It’s been a long week. Is it me, or are +/-9% swings on the Nikkei 225 index starting to feel normal? Traders must be loving this – at least the good ones.

I’m not so impressed. Of course, there are buying opportunities, but it gets a bit tiresome when markets swing this wildly based on the pronouncements of one guy who just can’t STFU for 5 minutes.

Click it, I dare you! And don’t get me started with the Simpsons memes.

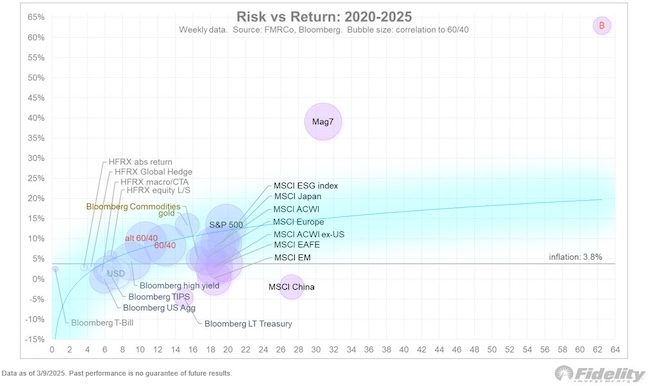

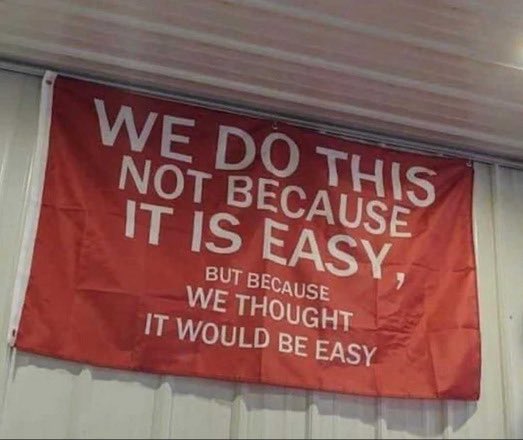

Where was I? Tapping the sign, right. The free lunch quote has been attributed to Harry Markowitz, although I have heard Ray Dalio say something similar. It’s a drum I have been banging for years, sometimes with minimal effect.

When the stock market is going up, nobody cares about diversification. Why would I want to own bonds and gold and other stuff when stocks are on a tear? Just buy the index and chill, right? It’s easy to forget that stocks take the stairs up and the elevator down.

Until you get a reminder.

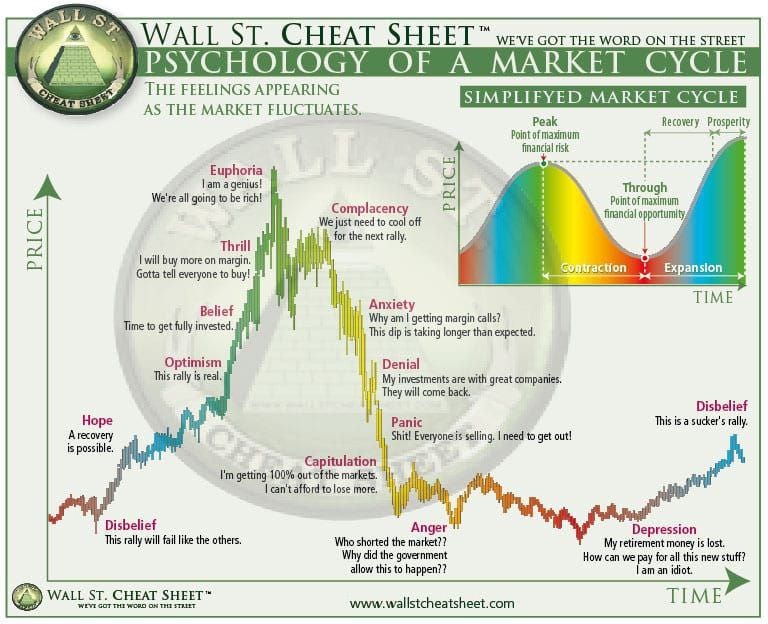

In 2002, psychologist Daniel Kahneman won the Nobel Memorial Prize in Economic Sciences for his work on the psychology of judgement and decision making. Kahneman points out that individuals are more depressed with investment losses than they are satisfied with equivalent returns. In other words, people hate losing money considerably more than they like making money.

Big liquidation events are like waking up after a party. It was fun, but now it’s time to sober up and review your time horizon, risk profile and asset allocation.

Are you diversified enough?

If recent events haven’t troubled you, and you have barely looked at your investments, the answer to this question is probably yes. Carry on!

If things have been a little nervy, then maybe you were over-exposed.

Don’t get me wrong, I’m all for buying stock indices and holding them forever. It’s not a bad strategy, as long as you can stomach the downturns. And as long as you don’t need the money soon. And, it’s not like a diversified portfolio doesn’t go down in times like these either. When panic sets in, people will sell anything they can get their hands on, but pretty soon you will see a flight to safety.

