I keep seeing posts declaring the 60/40 portfolio dead. No sh*t, Sherlock! Markowitz’s Modern Portfolio Theory dates back to 1952. I learned that 60/40 was no longer relevant in 2005. Where the hell have you been?

In case you are not familiar with it, the 60/40 refers to the traditional portfolio strategy that allocates 60% to stocks and 40% to bonds. The stock part aims for long-term growth while the bonds smooth out the volatility in rough periods.

Markowitz advanced this idea by blending a range of assets to produce a more efficient portfolio, recognising that the typical investor wants reasonable returns without excessive risk. See my post on Asset Allocation for more on this.

Can’t I just long equities?

Yes, it’s perfectly acceptable to just average into one or two stock ETFs and hold them for the long term, especially if you’re young. In fact, you can do that and read no further – you don’t need any help!

However, if you believe in passive investing and market indexing, which many people do these days, you must understand that the market encompasses more than just stocks.

Also, if you are investing a significant amount of money, it’s unwise to be 100% invested in one asset class, unless you have specific knowledge and overwhelming conviction. (which, by definition, a passive investor does not)

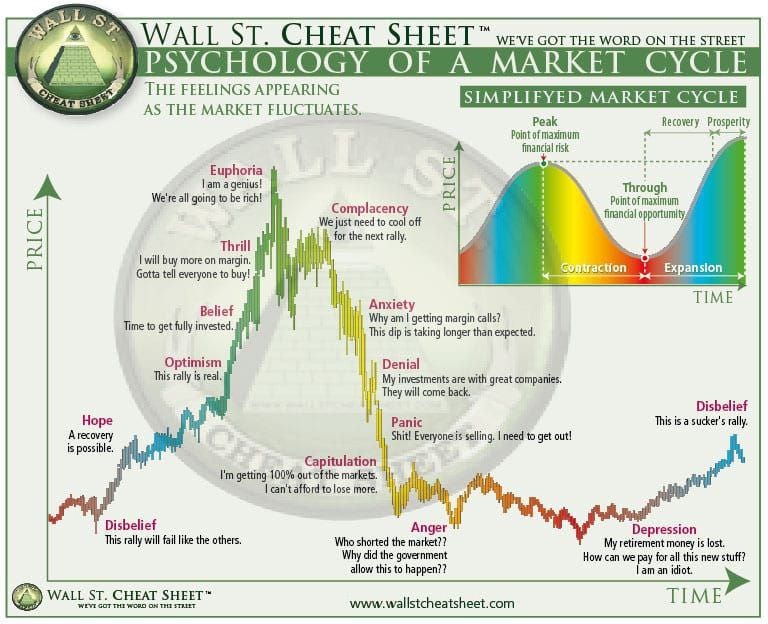

What’s a lot of money then? Great question! It’s different for everyone, but let me put it this way: If you are a passive investor, 100% in stocks, and you are starting to get concerned about the damage a market crash could do to your net worth, you might be getting close!

The funny thing about the 60/40 idea is that young people these days are probably already allocated 60/40, but to tech stocks and crypto!

Yeah, crypto, so where does that fit in?

This question is doing the rounds. If crypto is a new asset class, then where does it fit in a diversified portfolio? How big should the allocation be?

I saw this article recently: Bigger bitcoin HODL: Time for 10% to 40% of portfolio in crypto, says financial advisor Ric Edelman

I was not familiar with Ric Edelman, but it turns out he is pretty much a superstar financial adviser – check out this clip:

We can argue all day about whether the allocation should be closer to 10% or 40%. It clearly depends on an individual’s situation, risk profile, level of conviction, etc. The notable thing about this article is how it mixes up the whole Bitcoin vs. crypto terminology.

It mentions Bitcoin to start, but then it refers to crypto. So you should be putting 10-40% of your portfolio in what exactly? Bitcoin ETFs? Cryptocurrencies? Which ones? It’s not very clear.

I mean, they’re all the same thing, right?

