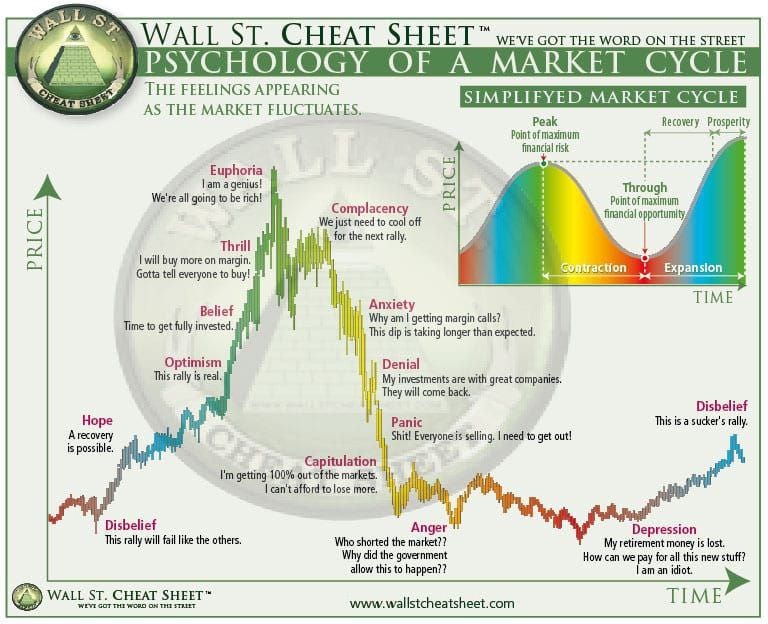

Are we winning yet? It’s tricky explaining to people why investing isn’t gambling when the markets continue to exhibit the qualities of a casino. Where to start?

Even my favourite investing question, ‘Are we in a bull market or a bear market?’ is a tough one to answer right now. Maybe we can get there by the end of this post!

US stocks first

I know many people doubt that Trump actually has a plan, and crediting him for deliberately cooling down the US stock rally seems a bit of a stretch. But you have to remember that he’s got Scott Bessent sitting in the treasury. I lean towards there being method in the madness.

We should listen to what they are telling us. Both Trump and Bessent have been quoted as saying we should expect some turbulence. The sharp drop on Monday was a warning shot. I sit in the camp that says we get 3 to 4 months of significant uncertainty before they start focusing on pumping things up before the midterms in November.

Markets hate uncertainty. It’s going to be a bumpy ride.

The cooler US CPI print last night provided some welcome relief. We are moving towards an economy that is ready for more rate cuts. However, tariffs won’t show up in inflation numbers until next month. Trump & Co. can’t force Powell to cut short-term rates, but Bessent has said that they are focused on bringing down the 10-year bond yield. Something to keep an eye on.

Talk of a recession seems overblown. The US economy is slowing, not sputtering.

Japanese stocks and bonds

Shout out to Japan Stock Feed for this excellent summary of a recent interview with ‘legendary salaryman investor’ Tatsuro Kiyohara.

A few quotes:

“For the first time, Japanese companies truly belong to their shareholders. That’s a massive structural shift—a revolution.”

“Yes, risks remain. But this governance transformation is so significant that it outweighs them. That’s why, even if a crash comes, I focus on making money from the rebound rather than betting on the decline.”

“Put simply: If share buybacks and dividend hikes continue, stock prices will rise.”

“I’ve said before that I’m terrible at predicting markets, but if we zoom out, I’m bullish on Japan.”

The TSE campaign to make life better for Japanese stock investors has been a roaring success. Who says things never change in Japan?