An underappreciated aspect of diversification is the opportunity to tactically rebalance and take advantage of market events. I sold some of a gold ETF this week near all-time highs and bought stocks while everyone was puking them. I didn’t need dry powder. Just a little reallocation.

You can’t do that if you don’t own the gold in the first place. You have to find more cash.

A quick thought experiment

If you are reasonably young and earning good money, then the recent market gyrations are just a blip, but do me a favour: imagine you are 65 years old, about to retire, with a nice fat nest egg invested in the MSCI World Stock index.

And the market dumps 20% in a couple of days. It takes a breather over the weekend and then resumes dumping in earnest. 30% of your retirement pot is gone. Financial media is screaming about recession, trade war, deleveraging or whatever it is this time. Remember in March 2020, when the market crashed and we faced the reality that the entire world was about to shut down? The doomer economists are running victory laps, and the market looks like it is never coming back from this.

How do you feel?

Remember that feeling when you are making future investment decisions, especially as you get closer to spending the money.

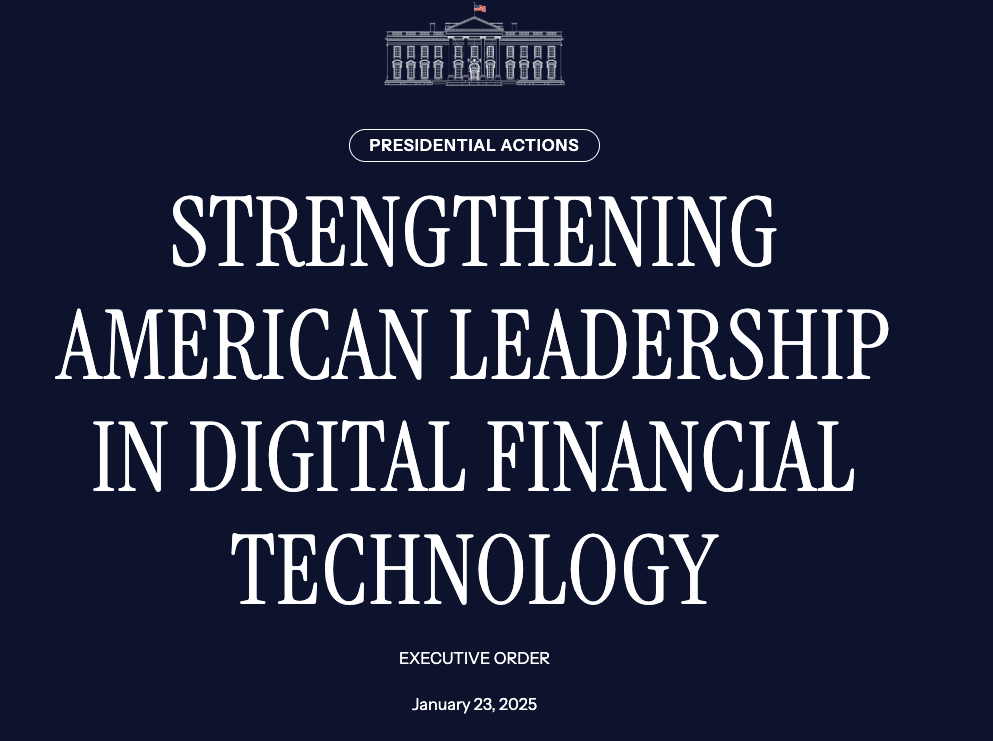

Of course, what happened after March 2020 was that central banks slashed interest rates and unleashed a tidal wave of stimulus, and the markets came roaring back before the year was even over. But that type of thing comes at a cost – that’s why your hard-earned cash doesn’t buy as much stuff any more…

Ok, so how do we do this diversification thing?

There are various ways to get yourself a diversified portfolio. How hands-on do you want to be?

For the people who want to put as little effort as possible into it, you can simply buy multi-asset ‘balanced’ mutual funds. I recently came across a collection of Japanese funds that are divided up by age group: “Happy Aging 40”, “Happy Aging 50”, “Happy Aging 60”. The allocations get more conservative the higher the age. These types of funds are available everywhere. Simply dump your money into the fund that fits your time horizon and get back to whatever you’d rather be doing.

In my advisory business, for larger chunks of money, I recommend professionally managed investment portfolios fitted to the client’s base currency and risk profile. Yes, they cost more than an ETF, but they are incredibly well diversified. The asset allocation is reviewed annually, and every quarter the managers implement a ‘tactical overlay’ and buy more of the assets they like and sell some of those they don’t. These guys don’t just buy a broad stock index – they are breaking equity holdings down by style: value, growth, small/large cap, etc. Of course, the entire portfolio is rebalanced annually.

I also recommend a core/satellite approach for even broader diversification. That’s how you slot in the algorithmic trend following strategy that trades stocks, interest rates, currencies, metals and other commodities with very little correlation to any one market. Funnily enough, it likes volatile times like this.

For coaching clients, I take the knowledge I have gained from watching professional money managers and help them develop their own asset allocation using low-cost ETFs. Click the coaching link to find out more.