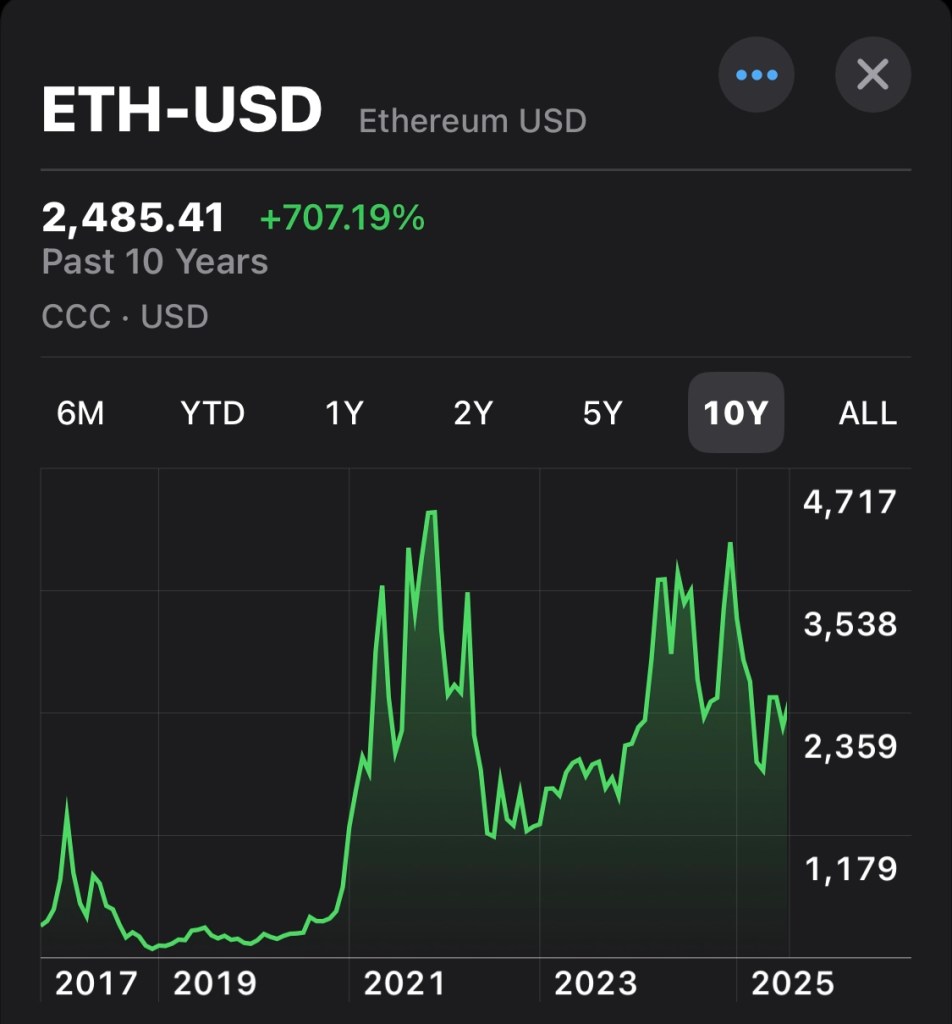

Not even close! And ETH is the second-largest digital asset. Think how many coins have gone to zero since 2017! In my opinion, if you’re going to allocate part of your portfolio to this asset class, you need to get smart about it.

Here’s a pretty solid definition:

I’m not saying you can’t have mad conviction on a particular coin and hold it as an investment. If you have that level of certainty, then go for it. Hardcore XRP hodlers don’t care what I think, and they shouldn’t. They believe in the coin. But should the average investor put 10% of their net worth into it? Of course not!

The mainstream media are leading lambs to the slaughter if they can’t get their terminology straight.

Here’s the only truly investable cryptoasset in my humble opinion. Doesn’t it look beautiful?

