Wow what a week it has been in crypto! In case you weren’t paying attention, the guy whose company bought $1.5 billion in Bitcoin just a couple of months ago sent a flurry of tweets and crashed the market by 40%. Yes, Mr. Musk is not the the most popular person in cryptoland right now, and Tesla shareholders are probably not very impressed either. For people who just got into crypto this year, as the bull market picked up steam, it’s literally been a crash course in risk.

Despite this I have spent my free hours this week labouring over this post, the reason being that over the last 12 months or so I have come to the following conclusion:

If you are serious about building wealth and pursuing financial freedom, and you have not done so already, you need to educate yourself on cryptocurrency.

Notice that I’m not advising you to go out and buy XYZ coin today. I’m saying you need to study, understand the shift that is going on in this space, and act accordingly. Otherwise you could miss out on a world of opportunity.

So what do you need to get your head around? Here are a few things:

Adoption

A couple of surveys in the US have just published some interesting results. The first is Gemini’s State of Crypto 2021 report. (you can read a good summary of the report by Zerohedge here.) Then NYDIG carried out a similar survey, reported in Newsweek here. The Gemini survey of US based individual investors shows that 14% of Americans already own crypto. More interesting is that 63% of respondents are “crypto-curious”. This group are interested in learning more about crypto, with 13% considering adding crypto to their portfolios in the next year.

NYDIG estimate that some 46 million Americans own Bitcoin, and they found that many of these people would be happy to store their Bitcoin with their bank if the option was available. (see here) Banks are seeing the outflows to crypto exchanges like Coinbase and are waking up to the opportunity to offer Bitcoin and other crypto directly to customers.

We are also seeing rapid adoption in the developing world, particularly in countries like Venezuela where the economy has been poorly managed, resulting in a severely devalued local currency.

Institutional Adoption

The 2017 bull market was peppered with whispers that “the institutions are coming”. Well in 2021 they are slowly arriving. There are currently 8 filings for a Bitcoin ETF sitting with the SEC in the US, and it looks like it is only a matter of time before the first one is approved. (Canada already approved a BTC ETF) In the meantime, Grayscale’s cryptocurrency-based trusts are nearing $50 billion in assets under management!

Morgan Stanley are launching access to three funds which enable ownership of Bitcoin for their wealthiest clients. Goldman Sachs are preparing to offer clients access to digital assets from this quarter. Insurance companies are starting to invest. Hedge funds and wealthy family offices are involved. Guggenhiem Partners, who manage over $230 billion in assets, have a sizeable position in the Grayscale Bitcoin Trust, as do Ark Funds.

A growing number of publicly traded companies are now allocating part of their cash reserves to Bitcoin, and yes, at least at time of writing, Tesla is still one of them.

