Yes, on 20 January, Donald J. Trump will be sworn in as the 47th President of the United States of America. The orange man is expected to unleash a flurry of executive orders on day one. We’re talking about deportations, tariffs, and maybe, just maybe, some crypto-related announcements.

If you were holding out for an executive order to create a strategic Bitcoin reserve, I don’t quite know what to tell you. In classic Trump style, the first crypto president has spectacularly missed the point and befuddled the market with a ‘winning’ combination of grift and incompetence.

Where to begin? Over the weekend, whilst holding a black tie pre-inauguration crypto ball, the Trump team decided to launch a $TRUMP meme coin. Traders and degens scrambled to verify if it was official and when they did, the new coin went from zero to around $14 billion market cap in 7 hours.

People got rich. One of those people being the man himself, whose team owns 80%+ of the supply. The potential for a rug pull did not deter traders and the coin looked poised to continue its rise. And then, a truly crazy thing happened.

They released another meme coin.

Early this morning, news began circling of the launch of $MELANIA. Before long, Trump himself reposted the announcement. I bet you can’t guess what happened?

Yes, the minute the market realised the Melania coin was real, they dumped the Trump coin in droves to hop on the next train, sending $TRUMP crashing from around $72 back to $40. They also managed to overload the Solana blockchain to the point where it could no longer cope and chaos ensued as people struggled to get their money out of one ridiculous shitcoin and into the other.

I learned a new term today: grift dilution. That’s where you release a second grift, right on the heels of the first one, and it diminishes the impact of the first grift without creating any more profit via the new one.

Talk about snatching ‘it’s so over’ from the jaws of ‘we’re so back’…

The initial Trump coin had already sucked the liquidity out of all altcoins except Solana. The Melania coin managed to knock over Solana and even caused Bitcoin to dump about 6% in one candle.

Magnificent! And tomorrow the real chaos begins!

To add insult to injury, Trump’s World Liberty Financial purchased around $48 million of Ethereum (for whatever stunt they are planning to pull next, no doubt) and the price of ETH, wait for it…, did not move at all!

Cursed that coin is.

I know what you’re thinking: isn’t releasing meme coins with massive rug potential right before taking the highest office in the land kind of, well you know…criminal? But never fear, because the new administration is replacing all the top dogs at the SEC with their own people.

Not that anyone in crypto is sad to see Gary Gensler head out of the door. But somehow I can’t imagine that David Sacks, the new crypto czar, would have been prepared for this level of insanity. Who knows, though?

I write this with full knowledge that people outside crypto probably don’t even know any of this happened and are just going about their Monday. Metaplanet (3350) just made another all-time high today as investors pile in hoping that Trump will announce something monumental related to Bitcoin overnight. While he may do so, he could of course just launch a $BARRON meme coin instead.

It’s going to be a weird four years…

As I edit this hasty missive, I see that $TRUMP is back at around $58 a coin, which is approximately $11.6 billion market cap. $MELANIA is at $1.7 billion. So maybe it is a successful grift after all? The mind boggles.

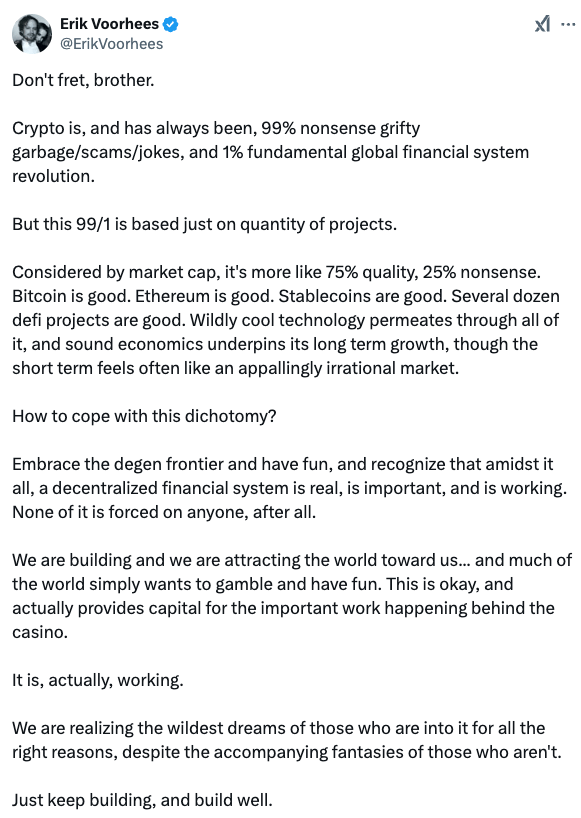

Before we all get too down on crypto, OG Eric Voorhees actually explained things rather well in this post:

Amen to that. Take care out there, folks!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.