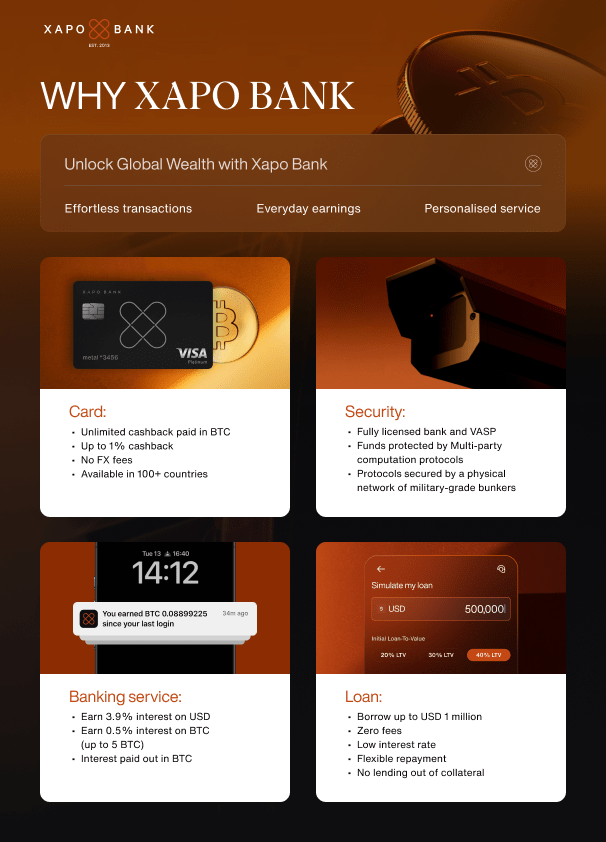

Xapo Bank’s account is entirely app-based and enables Bitcoin customers to hodl, transact, earn, grow and borrow. It also now offers stock and ETF trading.

Users control a main BTC and USD account, which can be used for day-to-day transactions. Then there is the savings account, which pays interest on USD and Bitcoin holdings. And finally, there is the BTC vault for secure cold storage.

The USD savings account currently pays 3.5% annual interest, and the BTC savings account pays 0.5% per year. (rates are subject to change)

Xapo Bank has also just launched a new BTC Credit Fund, offering a simple way for people to grow their Bitcoin by earning up to 4% APY on their holdings.

The Bitcoin trading fees are very competitive, and both Bitcoin and USD can be transferred easily and inexpensively from the app.

Users can opt for both physical and virtual debit cards, issued by Mastercard and VISA (depending on their country of residence). The cards pay 1.00% cashback, and the really neat thing is you can choose whether to spend your USD balance or your BTC balance. People often complain that you can’t pay for stuff in Bitcoin – well, now you can!

ATM withdrawals are also free up to some thresholds.

Along with BTC, users can also access S&P 500 and NASDAQ stocks and ETFs to grow their balance.

Customers who need cash but don’t want to sell their Bitcoin can borrow against their BTC holdings at an initial loan-to-value of 20%. The cash arrives in under a minute, ready to use through debit cards, bank or crypto transfers.

Borrowing against Bitcoin may also be a clever way to avoid triggering a taxable event. I have been trying to find confirmation of this for Japan tax residents and have not been able to find anything so far. Selling or spending crypto creates a taxable event. However, it seems likely that borrowing against crypto does not – please note, this is not tax advice, and readers should do their own research before taking action.

One thing is for sure: borrowing against Bitcoin is a smart way to avoid selling at inopportune times, when the market is down, and still benefit from future asset appreciation.

Ok, it sounds amazing, but what does it cost?

Of course, all of these services come at a cost. Membership is USD 1,000 per year.

Some people struggle to come to terms with paying the annual fee. My take on it is that it’s worth it for an easy-to-set-up and use overseas USD account alone. I have used several offshore banks previously, and the transaction fees were significant. Many have a minimum balance requirement with higher costs if you fall below the threshold.

With debit cards, savings accounts and the BTC vault, Xapo Bank is offering a premium banking service at a manageable cost. I can tell you that the app is very smooth and easy to use, and for a hodler like me, the appreciation of BTC over time easily covers the fees. If BTC trades at over USD 100,000, then 1 BTC in the savings account earning 0.5% annual interest already pays half the cost!

The customer service is top-notch, too. Customers have a dedicated Account Manager, whom they can contact by email or chat on the app. If there is a security issue and a bad actor tries to take control of your account, the account manager will get on a call with you to verify your identity and take action to protect your account.

How to open an account

Opening an account is simple: Click here, and all you need is an ID or passport and a quick selfie. Personal information is verified using your mobile phone.

Referral program: Use this link or referral code XRP-HFF-MR and receive US$42 per month in BTC for 12 months. (To qualify each month, you must have an active paid membership and maintain a minimum of USD 5000 or its BTC equivalent balance in an eligible Xapo Bank account during the cycle)

Any questions?

I am a satisfied customer and have been using Xapo since 2017. Feel free to ask me anything in the replies or via the contact form.

If you have questions for Xapo Bank, check out the FAQs on the website and get in touch with them directly!

If you use the referral link/code to sign up as a member with Xapo Bank, I may receive a small commission, at no additional cost to you.

Top image by Be Ba from Pixabay

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.