Uncorrelated assets for the win

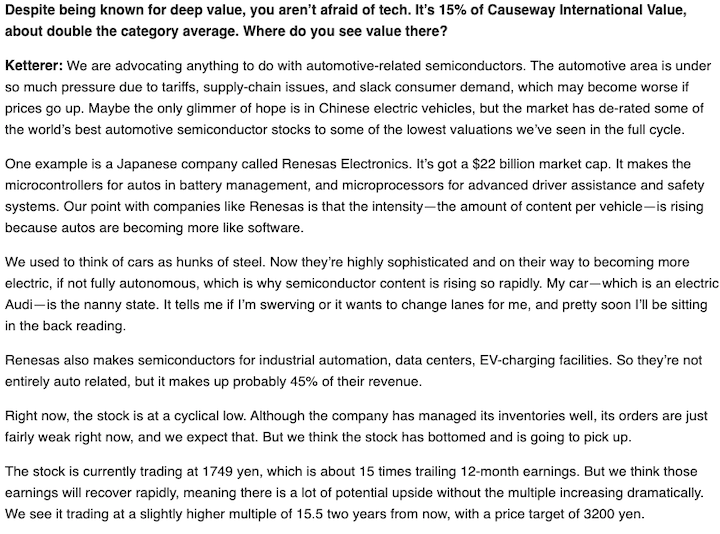

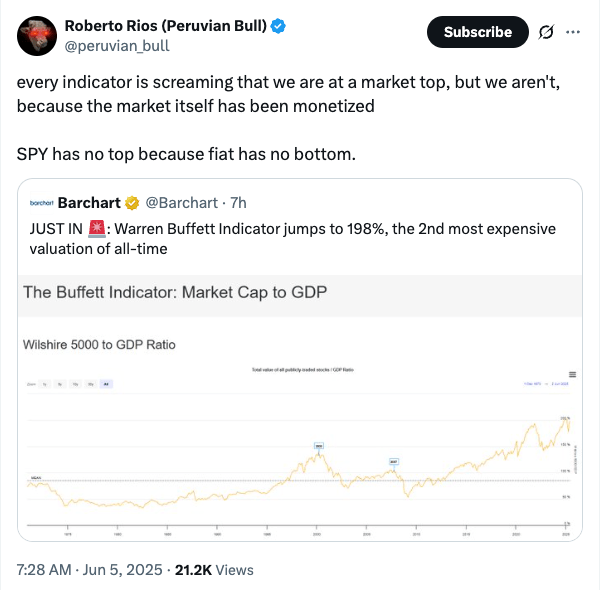

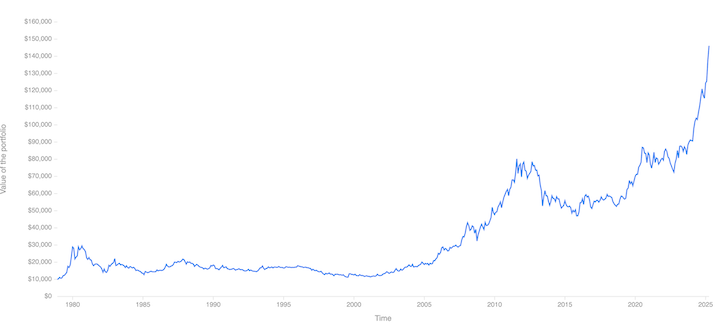

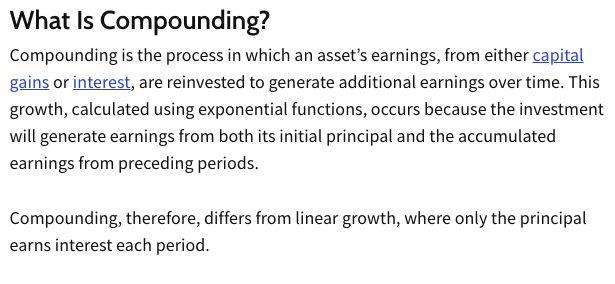

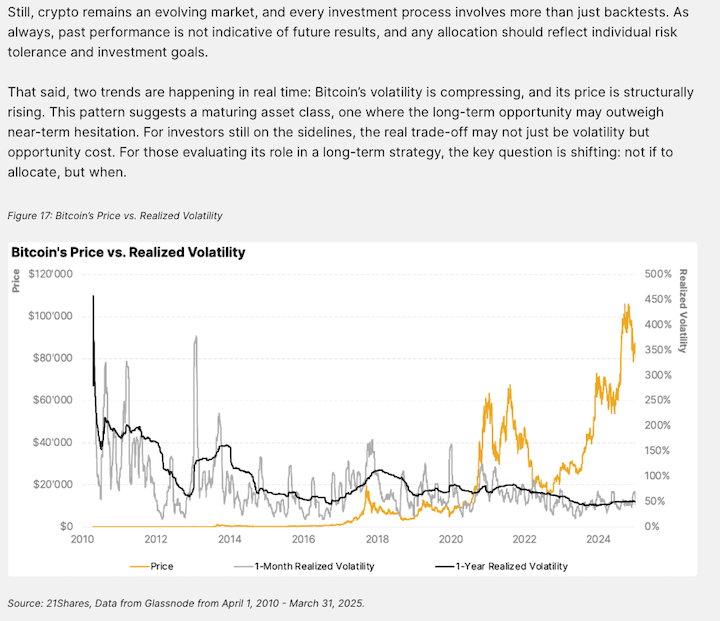

The modern portfolio enhances 60/40 by adding assets that are uncorrelated or only lightly correlated to stocks and bonds. That’s how you achieve better risk-adjusted returns. (similar or better returns with less risk) Back in 2005, I never imagined a shiny new, uncorrelated asset would emerge. It really is a remarkable thing.

If you are interested in understanding how a modern diversified portfolio benefits from the addition of Bitcoin (and even other crypto), this report from 21shares is worth a read: Primer: Crypto assets included in a diversified portfolio – Q1 2025

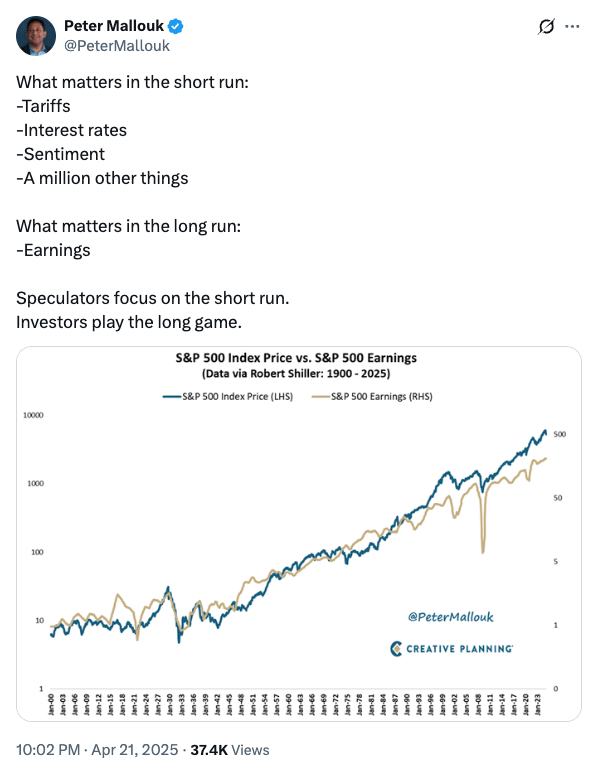

Here’s a quick summary: between April 2022 and March 2025, Bitcoin’s correlation to the rest of the asset universe was 36%. People like to compare Bitcoin to tech stocks, but its correlation to them was only 40%. These levels are significantly lower than traditional assets’ correlation to each other, which typically comes in at around 60-70%. This makes Bitcoin an ideal asset to add to a diversified portfolio in order to beef up returns without meaningfully increasing risk.

What makes Bitcoin especially interesting is how sometimes it behaves like a risk asset, like equities, and other times, it acts as a defensive asset, like gold. Over time, it is expected to become more of a gold-like store of value asset.

“This makes Bitcoin unlike any other asset in the market. It is structurally independent, behaviorally adaptive, and still offers significant asymmetric upside relative to legacy safe-haven assets. For portfolio construction, Bitcoin stands out as both a potential long-term hedge, and a high-impact diversifier at present.”

Adding a 1% allocation to Bitcoin to a modern portfolio over the 3 years resulted in stronger risk-adjusted returns. (It improved both cumulative returns and shape ratios)

Adding Bitcoin did not increase downside risk.

When scaling up to a 5% Bitcoin allocation, the risk-adjusted returns were even stronger, and the volatility remained manageable. Interestingly, they also tried a 3% allocation to the top 5 cryptoassets and achieved a similar uplift in performance without greatly increasing the risk.

So what’s the conclusion to be drawn here? You don’t have to go 40% into Bitcoin! Just a modest allocation increases portfolio efficiency without meaningfully increasing risk.

What are we trying to do again?

