I’m kind of bullish on stablecoins. And I’m not sure if I’m bullish enough.

It may seem odd to be excited about tokens with a fixed value, but hear me out: 24/7 tokenised stock trading is coming on all your favourite stock and crypto apps. We can argue about whether this is a good thing or not later, but it’s coming regardless. Larry Fink is all over it for starters.

If you have never transacted in stablecoins, it can be scary at first, particularly with large dollar amounts. One mistake in the address field and your coins are ejected into the ether, never to be recovered. It’s a good idea to send a small test transaction first. However, once you get used to it, you will never want to make an overseas bank transfer again. Scan a QR code or copy the deposit address, click, click, click, send, and within a few minutes, the money reaches its destination, anywhere in the world at any time of the day, for very little cost.

So, how is someone going to get money into their trading account on a Sunday afternoon to go 10x long Nvidia when the banks are closed?

Stablecoins.

I realise this is a pretty flimsy investment thesis, so I’m partly writing this post to discover if there is more to it than that. Let’s examine the evidence and see where it goes.

Exhibit A: The GENIUS Act

The US has made significant inroads in stablecoin regulation. The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) was signed into law last year to establish a federal regulatory framework for “payment stablecoins.” It’s designed to bring clarity and oversight to a market that had grown rapidly outside traditional financial regulation.

Here are the key points of the GENIUS Act:

- It defines “payment stablecoin as a digital asset issued for payment or settlement and redeemable at a predetermined fixed amount (e.g., $1). Issuers would be required to hold at least one dollar of permitted reserves for every one dollar of stablecoins issued.”

- It excludes these tokens from being treated as securities or commodities

- It requires stablecoin issuers to hold 1:1 reserves in liquid, low-risk assets (like cash or short-term U.S. Treasuries)

- It prevents stablecoin issuers from paying interest or yield to holders simply for holding the coin

- It becomes effective in early 2027

So a stablecoin is essentially a digital token that does not fluctuate in value. The issuer must back every stablecoin issued with real assets, such as cash or bonds.

Here’s where it gets interesting – stablecoin issuers are purchasing yield-generating assets like U.S. Treasuries. In unregulated jurisdictions, they can pass part of this yield on to the stablecoin holders. So, owners can earn interest on their stablecoin holdings.

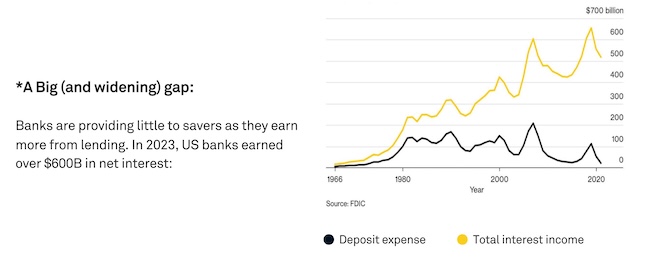

The banks don’t like this at all because the yields on stablecoins are higher than banks are willing to pay their customers. They are worried that stablecoins will pull deposits away from them. The pushback on stablecoin yield is particularly strong from regional banks. The big banks aren’t so concerned because they are all busy creating their own stablecoins.

This post from Patrick @Stillm4n provides an excellent summary of the banking industry’s concerns and attempts to estimate the size of the “systemic risk” to the banks. It also comes with a memorable quote:

The graph below is from Patrick’s post. No wonder the banks are concerned about losing these fat margins…

Exhibit B: Tether

Tether is the world’s largest stablecoin issuer. Its USDT token has a market cap of around $186 billion. Its reserve composition has been in question for years – no crypto market cycle passes without a round of Tether FUD. (Fear, Uncertainty and Doubt)

Tether says USDT is backed 100% by reserves consisting of cash, cash equivalents, and other assets.

In short, Tether’s assets probably outweigh its liabilities. However, Tether is not a listed company and therefore harder to scrutinise than its regulated competitor Circle (CRCL). So the Tether FUD is unlikely to die despite reported assets that include large holdings of U.S. Treasuries, gold, Bitcoin, secured loans, and other instruments. It also recently launched USAT, a U.S.-compliant stablecoin aiming to satisfy the GENIUS Act requirements.

Yields on Tether’s USDT generally range between 2% and 8.8% APY on most reputable platforms, though some specialised DEFI platforms are offering up to 15-22% APR for longer-term, locked-up deposits.

Exhibit C: Circle Internet Group (USDC)

