Happy New Year, everyone! Welcome to the year of the snake. Just as we get back in the swing of things, a three-day holiday lies ahead. I watched the news last night and was reliably informed for 20 continuous minutes that it is snowing in the places where it always snows at this time of year. It’s nice when things go to plan, huh?

If you enjoy winter sports, it looks like a great season for it!

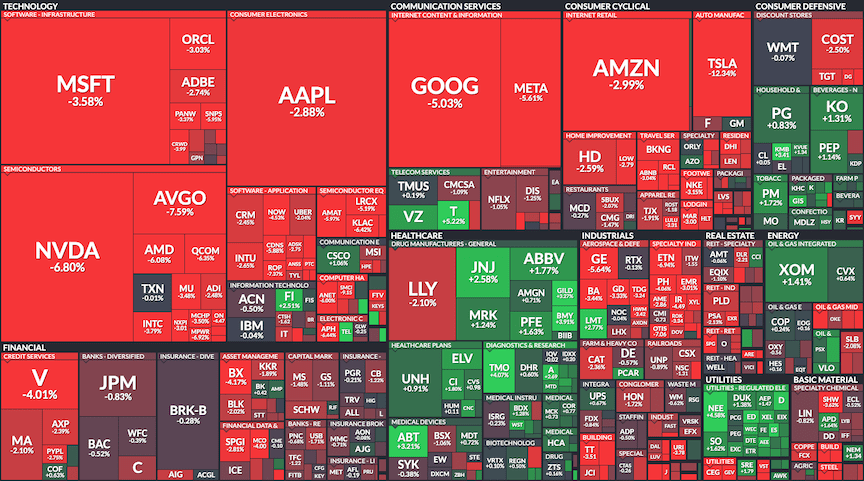

It would be nice if the investment climate was equally predictable, but alas, it’s complicated. In many ways, 2024 was smoother than expected. Global stocks gained around 19%, led by the Magnificent Seven and the hype around the AI trade. Japanese stocks kept pace well, although gains were concentrated in the first half of the year and things got a little scary for a minute there in August!

I had a look back and over the year I wrote 26 posts, covering the usual financial planning and asset allocation stuff along with macro views, currency, stocks to watch, crypto, AI, quantum computing and more. I hope it kept you entertained and maybe provided some actionable ideas. I plan more of the same in 2025, with the focus remaining on action. There’s already far too much information out there and the key for me is uncovering what we can actually do with it.

January is prime NISA allocation season and I’m sure many of you are already getting your accounts organised. If you are a ‘keep it simple’ type and have already completed this task, I salute you! Just like the gym, most of the battle is simply showing up and getting stuff done.

If you haven’t started yet, here are some things to consider:

Consensus views

So what is the forecast for 2025? The Bloomberg Outlook is always an interesting read. In short, the ‘experts’ are calling for more of the same: a strong US economy, a continued AI-led boom, albeit with a slightly tempered outlook on stocks.

