I know I shouldn’t be posting about the guy everyone is sick of hearing about this week, but he’s proving hard to ignore.

I always argue that political changes have far less impact on asset markets than people expect, and I still believe that is true, but you have to hand it to the new Prez – he is pumping everything!

I write this following a highly enjoyable meet-up in Tokyo last night. We finished at a very responsible hour but I can’t say I am firing on all cylinders today – that’s the price of getting old. So, I will try to make this update as quick and painless as possible.

We all know about the flood of executive orders issued in the past few days. Trump sure loves a good fanfare. However, it was his online address to the World Economic Forum that caught my bleary eye this morning:

Trump said he would ask OPEC to lower the oil price and “with oil prices going down, I’ll demand that interest rates drop immediately,” adding that “likewise they should be dropping all over the world.”

Fed chair Jerome Powell will have something to say about that, of course, but it’s clear that Trump’s intention is for the US to lead global interest rates on a downward path. The S&P 500 reacted by notching its first all-time high close of 2025, rising +0.53% to $6,118.71.

Powell is not the type to be bullied and the Fed is actually signaling a slowdown in rate cuts this year as it awaits further economic data. However, the central bank is going to come under a lot of pressure to pave the way for higher asset prices.

Trump wants a booming stock market to brag about.

He wants higher crypto prices, too.

Last night he signed an executive order establishing the Presidential Working Group on Digital Asset Markets. Here are the main points:

- Secure America’s position as the world’s leader in the digital asset economy

- Create a federal regulatory framework for digital assets

- Prohibit the creation of a central bank digital currency

- Evaluate the potential of a strategic national digital asset stockpile

Hot on the heels of the executive order, the SEC rescinded the controversial SAB 121 accounting guidance, opening the door for banks to custody crypto assets. This one is bigger than many people realise, although it brings new risks as tradfi will surely make the same mistakes crypto lenders made last cycle – you shouldn’t dabble in under-collateralised fractional reserve lending on an asset you can’t print. But no doubt they will try!

The Bitcoin price whipsawed overnight, rising initially and then dumping in disappointment that the order did not explicitly mention Bitcoin or plans to acquire more Bitcoin. The most likely outcome seems to be that the government will hold onto existing crypto assets seized in legal proceedings.

My two cents: traders and Bitcoin maxis have become too fixated on the idea of the Strategic Bitcoin Reserve and are probably going to end up disappointed. However, the new administration’s appetite for clear regulation and openness is a huge positive for the industry. It is probably also going to provide a healthy level of support for the ongoing bull market. Too much good news all at once could easily have led to a Q1 blow-off top.

Let’s hope the shenanigans I wrote about earlier this week in Are you tired of winning yet? were a blip and the new admin will focus on the long-term health of the industry rather than pumping dumb stuff. I can’t say I’m convinced on that one…

Meanwhile in Japan

It’s BOJ day! Japan didn’t get the memo about cutting rates. No shocks this time as the Nikkei Shinbun was ahead of the decision to raise rates to 0.5%, the highest in 17 years. The BOJ expects wages to rise this year with inflation at around 2.5%. Real interest rates are expected to remain negative and policy is still largely accommodative.

The Japanese stock market is calm this afternoon but let’s give it a day or so before we judge the reaction. Part of me hopes for chaos next week and a chance to allocate the rest of my NISA with blood in the streets but I think I would prefer peace and quiet.

All roads lead to inflation?

