Chaos by Christmas? I do like a bit of alliteration, but this doesn’t sound good.

That nifty little turn of phrase came in a message from a friend. He’s been concerned about the way things look for a while, even as markets melted up following the Liberation Day debacle. The chaos message was timely, as I was already working on this post.

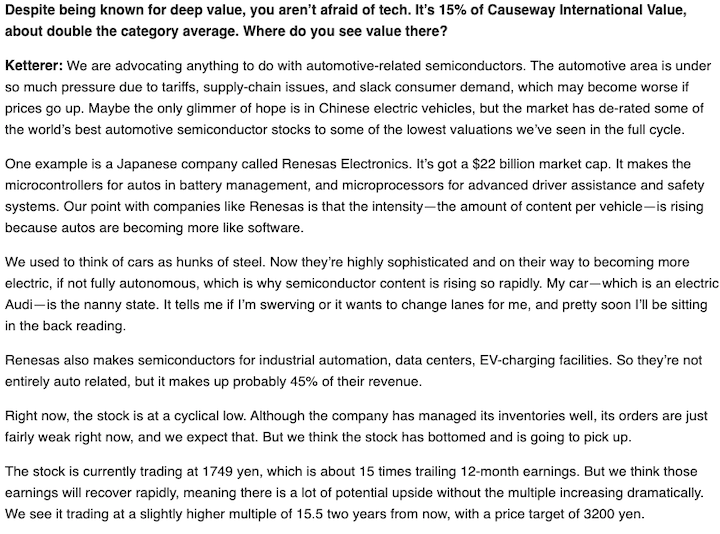

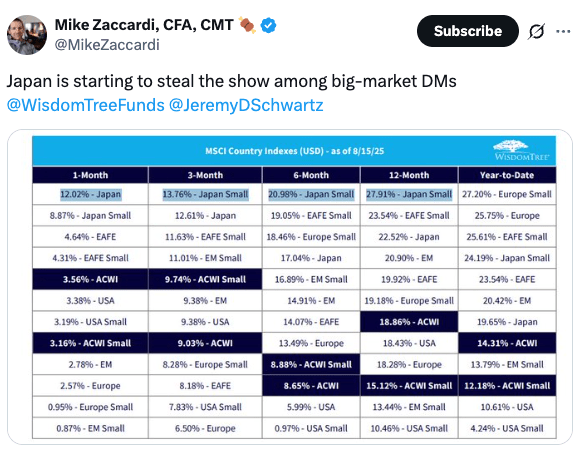

Exhibit A: Wall Street’s New Obsession? Japan’s Market Just Went Vertical – a short article about foreign investors returning to Japan in size. The Nikkei 225 is at real deal all-time highs. You see the latest price on the news each night. Is there perhaps a little euphoria creeping in?

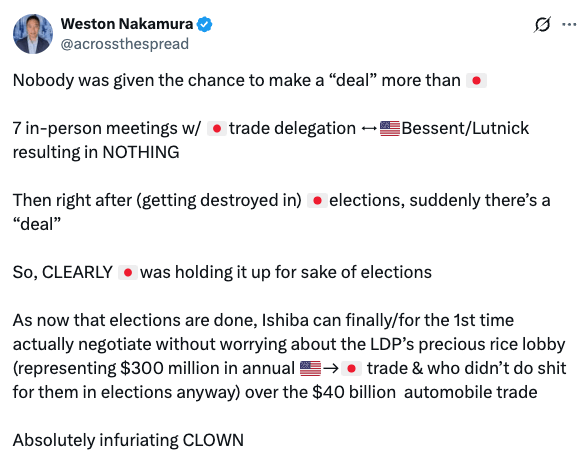

Expectations are high. The Fed is supposedly going to ease in September. The BOJ seems to be due to hike. But will they? Federal Reserve Chair Jerome Powell is set to speak at Jackson Hole this week, but I doubt he will give much away. He has been under considerable pressure from the Trump administration to cut rates and has held firm so far. There are signs of cracks in the job market, but does JPow really have enough data to justify a cut? We’ll see, but I’m sceptical.