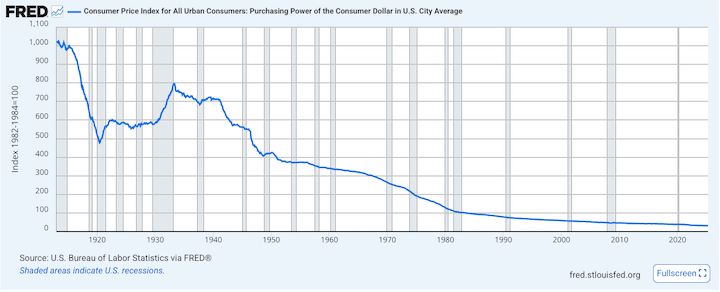

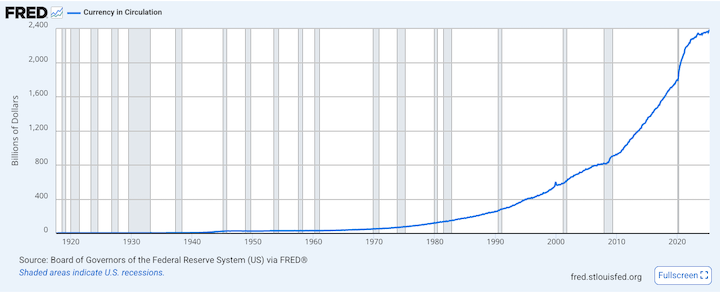

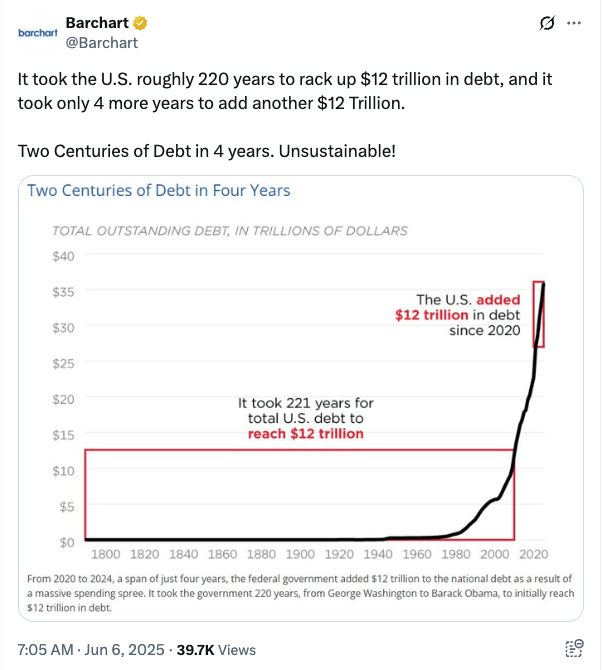

The whole point of investing is to beat inflation in your base currency. Doing it most efficiently with the least amount of risk is just being smart.

You can be overweight certain satellite holdings if you have a high level of conviction in them.

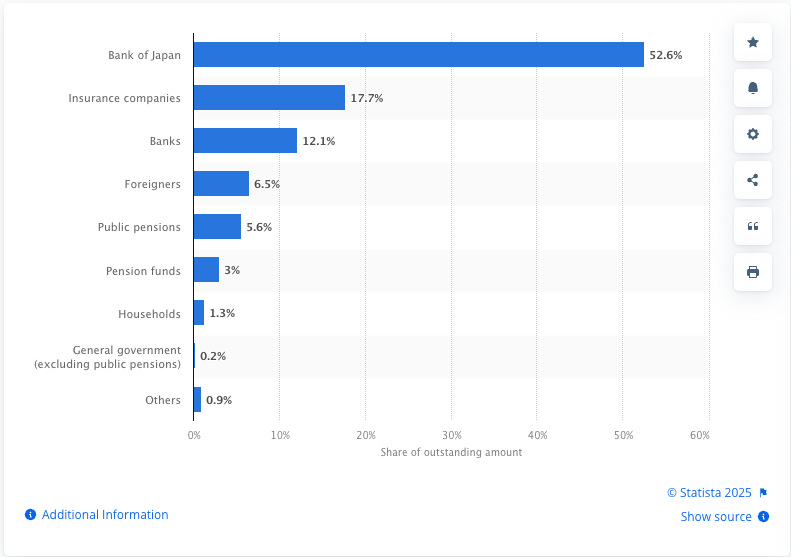

I still run a boring diversified portfolio, despite currently exceeding the recommended daily dosage of Bitcoin and Japanese stocks.

What’s my level of certainty?

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.