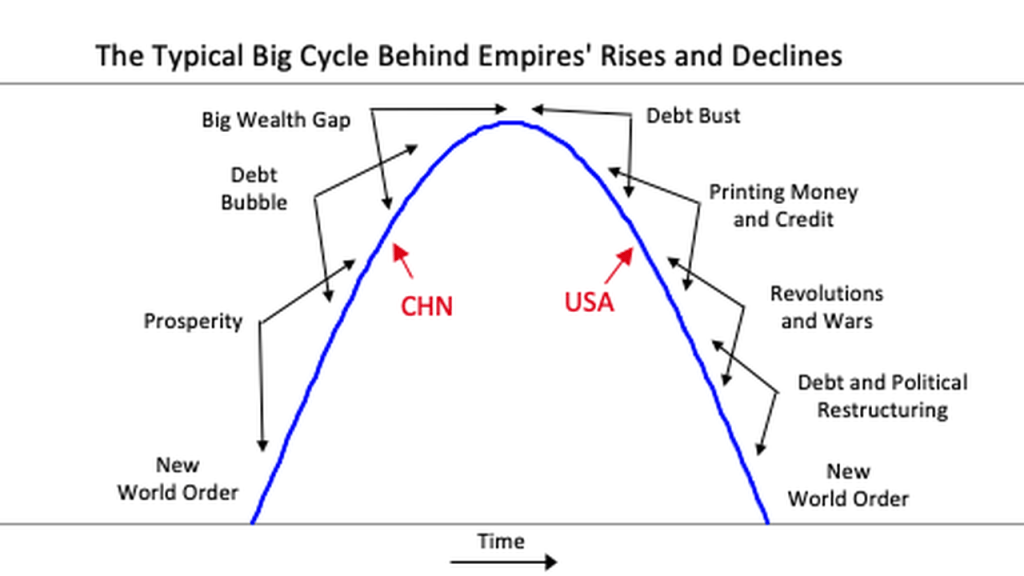

Inflation fears

Bitcoin is seriously starting to rival gold as the ultimate hedge against inflation. And following over a decade of money printing and quantitive easing in response to the 2008 Global Financial Crisis, and yet more stimulus to combat the economic damage wreaked by Covid-19, inflation fears have been wobbling markets in the last few weeks. With its hard-coded fixed supply, 4 yearly halving events and digital immutability, Bitcoin is programmed to be deflationary. You simply can’t print more Bitcoin, even if you wanted to.

This is why the likes of Michael Saylor at MicroStrategy are investing part of their company treasury in BTC. Bitcoin is now viewed, by some at least, as a superior store of value, an alternative to the “melting ice cube” that is Fiat currency

DeFi

The word “disruptive” gets thrown around a lot these days as technology challenges the old “traditional” way of doing things. Some may say this is just a natural progression of things, but it perhaps doesn’t feel that way if it is your business that is in the process of being disrupted! DeFi, or Decentralised Finance is threatening to disrupt TradFi, or Traditional Finance. DeFi is one of those terms that can quickly turn off people who only have a passing interest in crypto – it all sounds too complicated. To keep it simple, DeFi is removing the middleman from financial transactions, with the middleman generally being a bank or brokerage.

Here’s a good definition from Investopedia: DeFi refers to a system by which software written on blockchains makes it possible for buyers, sellers, lenders, and borrowers to interact peer to peer or with a strictly software-based middleman rather than a company or institution facilitating a transaction.

The potential for DeFi is clearly huge, and it is in the very early stages. Expect plenty of volatility as TradFi is not going to give up easily! It is also going to be tricky to regulate as there is no central body with its HQ in a particular jurisdiction, where it can be bound by that country’s specific rules.

NFTs

Non Fungible Tokens suddenly hit the news this year when a digital collage by the artist Beeple sold for a whopping $69 million! NBA Top Shots offer the chance to own digital highlight plays, with some listed as high as $250,000. A lot of assets are accused of being in a bubble these days but this one is hard to deny. After all, if you want to look at the Beeple collage, it’s right there online to view for free and you can download a JPEG onto your computer. However, don’t write NFTs off so easily. Ownership of something digitally certified as unique can be applied to art, fashion, collectables, licenses and certifications, tickets for entertainment and more. The potential for use in gaming and virtual worlds is huge too.

Ethereum

You may have noticed a dramatic increase in price of the number two cryptocurrency, ETH recently. ETH is programmable money and much of the above DeFi and NFT ecosystems are built on its protocol. ETH is not without competition, but it has first mover advantage in the smart contracts space. There is even talk of the ETH market cap surpassing (flipping) Bitcoin over time.