The same goes for the BOJ. Pressure is also coming on Governor Ueda from the US administration. Does the central bank feel certain enough about the inflation outlook and tariff outcome to take the plunge? One thing is certain: if the BOJ is going to hike, it will be leaked ahead of time. No one wants a surprise like this time last year. If you don’t hear anything in the days before, expect no action.

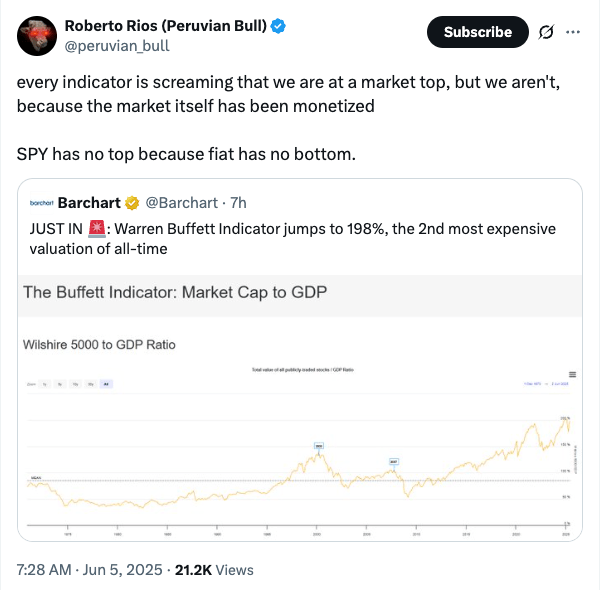

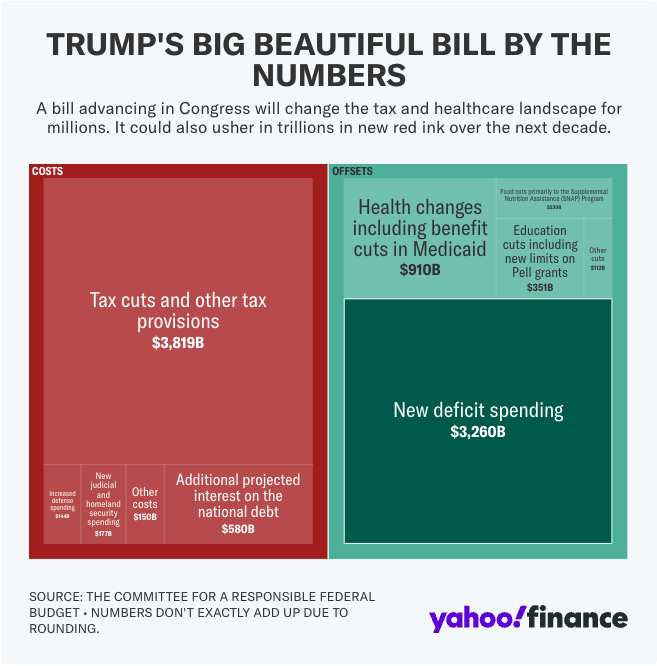

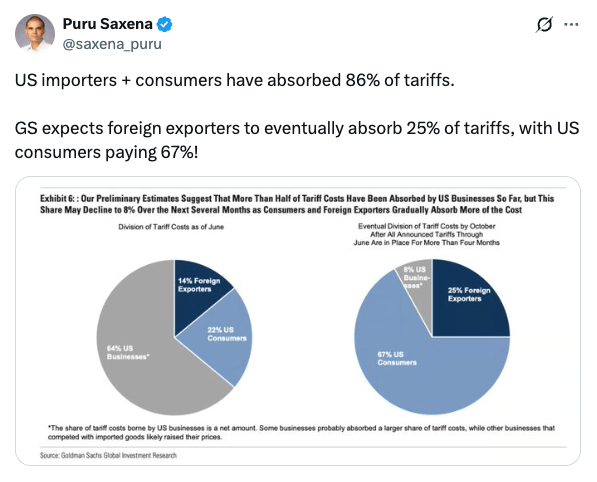

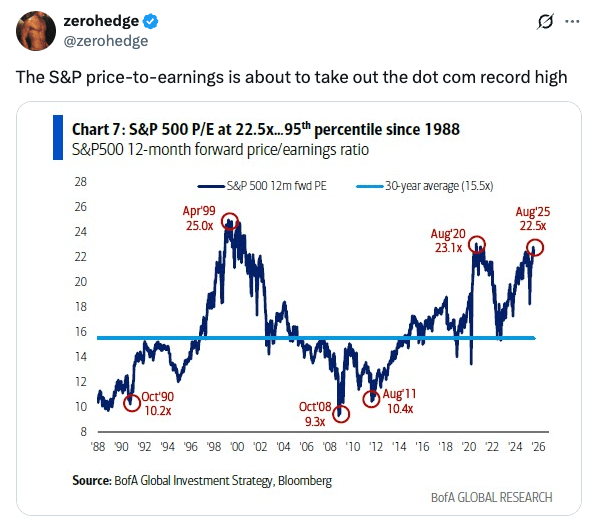

