The American people have spoken, and it’s about goddamn time! We may argue about politics but I think there’s one thing we can all agree on: there is no need for a presidential election campaign to take all year. Can’t you just get it over with in a month or so?

You have likely already had your fill of election hot takes, so I will spare you mine. I will, however, use this post to explore what the result could mean for our investments over the weeks and months to come.

Risk on, for now at least…

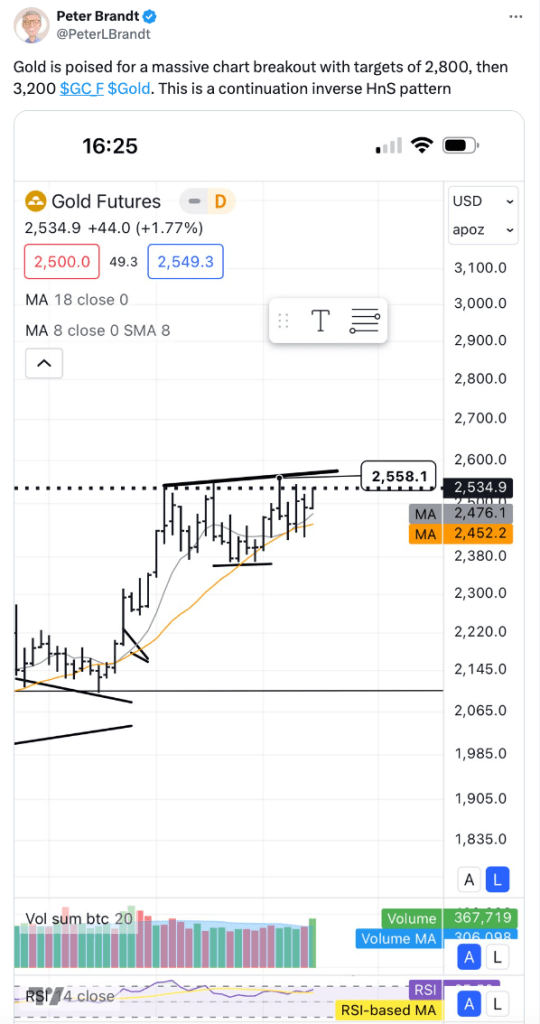

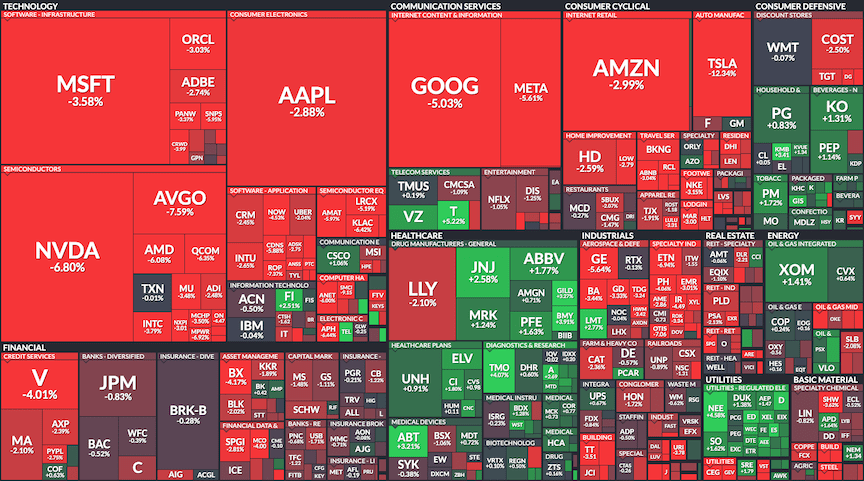

The initial market reaction to Trump’s win was well-expected. Stocks pumped, and Bitcoin surged to a record high. Add to that above-trend GDP growth and gold around all-time highs and you have an intriguing risk cocktail in the mix.

And then, last night, Jerome Powell delivered another rate cut. The Santa rally is well and truly in play.

Financial conditions in the US are easing considerably with a strong economy and inflation not fully defeated. What could go wrong? Many, myself included, think that the Fed is cutting too soon.

It’s one thing to disagree with the man’s strategy. However, don’t go asking him any stupid questions!

I’ll take that as a ‘no’.