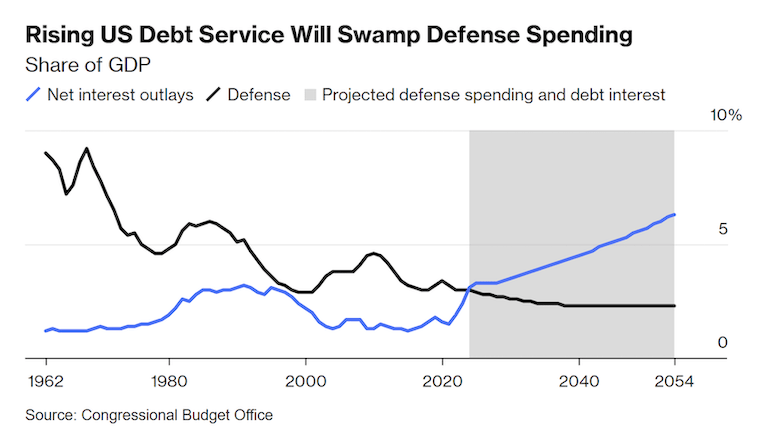

In the US, the Fed is cutting rates without first scoring a decisive victory over inflation. Trump’s tariffs, if enacted, are likely to be inflationary. The resurgence of inflation appears to pose the biggest risk to markets this year.

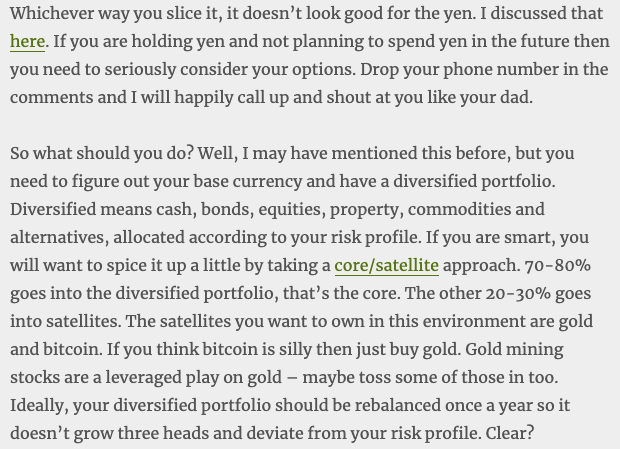

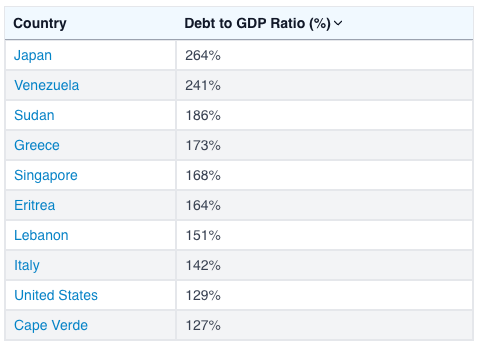

With debt to GDP at 263% and little chance of growing out of the hole, Japan seems destined for higher inflation. It’s going to be tough for the BOJ to raise rates high enough to prevent this outcome and the weak yen will only accelerate price rises. JPY cash remains a bad place to hang around for too long.