In the US, the S&P 500 is also pushing all-time highs, driven as ever by the Magnificent 7 tech stocks, which are driven in turn by the AI boom. Despite the furore over job numbers, the consumer seems to be doing ok on the face of things. However, the tariffs are yet to show up meaningfully in the data. Expect that to change soon.

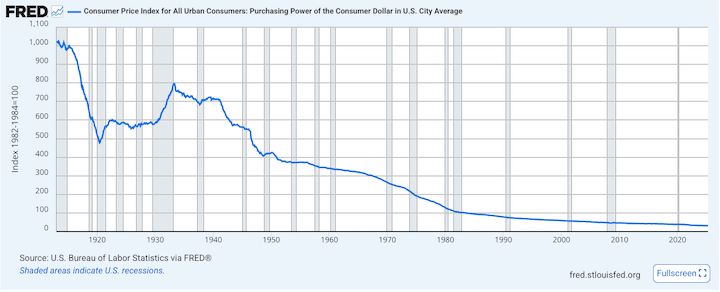

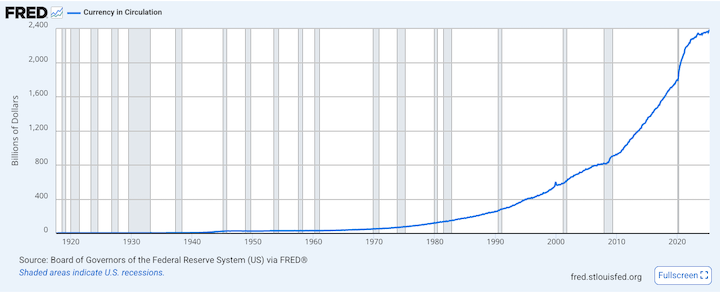

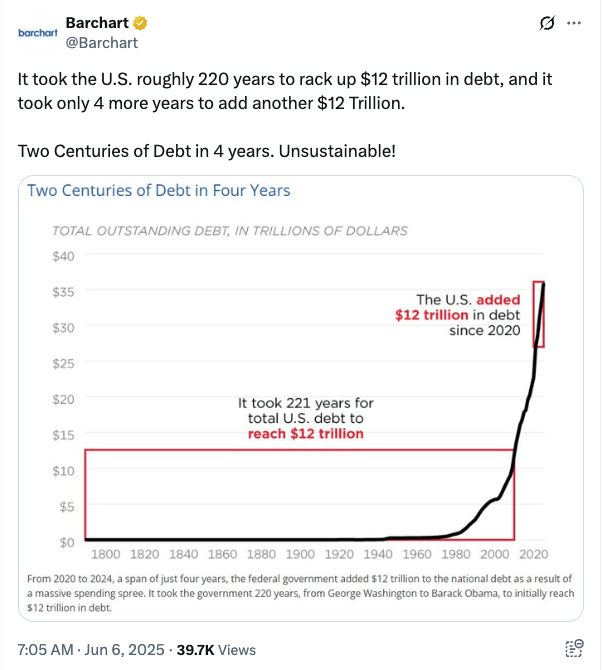

Where are the Robin Hood gamblers going to get their funds from when their cost of living keeps rising? Cash handouts from Trump? You can’t write anything off these days…