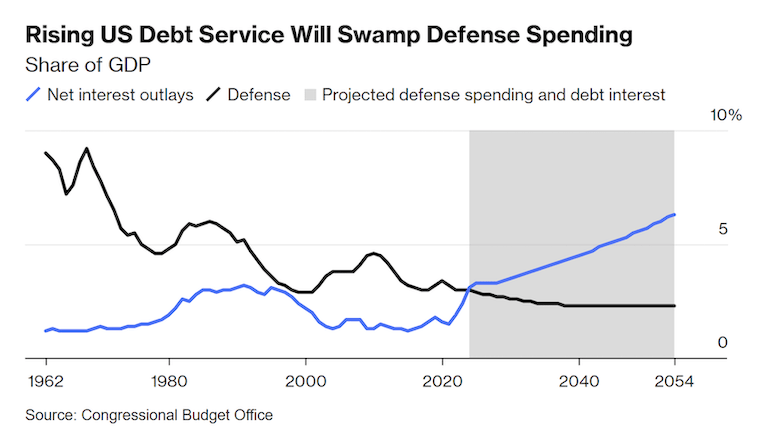

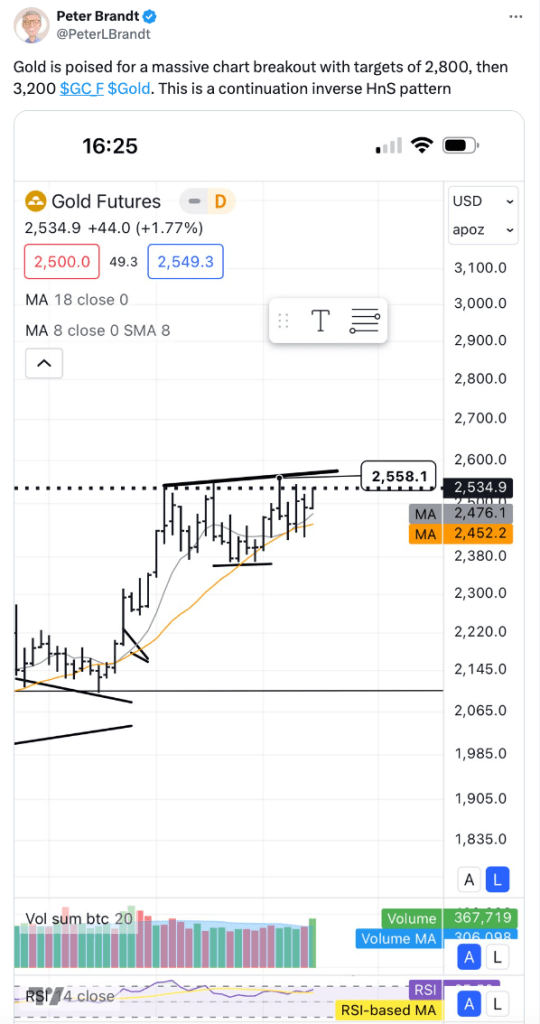

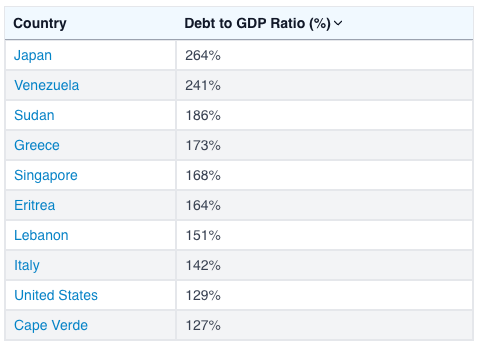

Smart consensus sees US interest rates continuing lower, a weaker dollar, gold higher, and oil lower, with a mild stock market correction likely, but no bear market. Simple enough!

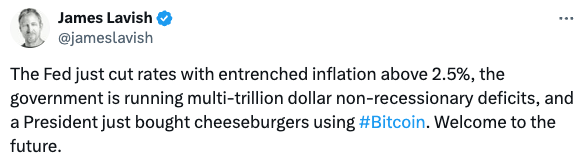

The potential spanner in the works is inflation reigniting as you know who takes office in the US. For what it’s worth, I think a lot of Trump’s tariff talk is bluffing/negotiating but we will know more in a few weeks. All bets are off if he invades Greenland lol! The inflation risk is a more pressing concern. You may have noticed how slightly stronger PMI data sent rate-cut expectations plummeting earlier this week. The market is near all-time highs, yet ultra-sensitive to the rates higher-for-longer narrative.