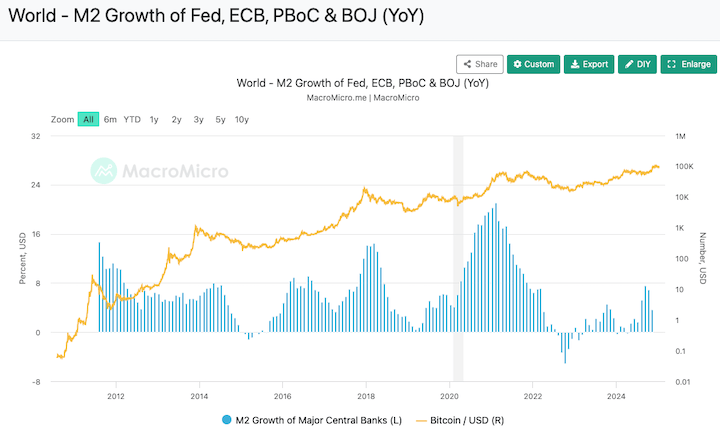

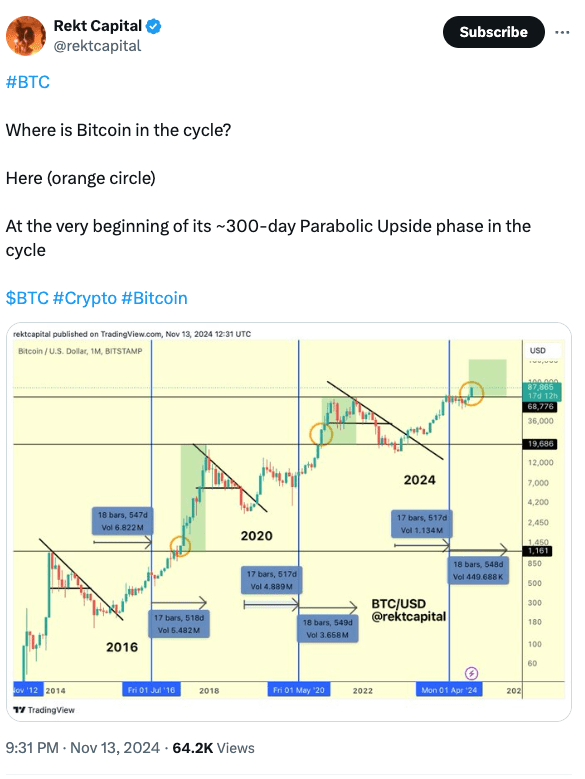

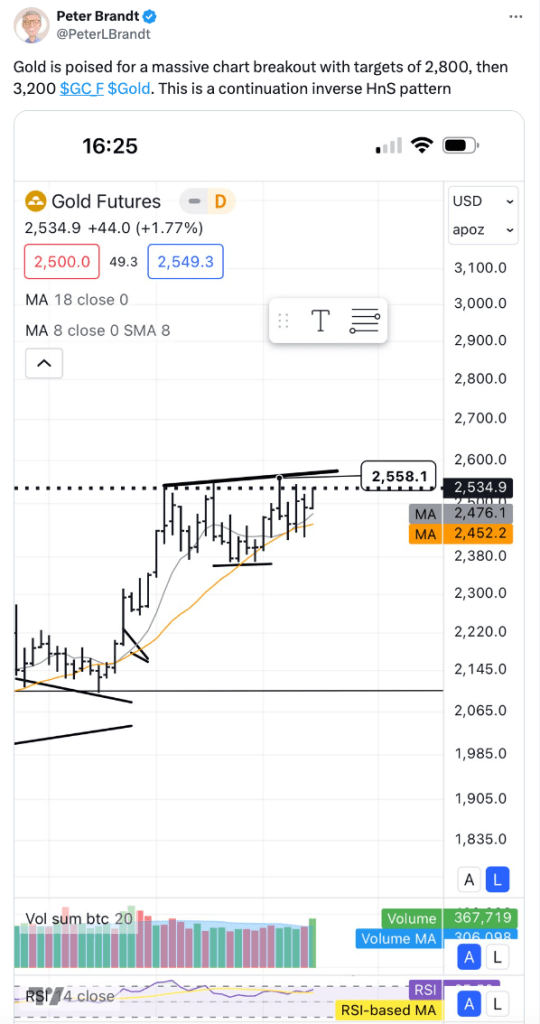

I covered the four assets to own to face inflation back in late October and I don’t see any change there. Bitcoin, commodities, gold and tech stocks remain the best plays. If you don’t own Bitcoin already, I would caution jumping in at this point in the bull market. I don’t know what innings we are in but it’s certainly not early. If you own it and are planning to exit this year, we are approaching the time to begin averaging out. I sold around a third of my Metaplanet holding just before the inauguration as expectations of something special from Trump drove it close to ¥5,000. Euphoria and hopium should be sold more and more aggressively in my opinion.

The last word on Trump: he loves to brag about stock market performance as proof he’s doing a great job and has even started taking credit for the Bitcoin price. I wouldn’t bet against US stocks and BTC this year while he is in the driver’s seat.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.