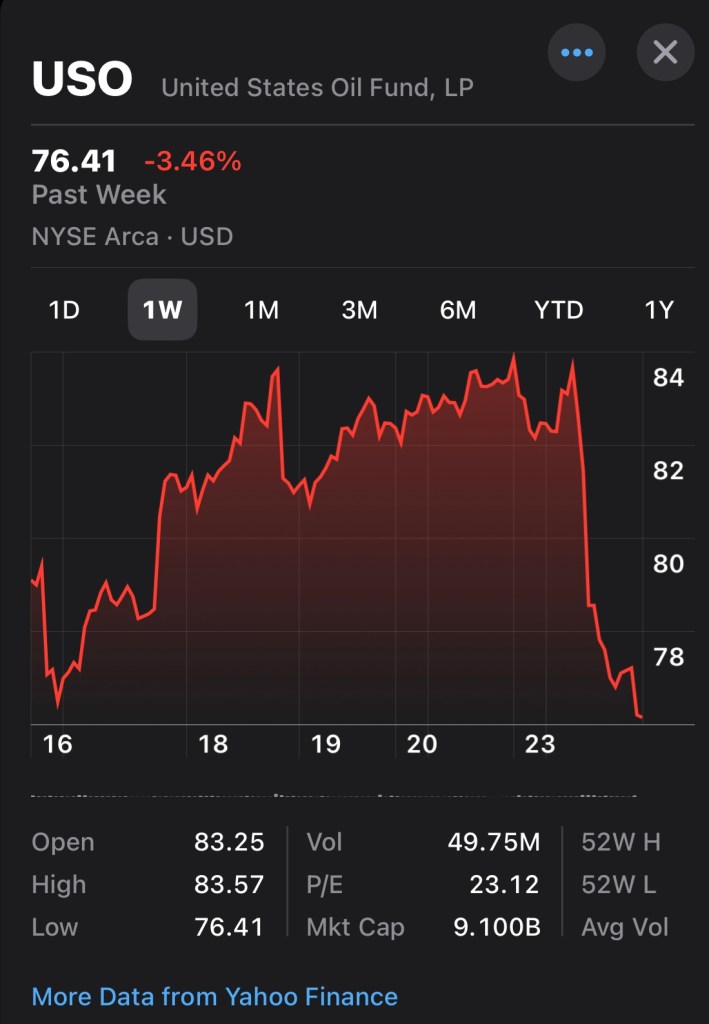

It’s not just eggs that have gotten expensive:

The final innings for crypto?