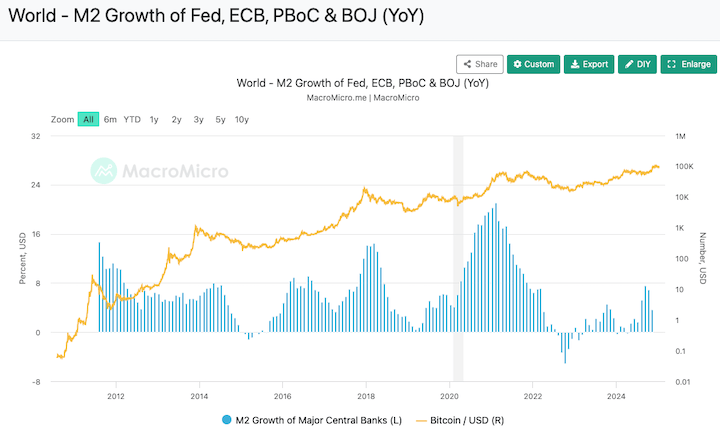

Liquidity drives markets. How high will risk assets go? Well, that probably depends on the money supply more than anything else.

Bubble watch

Getting away from the consensus views, this morning I found legendary investor Howard Marks writing about bubbles – his memo here is worth a read.

If you want to skip to the Tldr and know where the potential bubble could be, get a load of this:

So much for Mr & Mrs Watanabe being conservative. In my experience, the average ‘balanced’ Japanese investor has half of their money in the bank and the other half in whatever went up the most last year. And they are buying this with a weak yen???

So, how about Japanese stocks?

Global asset allocators that I pay attention to are still overweight Japan. And why not with USD/JPY at ¥158! There are many positives here in the land of snow in winter, with companies expected to post record profits for the 5th year straight. On average, wages increased +5.1% in 2024 and are expected to rise again this year, which is good news for consumer spending. The question is whether the hikes will keep pace with inflation. Remember, real wages have been down only over the last three years…

Still, there are several good reasons to own Japanese stocks: the TSE has successfully pushed companies to enhance returns for investors, resulting in a marked increase in dividends and buybacks. Companies also continue to unwind cross shareholdings.

Of course, the elephant in the room is the Bank of Japan. Having skipped a December rate hike, the BOJ is poised to continue its efforts to ‘normalise’ in 2025. In true Galapagos fashion, Japan boasts the only developed-world central bank trying to tighten policy this year. If you’re looking for a potential wrecking ball, look no further. A sharp upward move in the yen would severely curtail exporters’ profit. Not to mention the whole carry trade unwind thing. (oh, another elephant!)

On the other hand, banks will benefit from rising interest rates due to improved margins on their loan business. Homeowners won’t enjoy that one so much.

With demand for electric vehicles and smartphones flattening, the semiconductor sector will rely heavily on AI growth. A lot is riding on the rise of the machines.

All in all, though, the outlook is constructive for Japanese equities.

Time for some action!

Ok, I promised some action points. Obviously, I can’t give broad advice here, but this is how I am organising NISA this year:

- Tsumitate is set and forget. I’m at 40% JPX 400, 30% All Country, 30% NASDAQ

- Growth – I allocated about a third this week and plan to allocate the rest in the next week or two

- I am leaning toward a much broader ETF allocation this year rather than trying to pick stocks. The last two years have been too easy – you could just throw darts and the stocks you hit would go up. I’m not convinced it will be so simple this year

- At ¥158 to the dollar, I will keep a sizeable allocation to Japanese stocks. 1489 High Dividend is a favourite of mine and I also like the 1624 Machinery ETF

