As you may know, I have worked as an independent financial adviser for many years. I first got involved in this business in 2002, and the world has changed drastically since then. Some of the financial products that were popular at that time are almost obsolete now. So, is offshore investing over? Or is it still something worth considering for the right person?

A note here: I have never used this blog to promote offshore products, and that is not my intent here. However, I’m probably as qualified as anyone to discuss this topic, so here we go!

Much has changed

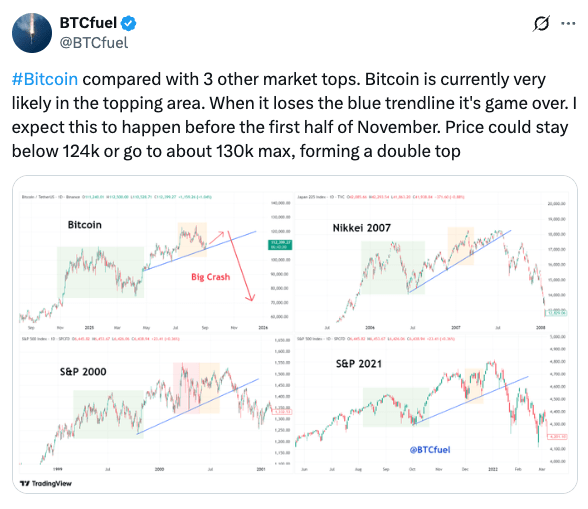

In 2002, if you were an expat in Japan, earning good money and looking for a way to invest, your options were fairly limited. Opening an investment account in Japan was not something many people considered. Along with the obvious language barrier when it came to reading product information, opening an account would involve meeting with a broker from a Japanese securities company and going through their sales process. If you think offshore advisers had a bad reputation, local securities company salesmen were not much better – they were well known for heartily recommending whatever was booming at the time and throwing their clients in at the chuffing top of the market.

Therefore, speaking to a British guy in a suit and cufflinks and investing in the Isle of Man was usually a more palatable option. Of course, these guys operated on commission, and some of them did not have your best interests at heart. Buyer beware! Many people got duped into long-term savings plans they didn’t understand.

To be fair, some of these people partly deserved what they got. All these offshore products had terms and conditions readily available in English. You just had to get a copy and read them! Plenty of people managed to ask questions, read the documents and invest in a product that they actually understood.

These days, investing in Japan could not be simpler. Go online, choose a brokerage, fill in the initial online form (with your name in half-width katakana hahahahahaha!) and then post off copies of your residence card/My Number card. You can have a brokerage account and a tax-free NISA set up in a couple of weeks.

So, is offshore investing dead?

Other advisers may have different mileage, but from my perspective, the demand for offshore products is certainly down significantly. I attribute this to two factors: getting a low-cost brokerage account is very easy, and nobody wants to pay for anything these days.

Not that avoiding high fees on investments is a bad thing. It’s one of the simplest things you can do to improve your returns. However, when offshore advisory is done well, you are not necessarily paying a lot for the product. Lump sum investment products in particular have very flexible fee structures, and a good adviser will be reducing their initial commission and taking an annual management fee for servicing you and providing ongoing advice.

Of course, much depends on your country of origin, how long you plan to spend in Japan and where you will go next. Offshore isn’t a great fit for everyone. (Americans in particular, take note. NISA isn’t necessarily a great fit for you either, and you are likely better off getting US-specific advice and investing in US-based accounts.)

Here’s a simplified view of how I see the steps to allocate money:

- Make sure you have an emergency cash reserve

- Fill up anything tax advantaged first – in Japan, that would be NISA, iDeCo

- Any money over and above that is up for consideration – it could be invested in a taxable Japan brokerage account, an international brokerage account like Interactive Brokers, or offshore.

Again, a lot depends on nationality and personal situation, so no advice here, but some of the benefits of offshore get overlooked in the relentless pursuit of low fees.