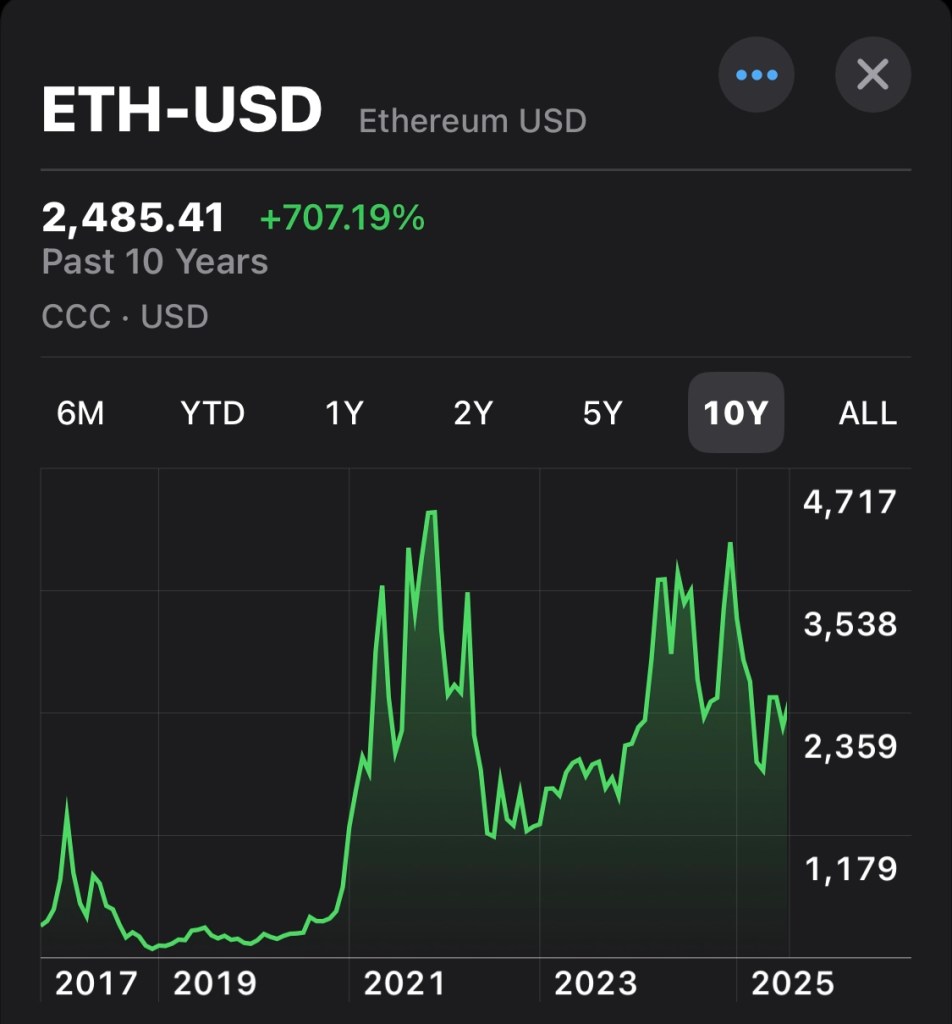

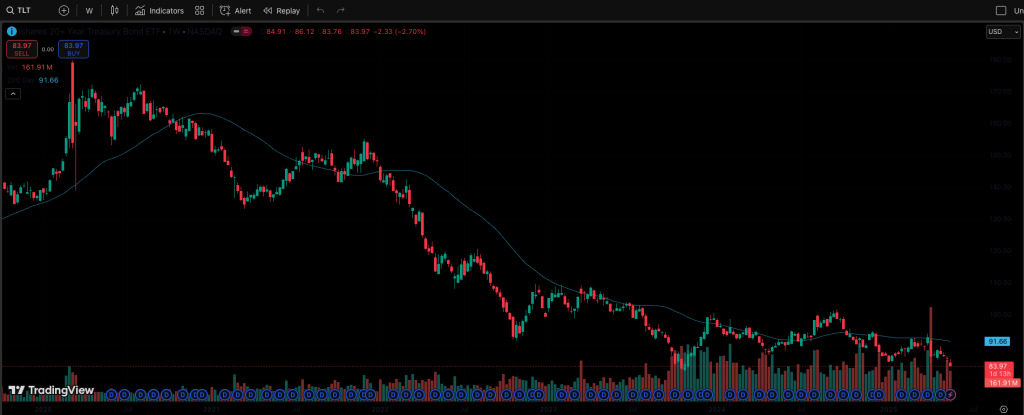

Bitcoin topped $124k last week and has now ‘crashed’ to $113k. Ethereum went on quite a run and got the crypto bros fired up about the alt season they’ve been waiting for. If history is anything to go by, then the next couple of months should mark the top of this cycle. I have no idea where it goes in that short time, but you should probably block out the people calling for $200k by the end of the year. $120k was my best guess, and we have done that. Maybe there’s a little more left in the tank, but who knows? When it feels euphoric, that’s the signal. The fear and greed index shows fear, so I’m not feeling it yet…

What to do?

Expecting a bit of chaos and doing something about it are two different things. And maybe there is no need to do anything other than just mentally brace for a correction. After all, prolonged bear markets are illegal these days. (I jest, kind of. See: It’s going up forever, Laura)

Let’s do Japan first:

I have thoroughly enjoyed the interaction on X between investors in Japanese stocks over the last few years. What a glorious time to be invested in this market! Japan has clearly turned a corner, both in terms of putting the bubble-era all-time high behind us and making strides in corporate governance. But at ¥43,000 in August, things feel a little hot. I don’t think there’s reason to panic and dump your J-stonks, but with almost everything going up, it’s perhaps time to take a look at holdings that you might have got a little lucky with.