On the subject of inflation, Powell also wasn’t afraid to say the quiet part out loud:

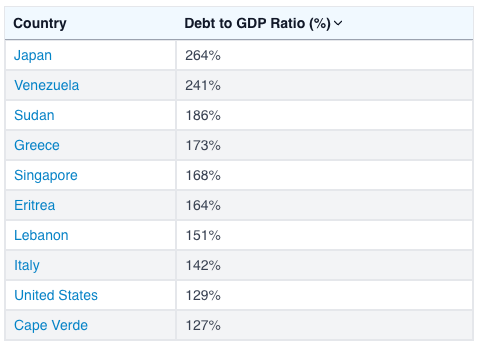

Take a moment on that one. Prices don’t come back down. Wages have to catch up. If you live and work in Japan, how are those wage hikes coming along? Data released on 7 November showed that Japan’s inflation-adjusted wages fell for the second month running in September. (you may remember that before that they fell every month for more than two years)

In case you missed it, I covered the four must-own assets for inflationary times in my previous post. All roads lead to inflation. Plan accordingly.

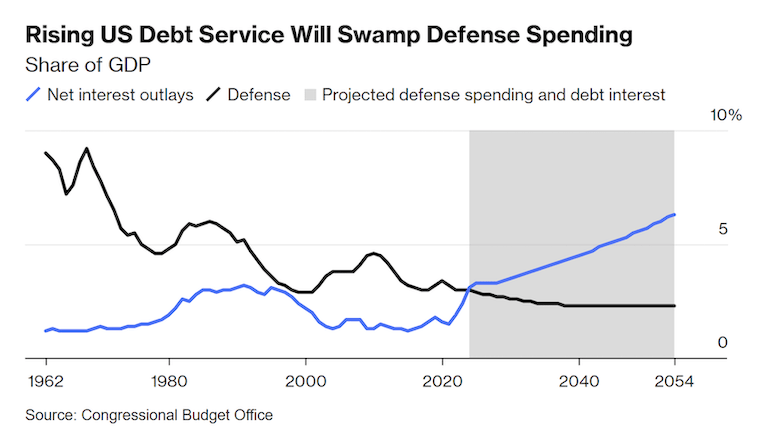

Stocks look likely to remain strong into year-end. If you are wondering what can go wrong after that, the bond market is the place to look. America just came out of the longest period of yield curve inversion in history. (short-term interest rates being higher than long-term rates) Without getting too deep into the weeds here, an inverted yield curve frequently precedes a recession. The consensus, however, seems to be that this time it’s different and the US economy is heading for a soft landing. Time will tell.

If you want to challenge yourself to understand the relationship between bond yields and the Fed, have a crack at this X thread. I’ve read it twice now and I think I still need another go…

How high is Bitcoin going?

Forgive me, I know I have been banging on about Bitcoin for a long time, even longer than the US election! My take is that the 4-year halving cycle is the best predictor of price movement – until it’s not. If that cycle breaks, I will change my view but as of now, it is playing out exactly as expected.

However, the Republican election sweep just added rocket fuel to the fire. In no particular order, here is the crypto bull case for the next 10-12 months and beyond:

- The Democrats’ war on crypto is over

- SEC head Gensler is on the way out – see ya buddy!

- A significant number of incoming senators are pro-crypto/crypto-curious

- Senator Cynthia Lummis has submitted a bill proposing a strategic bitcoin reserve. The proposal is for the US to buy 1 million BTC over the next 5 years. That’s 548 BTC a day. Currently, only 450 are mined every day.

- Detroit, Michigan just became the largest American city to accept crypto as payment for taxes

- Global easing cycle underway

- Retail didn’t even get interested yet

- Solana ETF possibly in the works

The parabolic phase of the bull cycle is upon us. I am not making any predictions as to how high it will go. Nobody knows. But the higher it goes, the harder it will fall at the end. That’s how the 4-year cycle runs. Here’s Mark Yusko with his take:

If you own Bitcoin, you need to decide if your strategy is to hodl for the long term or sell during the bull run so you can increase your holdings in the inevitable bear market that follows. Option two sounds great, but it’s harder than you think. Expect more on that in a later post. In my humble opinion, any other flavour of crypto needs to be sold in the bull market. Those Metaplanet shares too. It will all get crushed when the music stops. But for now, enjoy the ride!

Full send. This is not a drill.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.