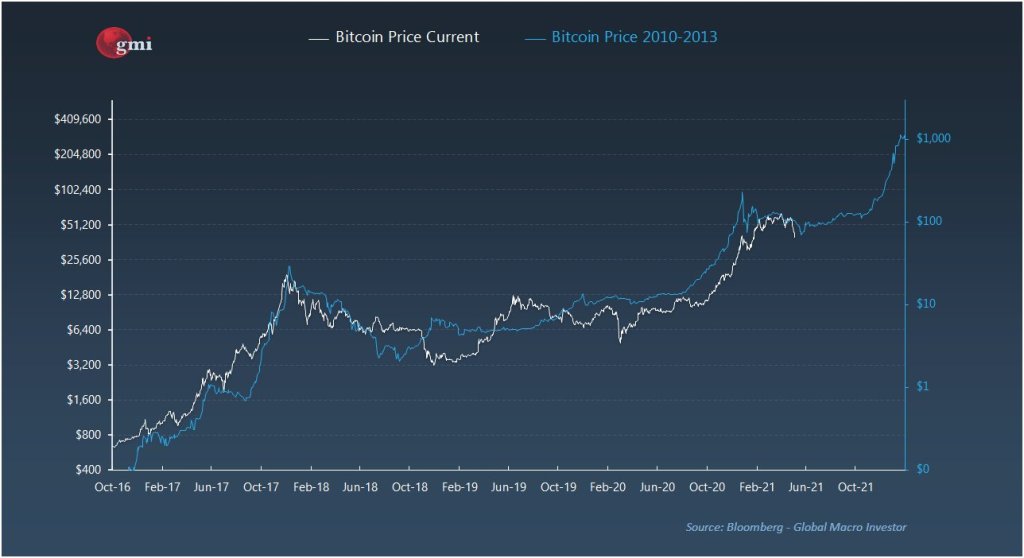

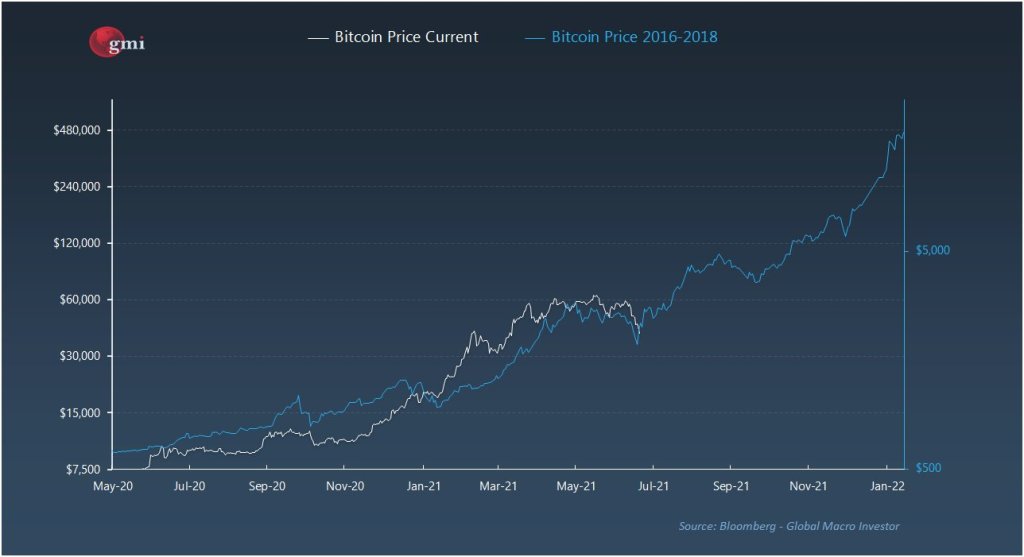

Cycles and how to invest

What I wish I had better understood during the 2017 bull market in crypto, and the subsequent bear market, is that it wasn’t the first time around the track. In fact, it happened in 2013. And now here we are in the 2021 bull market. Do you see a pattern here? The Bitcoin four yearly halvings generate a clear four year cycle. And as long as BTC leads the market, this cycle applies to other coins as well. The two graphs below compare the current bull market to those of 2013 and 2017.

I recommend reading this excellent post on the Bitcoin four year cycle. Understanding this is crucial to formulating an investment strategy for the years to come. Despite the current correction, we are now well and truly in Phase 1- the bull market! That’s why Bitcoin is in the news and every Elon Musk tweet moves the market. The Bitcoin bull market does not go straight up, there are usually a number of pullbacks, corrections and mini crashes. Bitcoin being in the news can be both positive and negative: It’s boiling the oceans, China is banning it, India too! Believe it or not, this is the fun part!

If you didn’t accumulate Bitcoin and/or other crypto in the last couple of years, then that’s a shame, but guess what? The next phase is the bear market. During this chilly crypto winter, BTC generally declines around 80% and Altcoins possibly more – and then comes your next chance to accumulate. If there is one thing I would like you to take away from this post it is this: If you learn about crypto in the months to come you are still early. I don’t think that dollar cost averaging and buying on dips (like the one now) this year is a bad idea, but be very careful with your sizing. It is not the time for FOMO (Fear Of Missing Out) and betting the ranch. A little skin in the game will give you motivation to study, but you need to think longer term. Step up the dollar cost averaging during phase 2,3 and 4 and 2025 is your target year for enjoying the good times!

