Welcome back to part three of our series on property investing with Graeme. In this installment he shows us how to use mortgages to our advantage:

Above is the number one mantra of a professional property investor, and if you want to build a successful portfolio it really helps to know how you can get a property for free and income for life.

Property is a major route to life-changing wealth and the main reason is because you can use other people’s money to make money. Even if you use your own money, an important point is how you buy a property and get your money back whilst making a rental profit each month. In many countries, (UK, USA, Canada, Australia, New Zealand etc.) not only can you pull your money out of a property by remortgaging and make a monthly rental income, you can also increase the property’s equity over time.

Money Out with a Mortgage

The principle of money in money out works because of mortgages. Mortgages are available in all countries, however the calculation to find money in money out deals may vary slightly from one country to another. For example, in the UK we focus on getting our money spent on a property back in 6 months because this is the legal amount of time it takes to get a remortgage after purchase. In other countries this time frame may be slightly different, however the basic principle of using mortgages (the bank’s money) to return your personally invested money is the same around the world.

To use the U.K. example, whenever a serious investor analyses a property he or she asks the question:

What is this property worth, refurbished to a good standard in 6 months time?

We want to refurbish properties to a good standard because the mortgage company will increase the loan amount and six months after purchase we can get all our invested money out of the property. Furthermore we want to refurbish a property to a good standard because we want to be good landlords – property is a people business and a good property attracts good tenants who stay longer and pay full rent on time. Initially it costs more to refurbish a property to a good standard but in the long run this is the smart business thing to do.

So how do we know what is a money in money out deal? This is best explained with an example:

Money In Money Out Example

Lets say we find a property on the market and comparables suggest it is worth 100K in good condition. To keep things simple and based on standard UK mortgage lending we will assume a loan of 75% to the value of the property.

If we want to get all our money back we do a simple calculation:

100K x 75% = 75K (loan amount)

– refurbs e.g. 5K

– other costs 2K (legal fees, survey)

= 68K

So we know our maximum offer to the seller is 68 K and we can invest a total of 75K if we want to get all our money back on the remortgage.

With this example let’s assume we have the 75K in savings and our offer of 68K is accepted. We buy the property for 68K, pay the survey and legal fees and refurbish the property with 5K. Then 6 months later, when the property is already rented, we take a remortgage and the mortgage company’s surveyor looks for comparables in the area and finds the fair market value is 100K, and because most UK mortgage companies give 75% of a property’s value, they give us 75K and hey presto we now have the 75K spent back in our bank account.

Comparing Apples with Apples

“How do we find good comparables?” you may ask. “How do we know the true value of a property?”

Well, we have to think like a surveyor because surveyors are the people who actually put the values on properties.

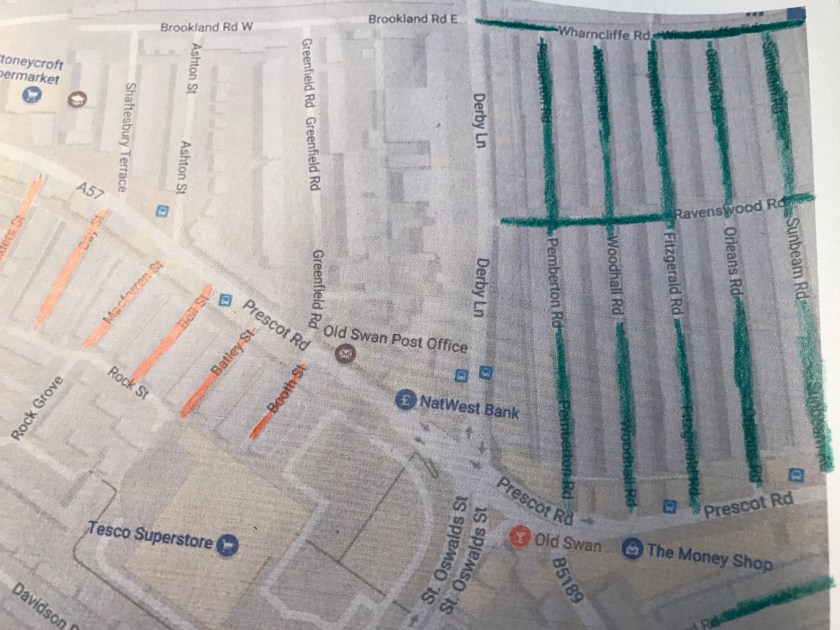

A surveyor looks at similar properties that have sold in the same area recently. In the U.K. we use websites such as nethouseprices.com, mouseprice.com or ourproperty.co.uk as these websites use Land Registry data. (the organization which stores official property title deeds)

Specifically we want to know if anything has sold within the last 6 months that is very similar to our property, in particular comparables should have the same number of bedrooms. Ideally these comparables are in the same street. If not the same street then within ¼ of a mile, and if not then expand your search out further which is easy to do when you input your information into a property website’s search engine.

Look for properties in a high price range and in good condition.

If the comparables are a bit tired or fully distressed call 3 estate agents and ask for an honest appraisal and take the average of the 3 predictions. Another method is to call a local surveyor and ask “What will this property value at in the current market, once refurbished?”

To be extra safe you can use all the techniques together and take the average.

The Power of Persistence

Now, one mistake amateur investors make is believing the seller’s asking price. Our research tells us the value of our example property is 100k after refurbishment, however the asking price might be 110k or 130K or 90K or whatever the seller thinks it is worth. The only thing you need to remember is: The asking price is irrelevant!

Of course you may say, “This is all very interesting but no seller will accept such a low offer” and you would be right that it is unusual. However it is possible, and successful investors actively search for such below market value (BMV) deals.

Property investing courses say that 1 in 40 such BMV offers are accepted. The truth is it depends on the market. It might be 1 in 60 BMV offers in a buoyant market, but when sellers are desperate you might only have to make 20 such offers. The point is there are motivated sellers in every market and professional investors have a variety of ways of finding them.

As you can see you will have to experience a lot of rejections in order to get a real BMV deal. You will have to kiss a lot of frogs to find a prince. Amateurs hate rejection but it is part of the game, and if you don’t embrace rejection it may crush you to the point of giving up. However, just because someone says “No” it does not mean they won’t say “Yes” at a later date. If a seller rejects your offer simply record the offer in your property database and move onto the next property. Then 3 weeks later re-offer. You will probably offer 3 or 4 times on the same property and that is fine. Your database is a simple chart that shows property address, offer, date of offer, refurb estimate and rent per month. Your database is a simple, powerful tool that will grow and, given time, help you find good BMV deals. Remember to put all your offers into the database because as my mentor likes to say, “The money is in the database”.

The number one mantra of a professional property investor is:

Money in, money out, asset for free, income for life.

In the next article we will examine the final piece of the mantra i.e. how to get rental income for life, even while paying a mortgage on the property. For now however, let’s summarize this piece which has focused on getting your money out of a property and gaining an asset for free.

Summary

- Research and make many BMV offers

- Buy BMV

- Refurbish

- Roll onto long-term finance with a bank.