I will leave the offshore regular savings plans out of this, as they are somewhat outdated. But many people, including myself, still have plans set up years ago, and that’s fine.

The offshore portfolio bond is for larger lump sum investments. It’s essentially an insurance structure; the individual owns the policy, and the policy owns the assets. It is open architecture so policyholders can access ETFs, mutual funds and individual stocks. For Japan residents, you are not required to report capital gains and dividends within these policies as they occur. You report when you exit the policy and pay a one-time tax payment (一時所得) of around 20% of gains. E.g. You invest $100k and the policy grows to $200k – you cash out the policy and owe approximately $20k.

So you effectively get gross roll-up inside the policy. You can switch investments and take profits as much as you like without triggering a taxable event. For some people, that alone is worth the fees.

If you leave Japan, you just take it with you, and when you cash out, you may end up owing nothing here. Of course, some people may have to factor in the exit tax and the lookback, etc. It depends on amounts and timeframes.

Use of trusts

The other thing you can do with offshore insurance products is put them in a trust. Trusts can be very effective for estate planning, particularly for, but not limited to, British nationals.

In the case of Isle of Man assets, probate will be required on the death of the last policyholder before proceeds can be paid out of the plan. Placing the policy in trust avoids this lengthy and often frustrating process, allowing money to be paid out quickly to the beneficiaries.

Trusts allow the donor to maintain a degree of control over the assets and, in some cases, to have limited access to the capital. A discretionary trust, for example, can instruct the trustees to hold the assets until the beneficiaries reach a certain age before distributing the proceeds to them.

For individuals who are treated as UK long-term residents, a trust is an effective way to shield assets from UK inheritance tax. Trusts are also worth considering for anyone who plans to become a UK long-term resident in the future.

A note here: trusts will not help you to mitigate Japanese inheritance tax. Japanese tax authorities do not recognise foreign trusts and generally look through them and tax the assets. If Japanese inheritance tax is a concern, you should first do your own reading and then discuss with a local tax professional before taking action. Reddit is an incredible resource, but you should not be taking personal tax advice from there.

If you have an offshore policy that you have been holding onto and perhaps do not know what to do with, it could be worth discussing with your adviser as to whether it would be better to put it into a trust. If you have lost contact with your advisor, you are welcome to contact me. I can also assist with general advice on whether it is better to keep the policy or cash it in and invest elsewhere.

In conclusion

Offshore investing is generally less relevant than it used to be. However, it is far from dead. In particular, high-net-worth individuals may find there are significant benefits to investing in a tax-free jurisdiction, and/or taking assets out of their own name.

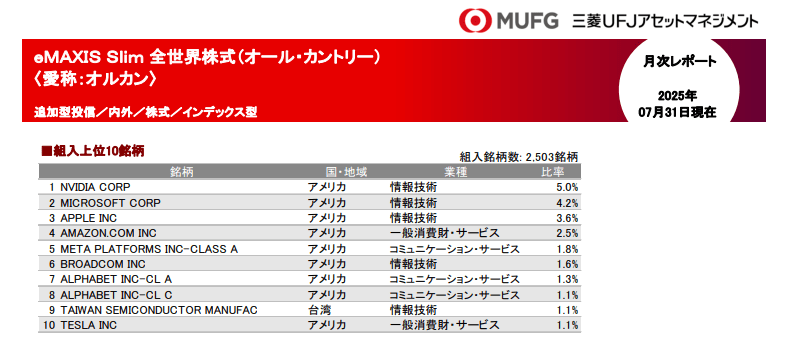

For simple day-to-day investing for longer-term Japanese residents, NISA and iDeCo are incredibly hard to beat, and local brokerage accounts provide access to a wide range of assets. We are really spoiled these days. If you need help getting things organised, don’t forget that I offer fee-based personal finance coaching!

Top image by Clker-Free-Vector-Images from Pixabay

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.