I note that there is talk in some circles of a super-cycle. That is no 80% decline this time and the bull market continues. It sounds wonderful and there would be no complaints from me if it happened, but I am not convinced and am basing my planning on the 4 year cycle. What I could see perhaps happening is ETH and perhaps some of the DeFi coins decoupling from the Bitcoin cycle and going their own way. Only time will tell on that too.

Crypto and Japan

In 2017 Japan appeared to be positioning itself as a global leader in crypto regulation, and there was even one ICO issued by a regulated exchange in Japan. (Quoine, now known as Liquid’s Qash token) However, very little of note has happened since then. Hacks at Coincheck and Zaif probably didn’t help. Only a handful of crypto assets are available on Japan exchanges and there are no stablecoins on offer. If you are looking to invest in Altcoins or DeFi coins you will need an account overseas to do so. (FTX, Kraken etc.)

Moreover, the tax treatment of crypto gains in Japan is less than friendly. Gains should be reported as miscellaneous income and are taxed at your highest marginal rate, with the maximum of 55% often mentioned in reports. I would note here that your marginal rate depends on how much you earned in the previous year and, depending on your income you may pay significantly less than 55%. Here is a useful summary of the Japan tax treatment.

You should also note that there is no offset on losses as there is with stocks. This makes me think that the best strategy in Japan is to accumulate over time and hold for the longer term. (noting that crypto moves fast and long term could mean 3-5 years) Trading aggressively doesn’t really seem worth it, although some may disagree. I would be careful of this one major pitfall: making big gains in one coin, selling and creating a taxable event, and then moving them to another coin to try to make more money but actually making a big loss. You will still be liable for the gains from that first trade, even if you don’t actually have any of the money you made left…

One way around the tax issue is using funds, and ETFs when they are finally available. Grayscale’s trusts are taxed as stock, (so 20% on gains) and I imagine ETFs will be too. (you will need a US Brokerage account though)

So be careful on tax. That said, we are talking about an investment space with massive growth potential. If you accumulate during the bear market and sell during the bull cycle and actually bank the money you probably won’t be too unhappy about paying some tax.

So what should I do again?

Educate yourself. People will tell you to only invest in what you know, but if you aren’t expanding your range of knowledge you will be stuck with a rather narrow range of investments, and you could miss out on great opportunities. Yes, you should buy some and get a little skin in the game. It will encourage you to take notice of what is going on, but take it slowly. You may feel late to crypto, but we are still at the stage where one person’s tweets can move the market by 40%. It’s still early and there is plenty of opportunity. People often ask what percentage of their assets they should have in crypto, but I think you should size your positions according to your level of knowledge and conviction.

The other big part of crypto is learning to take responsibility. Don’t invest half of your life savings because of something you saw on Twitter. (or read on a blog!) Don’t leave your coins sitting on an exchange that could be hacked – learn how to self-custody and use cold storage. People have perhaps gotten too used to handing their money over to a third party and letting them look after it for them. Connect with people who know more than you do and learn from them, but make sure to go down the rabbit hole yourself. And if after that you are not convinced then that’s fine. It’s better to make an informed decision not to get involved than to just assume something is meaningless and miss the opportunity.

Below is a list of resources to get started. I may add to these from time to time.

That’s all I have for now. Best of luck and be curious!

Resources

Podcasts: What Bitcoin Did / The Pomp Podcast

Books: The Bitcoin Standard / The Internet of Money

People to follow: @100trillionusd / @woonomic / @PrestonPysh / @raoulGMI / @CryptoHayes / @RussellOkung / @glassnode / @CaitlinLong_ / @zhusu

Detailed Overview of DeFi

NFTs and Their Use Cases

Article On Bitcoin Energy Consumption

Video Interview on Virtual Worlds- Earning Money in the Metaverse

The Crypto Fear and Greed Index – I have found this to be a much better indicator than price. Buy at extreme fear, and sell, or at least be cautious, when it’s at extreme greed!

Disclaimer: This should go without saying, but the information contained in this blog is not investment advice, or an incentive to invest, and should not be considered as such. This is for information only.