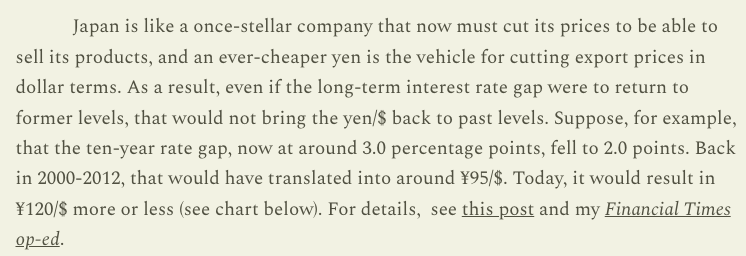

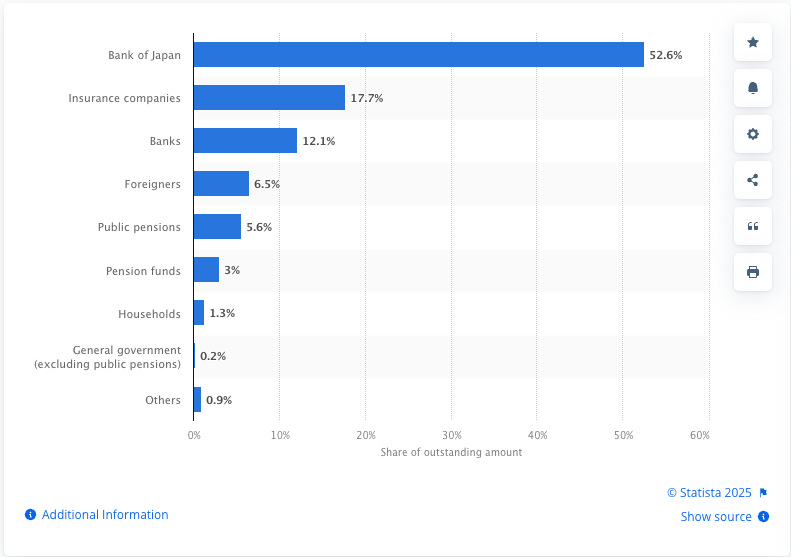

Much as I like Japanese stocks, the macro outlook terrifies me! Long-term bond yields are rising, and you have to wonder how much higher they can go before the Bank of Japan loses control. If the BOJ is not going to continue Yield Curve Control to reign in yields, then it is going to endure the full force of the crash in bond prices when yields get away from it. Maybe the BOJ can endure and hold to maturity, albeit with massive damage to its credibility. But who else is going to suffer?

This Japanese stock vs. macro dilemma reminds me of the ever-present earthquake risk. It’s really nice living in Japan, but your house could get destroyed tomorrow! The difference is that the Japanese bond market will take the rest of the world with it if it falls. Fun times!

Crypto

You knew I would get into crypto soon enough, right? More specifically, Bitcoin, seeing as everything else has been trashed. I distinctly remember that, about three weeks ago, we were on a nice trend back towards $100k – there was this beautiful procession of green candles, and I went to bed that night feeling quite confident that I would wake up to six figures again in the morning.

Bybit got hacked by North Korea that night.

Most crypto thing ever lol…

Then we had a poor reaction to Trump’s strategic reserve announcements, and before you knew it, we were fighting to hold $80k.

I see this going much the same way as US stocks: a few months of ‘It’s so over’ and then ‘We are so back!’.

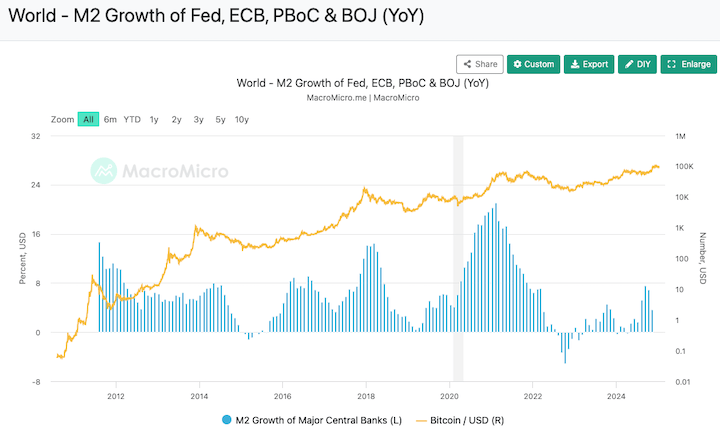

Follow the money supply. I will cover the Strategic Reserve and US regulation changes in a future post. Suffice it to say that most people are offsides and bearish. I would be concerned if it were any other way.

So, bull or bear?

US stocks – mini bear inside a bull

Japanese stocks – bull

Japanese bonds – don’t look up!

Bitcoin – bull

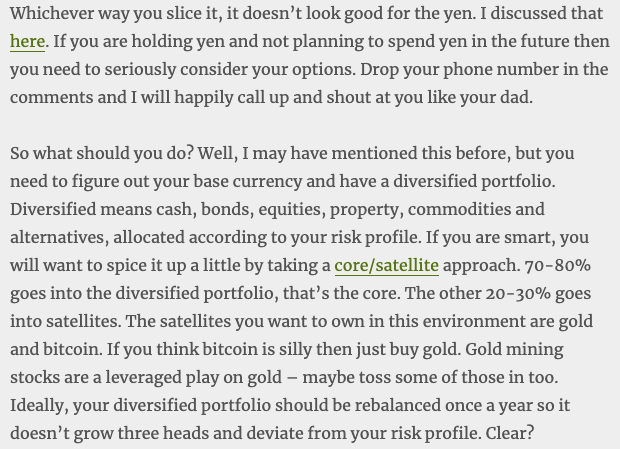

That’s how I see it. Red days on US stocks are for buying. I will treat the next 3 to 4 months as an opportunity to accumulate.

Japanese stocks, particularly value/dividend stocks, are a great tool to counter JPY inflation.

Diversification across asset classes for serious money.

USD, Bitcoin and gold are insurance policies on the macro risk. Fingers crossed on the earthquakes!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.