For me, that means going through my list and asking myself some basic questions: Why do I own this? Am I happy to hold it through a storm? My Japan account holdings now span two pages. I think I may have a few too many stocks. For some of them, I don’t really remember why I bought them in the first place. Would I buy them again now?

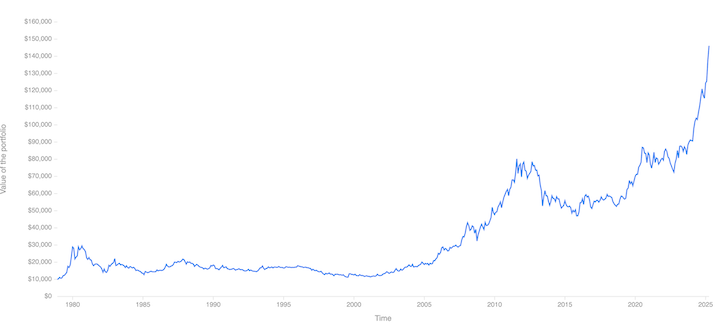

The majority of my holdings were bought for the dividends. That’s my way of keeping up with inflation and currency debasement in yen. I actually didn’t expect them to go up this much. I’m pretty comfortable keeping them and collecting my dividends through whatever may be on the horizon. NISA I won’t touch at all – that was all bought for a long-term hold.

I would like to get my holdings back to one page and a bit more dry powder in the cash account.

How about other markets?

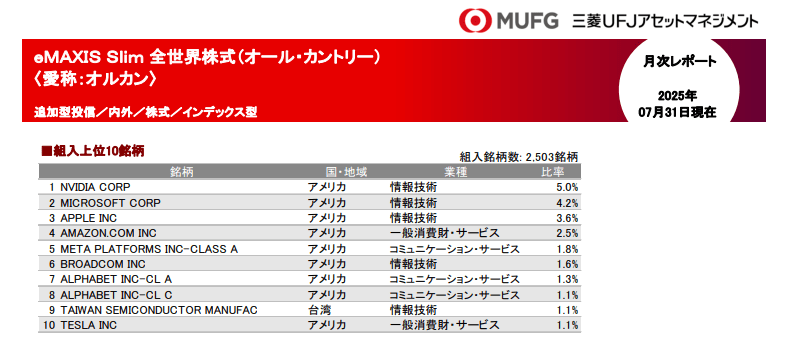

You may own a bit of everything in your All Country fund, but performance has really been driven by tech stocks. Here are your top 10 holdings:

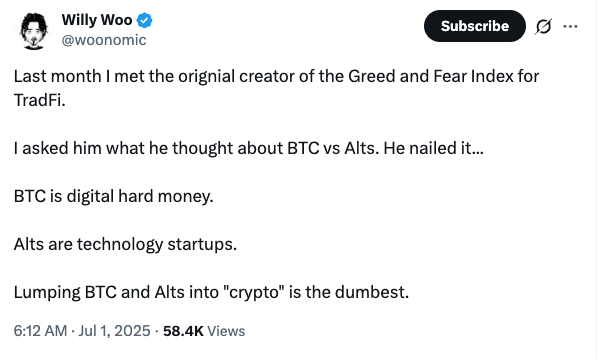

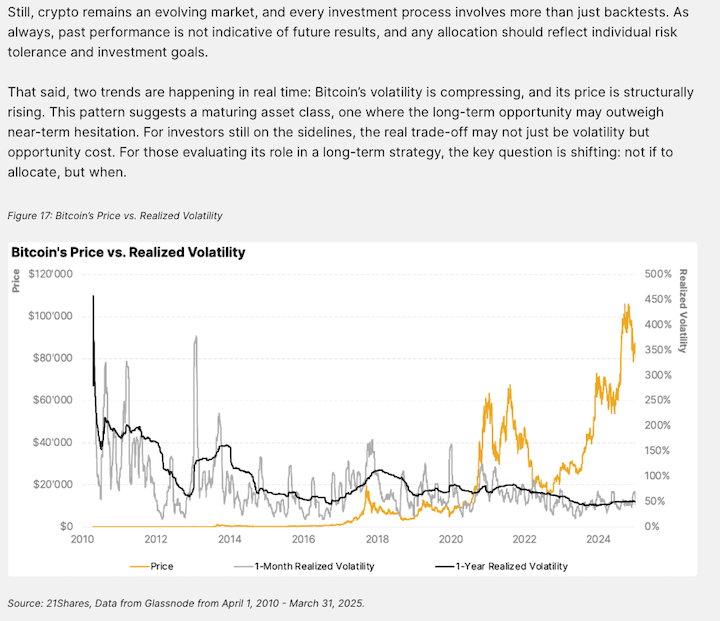

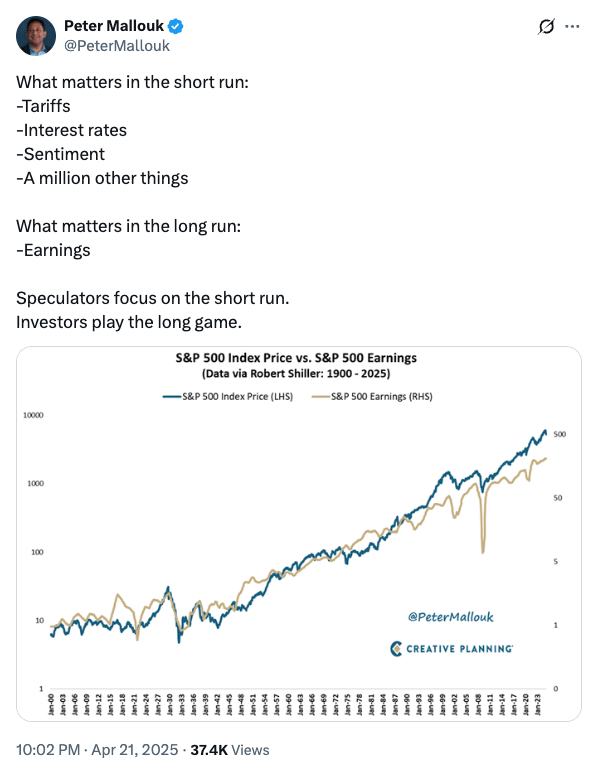

Is tech dominance going to ease? Bank of America thinks so. You may know from my previous posts that I believe that tech stocks and Bitcoin are the two assets that will reliably outperform currency debasement. Are they due for a correction? Maybe. Is the AI bubble going to burst? Probably, but what do we mean by ‘burst’? The AI genie is out of the bottle. It’s not going away. The world will continue to hunger for more computing power. I don’t feel like selling any of this stuff, but I would like to have some dry powder to buy more when there’s a panic.

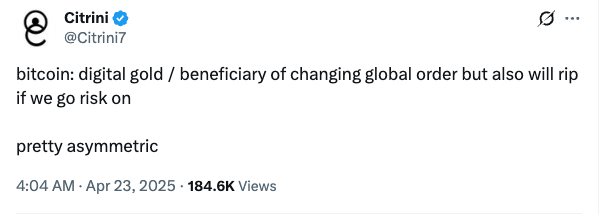

Got it, but we sell all the crypto, right?

I have said before, you need to have a plan for crypto and execute as best as you can. It gets harder the higher the level of euphoria.

My two cents: I’m not sold on the idea of dumping actual Bitcoin in order to buy it back cheaper. It comes with its own risks: the treasury companies and BlackRock suitcoiners want as much as they can lay their hands on. I don’t want to sell to them and then struggle to get it back later. Plus, the tax reporting is a pain!

ETFs are not Bitcoin; they are Bitcoin exposure. They can go. The treasury companies are probably going to be the FTX/Luna of this cycle – beware. Alts are struggling to attract enough attention and money in the middle of a bull market – you don’t want them hanging around your neck next year when everyone is depressed. (see my February post, Exit liquidity)

Chaos by Christmas? Maybe.

I would love a bit more euphoria first, though…

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.