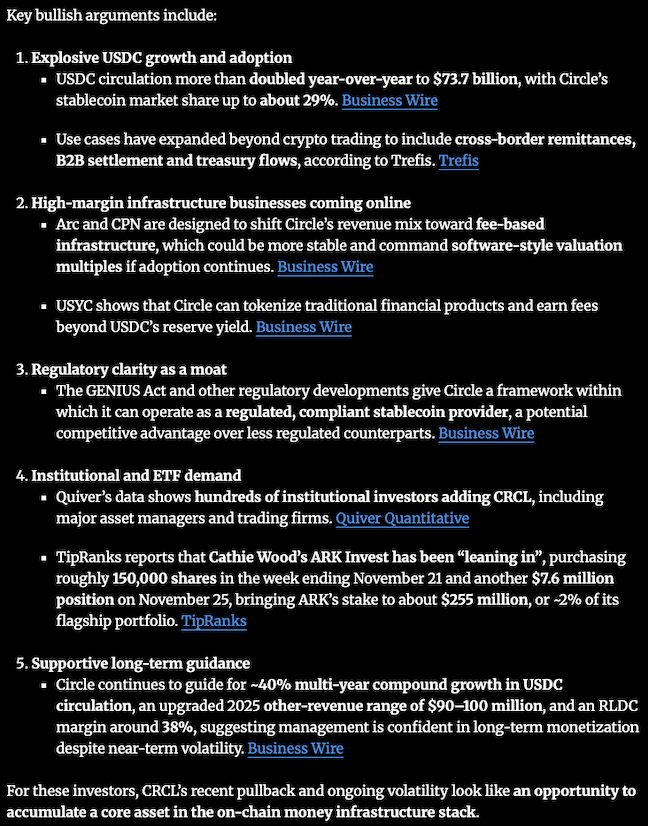

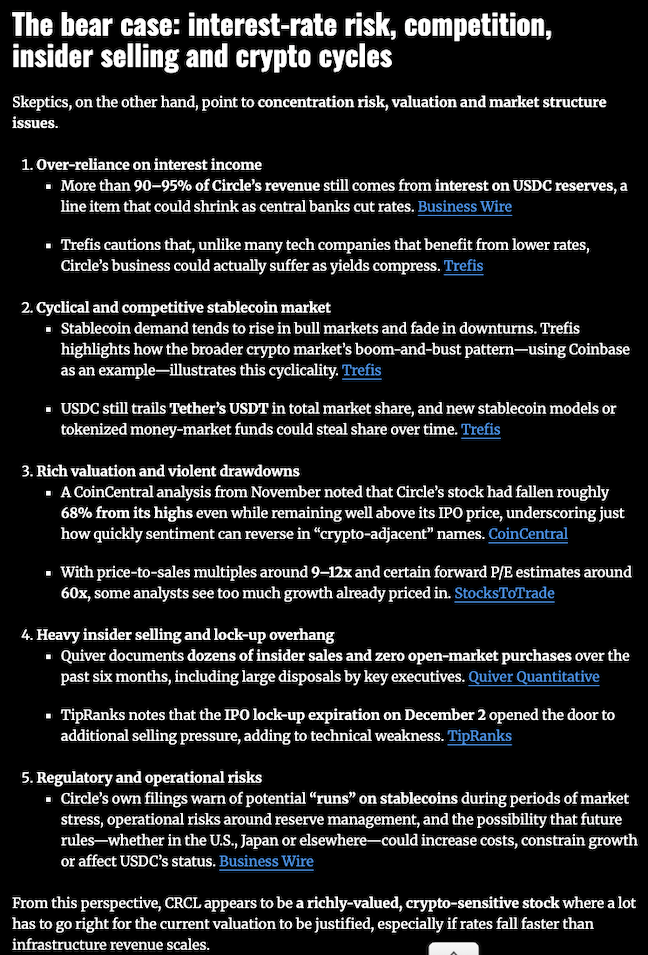

Following its May 2025 IPO, Circle’s NYSE-listed stock (CRCL) now provides a publicly traded way to gain exposure to stablecoin growth via equity rather than direct crypto ownership, which may appeal to traditional investors.

After ripping post-IPO, the stock has pretty much been down only. The bad news is that many see it as a pure crypto stock, so with crypto in a bear market, it is liable to sell off further. The good news is that means there is an opportunity to accumulate it at low prices. I own some already, but was a bit too early initially. It looks more attractive now.

The bull/bear case is nicely laid out in this article:

Exhibit D: The stablecoin landscape in Japan

Surprisingly, Japan has made rapid progress in stablecoin regulation:

- Stablecoins are regulated under the Payment Services Act (PSA) as “Electronic Payment Instruments”

- Issuance is limited to licensed banks, trust companies, and certain money transfer agents, fostering safety and consumer protection

- Recent PSA amendments allow stablecoin issuers to back tokens with up to 50% low-risk liquid assets (e.g., government bonds) rather than 100% demand deposits

- Japan’s FSA is consulting on strict reserve bond standards, demanding high credit ratings and minimum issuance levels for eligible backing bonds

- Large Japanese banks (MUFG, SMBC, Mizuho) are running stablecoin pilots regulated by the FSA

Circle’s USDC has been approved for use in Japan and is listed on exchanges like SBI VC Trade.

Along with the Megabanks, SBI Holdings, Monex Group and GMO Internet Group are all getting into stablecoins in one way or another. I own most of these already, so I guess I have some pretty good Japan exposure, although I bought these stocks for other reasons.

In summary:

- U.S. stablecoin regulation (GENIUS Act) legitimises digital dollars, but bans yield to holders, reflecting bank concerns about competitive deposit flight

- Tether remains dominant, but transparency and reserve composition controversies linger

- Circle (USDC) offers a more conservative reserve model with strong regulatory alignment and an equity play via CRCL

- Japan’s stablecoin framework is progressive and is expanding opportunities for institutional and retail engagement

So, all in all, I’m bullish on stablecoin infrastructure, but not to the point of betting the farm on it. I think this year offers a great opportunity to get some more CRCL exposure.

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.