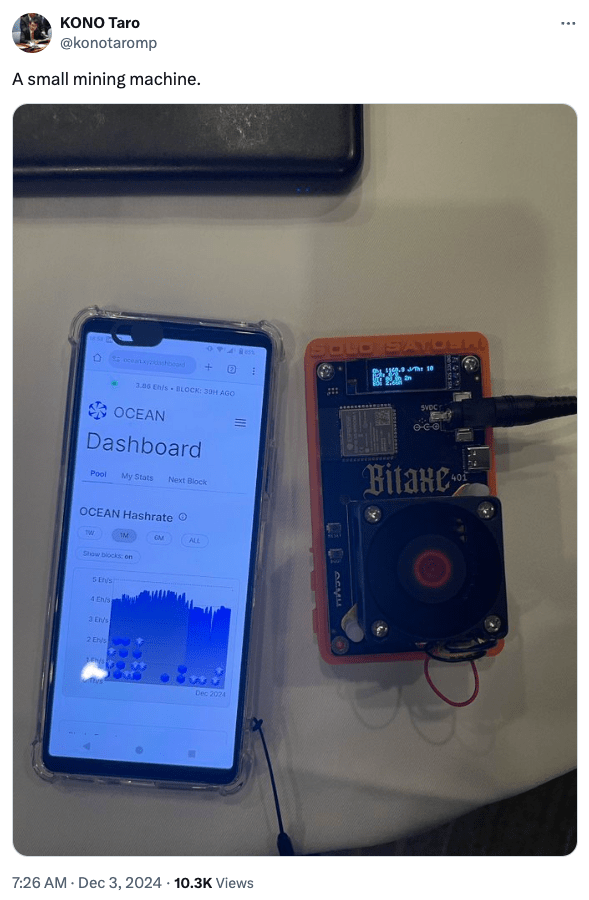

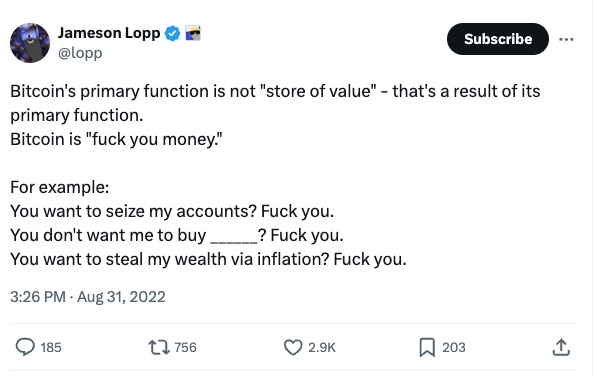

Can we forget about Bitcoin now?

Bitcoin has crashed to $93,000. These are desperate times!

If you are new to crypto, allow me to remind you that -30% dips are normal in a bull market. We had a -50% dump right in the middle of 2021. You get used to it, kind of…

If anything, the drawdowns have been mild so far. Unless you own Alts – those dips sting!

If you own crypto, I can’t stress this enough: the best thing you can do is go to sleep for about 3 months. Block out the noise.

I think we are all aware that 90% of what the orange man says is hot air, so if you are relying on the President-elect to send your bags higher, you may be disappointed. However, make no mistake, the new administration in the US is massively crypto-friendly compared to that of the outgoing dinosaur dude. It will be a factor.

The best indicator is right here – keep an eye on it: (chart from MacroMicro)

Money supply has just taken a dip of its own, hence the market reaction. However, it won’t stay down for long. Unless inflation really runs wild, conditions will loosen.

You may think I am nuts. A year ago I wrote The Investment Case for Bitcoin with the price at just under $40,000. Some guy on Facebook called me a scammer and proceeded to spout a bunch of talking points I recognised from mainstream media circa 2017. These people are everywhere and they are brimming with confidence. I wonder if he has any other assets he thinks we should avoid?

Currently, sentiment is remarkably bad for $93k. ‘Crypto influencers’ are stressing over every dip. When we reach the top, these same people will tell you that dips are mathematically impossible and we are going up forever. Welcome to magic internet money musical chairs!

Long term, it’s going way higher than you think against Fiat. Don’t sweat it if you fail to execute a perfect dismount from the bull. Just don’t FOMO in money you can’t afford to sit on for a few more years.

If you haven’t subscribed, feel free to do so to get my posts by email. If you need help, please check out the coaching link, and follow me on X for jokes and details of Tokyo meetups.

I wish you all the best for the year ahead. Let’s make it a sensational one!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.