Keep it simple

Here are a few action points if you want to take on this job yourself:

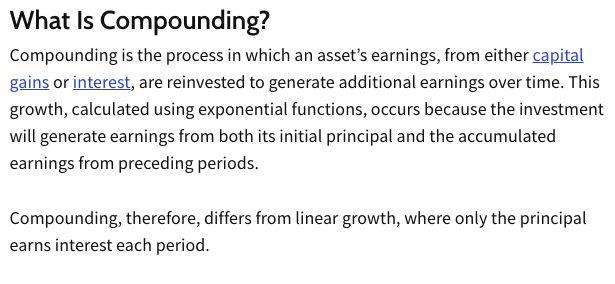

Separate regular and lump sum money. Regular is the money you invest every month in a pension, savings plan or Tsumitate NISA. If you are relatively young, you can just allocate all of this to stock indices/funds. Let Dollar Cost Averaging do the work for you.

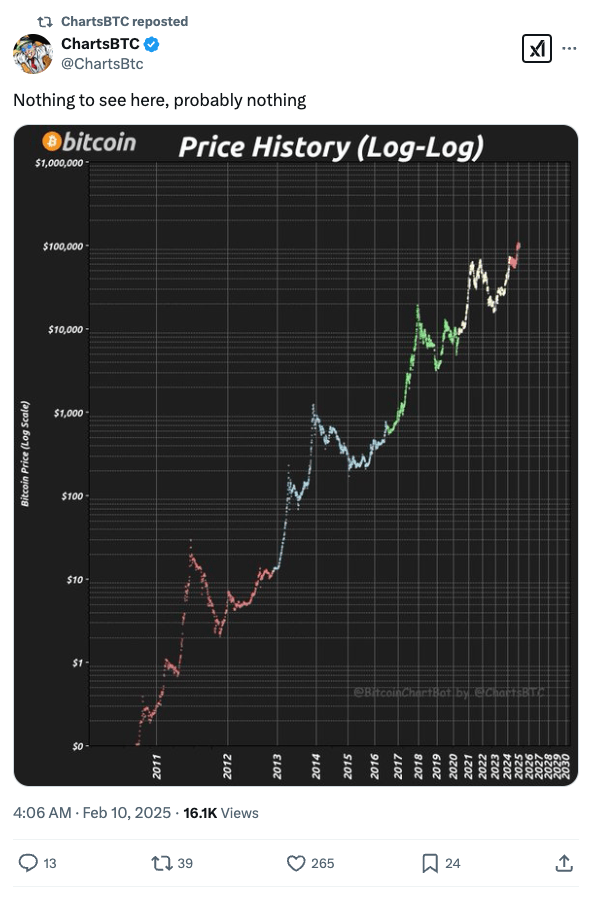

Lump sum money is a chunk of cash you have saved up that you are looking for a better return on. Here, you are going to want more diversification, and you should focus on the currency you are most likely to spend the money in (your base currency). The asset classes you want to look at are: cash, domestic (base currency) bonds, overseas bonds, domestic stocks, overseas stocks, property, and commodities. Hold more stocks if you are young, and more bonds and cash if you plan to spend the money soon. Allocate 70-80% of the lump sum to this broad portfolio, and the remainder can go into satellite holdings to beef up the areas you are most bullish on. For example, if you like Bitcoin, that’s a great satellite holding.

I have written plenty about base currency, asset allocation and core/satellite in the past. Feel free to take a look at earlier posts.

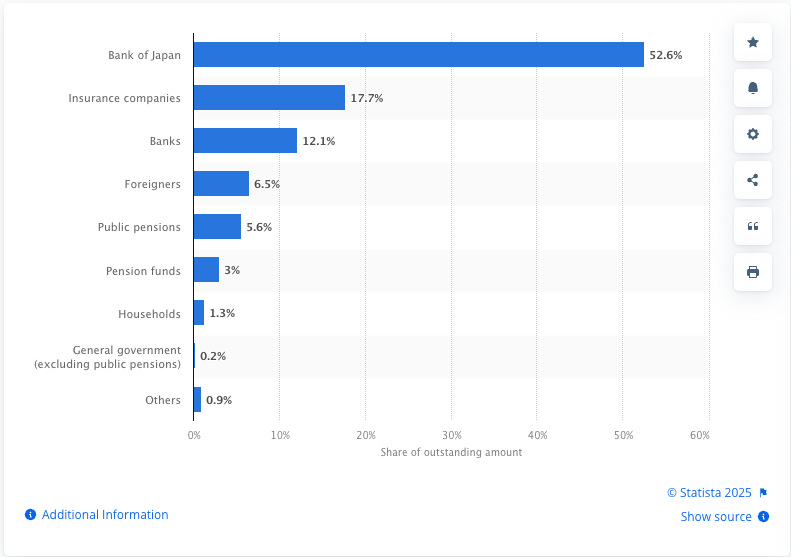

If you are gonna get really serious though, you are going to want to diversify your bonds.

Peace out!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.